Analysis of Trades and Tips for Trading the Euro

The first test of the 1.0719 price level in the first half of the day occurred when the MACD indicator had moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the euro. Shortly after, another test of 1.0719 happened, with the MACD in the oversold area, which allowed the second scenario for buying the euro to unfold. However, this did not lead to a significant upward movement. In the second half of the day, we await data on changes in retail sales volume, industrial production volume, and manufacturing production volume. If the data diverge from economists' forecasts, volatility may spike, although this is unlikely. Therefore, I will adhere more to a channel trading strategy. For the intraday strategy, I plan to act based on the implementation of Scenario #2.

Buy Signal

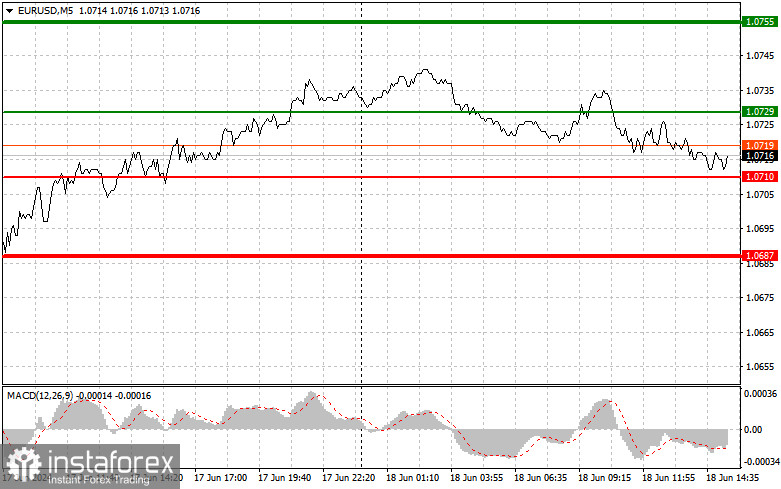

Scenario #1: Today, I plan to buy the euro upon reaching the price of around 1.0729 (green line on the chart), with a target of rising to 1.0754. At 1.0754, I will exit the market and sell the euro in the opposite direction, aiming for a 30-35 point movement from the entry point. An upward movement in the euro today can only be expected following very weak US data and a dovish tone from Fed officials. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the euro today if the MACD indicator shows two consecutive tests of the 1.0710 price level when the pair is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. Growth to the opposite levels of 1.0729 and 1.0755 can be expected.

Sell Signal

Scenario #1: I will sell the euro after reaching the 1.0710 level (red line). The target will be 1.0687, where I plan to exit the market and buy the euro immediately in the opposite direction (expecting a 20-25 point movement in the opposite direction from the level). Pressure on the pair will return in the case of strong US statistics. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline from it.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of the 1.0729 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 1.0710 and 1.0687 can be expected.

Chart Explanation:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: The anticipated price where Take Profit can be set, or profits can be manually fixed, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: The anticipated price at which Take Profit can be set, or profits can be manually fixed, as further decline below this level is unlikely.

- MACD Indicator: Following the overbought and oversold areas when entering the market is important.

- Important: Beginner traders in the forex market should be cautious when making market entry decisions. Before releasing important fundamental reports, staying out of the market is best to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. You can quickly lose your entire deposit without stop orders, especially if you do not use money management and trade in large volumes.

Remember, for successful trading, you need a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română