On Thursday, June 20, the Bank of England will hold its next meeting. In anticipation of this event, the pound in the GBP/USD pair remains quite confident despite today's inflation report showing negative results. The release reflected a slowdown in UK inflation, but GBP/USD traders remain optimistic and are not rushing to sell the British currency. The pair is attempting to approach the resistance level of 1.2740 (the middle line of the Bollinger Bands indicator on the daily chart) to open the way to the 28th figure boundaries.

However, take your time to open longs. The fundamental picture could change significantly tomorrow if the Bank of England announces a rate cut at its next meeting in August. Some analysts warn that the Bank of England could take the first step in this direction as early as tomorrow. This scenario cannot be ruled out, but the base scenario suggests maintaining the status quo and softening the wording of the accompanying statement.

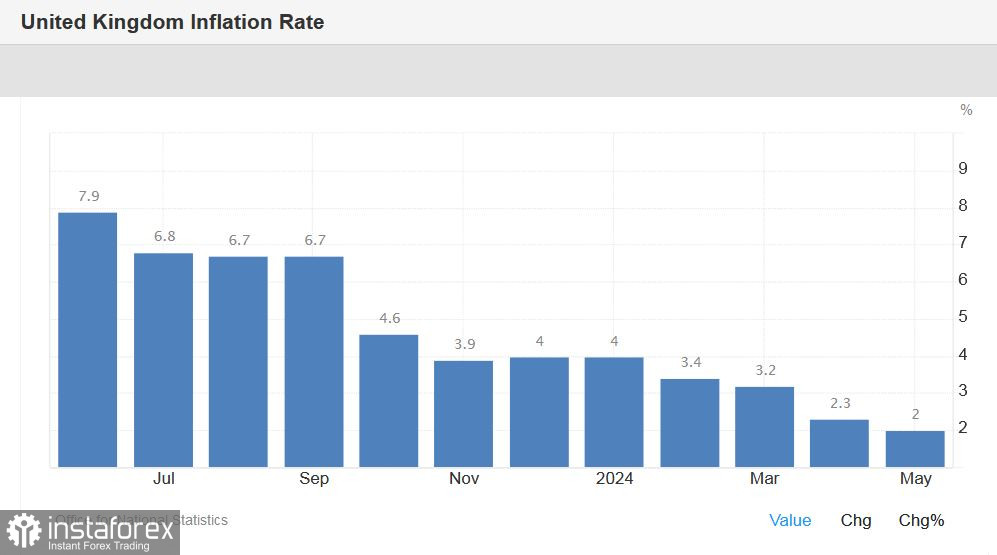

Let's return to today's release. The overall consumer price index (CPI) in annual terms predictably fell to 2.0% in May. On the one hand, the figure came in at the forecast level, but on the other hand, May saw the slowest growth rate since August 2021, nearly a three-year low. On a monthly basis, the figure remained at 0.3%, with a forecast increase to 0.4%.

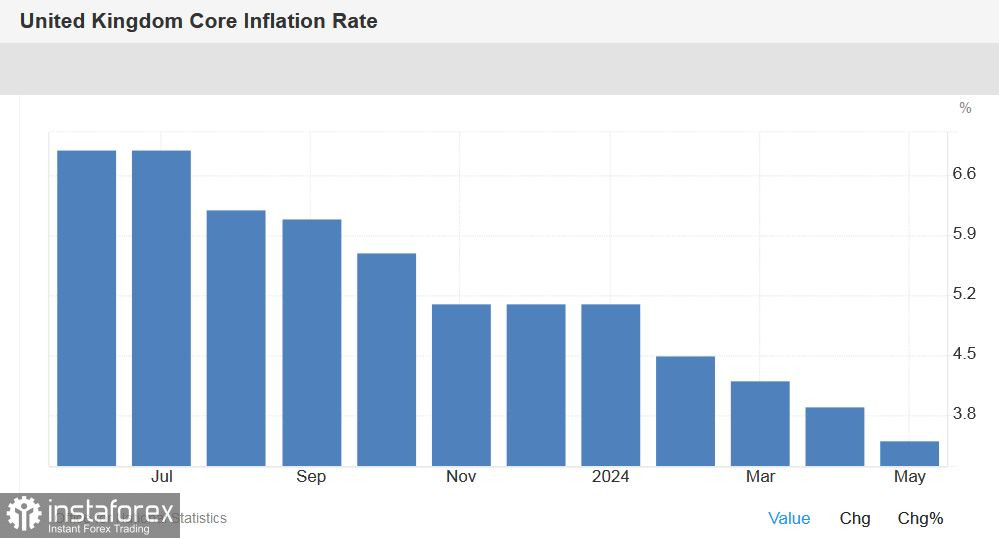

The core consumer price index also showed a downward trend, falling to 3.5% year-on-year (the weakest growth rate since November 2021).

The retail price index (RPI), used by employers when discussing wage issues, fell sharply to 3.0% year-on-year, the lowest since May 2021. Here, too, a multi-month downward trend has formed: the RPI has been declining for the past nine months.

The producer price index for inputs in May remained in negative territory, although it "grew" to -0.1% year-on-year.

The consumer price index for services in May rose by 5.7% year-on-year (in April, the increase was 5.9%).

What do these figures indicate? Primarily, they indicate a significantly increased likelihood of a rate cut at the Bank of England's August meeting. Representatives of the UK regulator had already hinted at August's prospects. For example, Deputy Governor Ben Broadbent stated at the end of May that the rate might be cut "as early as this summer" (i.e., at the June or August meeting).

Currently, the probability of easing monetary policy in August is estimated by the market at 90-95%. The probability of a June rate cut was 50-55% even before the release of the May inflation report. Obviously, today's figures have only increased this probability.

Can we talk about longs in the GBP/USD pair under such fundamental conditions? Certainly not.

Moreover, the pound could come under significant pressure even if the Bank of England keeps the rate unchanged tomorrow. Most experts predict that the Committee members will vote 0–2–7, meaning seven votes to maintain the status quo, two votes to cut the rate, and zero votes to raise it. If the number of "doves" increases (i.e., if someone else besides Ramsden and Dhingra votes for a rate cut), the pound could face a wave of sell-offs.

It's also worth recalling the latest survey conducted by Reuters. The surveyed economists agreed that the Bank of England would ease monetary policy at one of its upcoming meetings. However, opinions on the timing varied: 38 out of 71 respondents were confident that the central bank would cut the rate in August. Thirty-one economists said the Bank of England would make the first move in June. Two experts suggested the UK regulator would wait until September.

It is worth noting that this survey was conducted before the publication of the data mentioned above on inflation growth in May, which reflected a slowdown in key indicators.

Thus, despite the growth of GBP/USD, opening longs on the pair is very risky. The base scenario for tomorrow's meeting suggests maintaining the status quo and two votes for a rate cut. But given the "new data," the Bank of England may well begin easing monetary policy as early as tomorrow (or the number of votes for a rate cut may increase). Therefore, the risk of a sharp weakening of the British currency remains.

Given such a high degree of uncertainty, it is advisable to maintain a wait-and-see position on the GBP/USD pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română