The demand for the euro started to decline after several weeks, during which the wave pattern was on the verge of significant changes. However, the same pattern remained intact. Recently, I have regularly mentioned that the start of the European Central Bank's monetary policy easing cycle means a lot. Not just for the single currency, but also the entire European Union and its economy. In my opinion, the market had to take notice of the event. And how can policy easing be reflected if not through currency sales? I believe that the current movement is completely logical and it fully aligns with the current wave pattern.

The upcoming news background will be important for the market, as it is important for the dollar to maintain its upward trend. A minor pullback or correction may follow, but the key is to avoid any serious decline. The eurozone will release several important pieces of information this week. The first thing to pay attention to is the final estimate of the Eurozone inflation report for May. Inflation is expected to accelerate to 2.6% in annual terms, but if it turns out to be higher (which is also possible), then this may provide support to the single currency. Take note that ECB President Christine Lagarde mentioned that interest rate cuts will not lead to a linear path. In other words, the ECB will respond to economic indicators at each meeting. If inflation sharply accelerates in May and continues to show weak results in the future, this could be a reason to postpone the rate cut in September, which the market has already planned for.

In addition, preliminary estimates for PMI data for June are set to be released on Friday. No significant changes are expected, but stronger or weaker values could affect the euro's rate. However, I don't expect the market to turn bullish after these reports. There is currently a much more important news background that could exert pressure on the single currency throughout the summer at least.

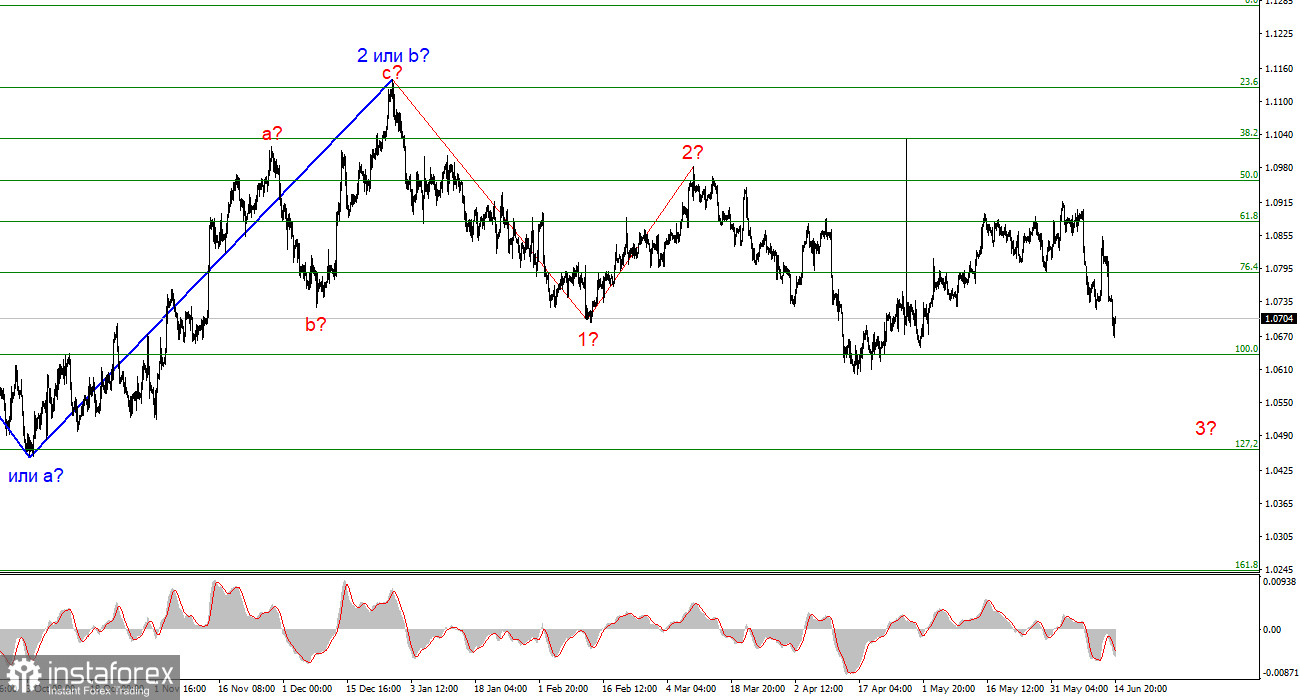

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. In the near future, I expect a downward wave 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark. The internal wave structure of wave 3 or c may take on a corrective five-wave form, but in this case, quotes should drop to the 1.04 area.

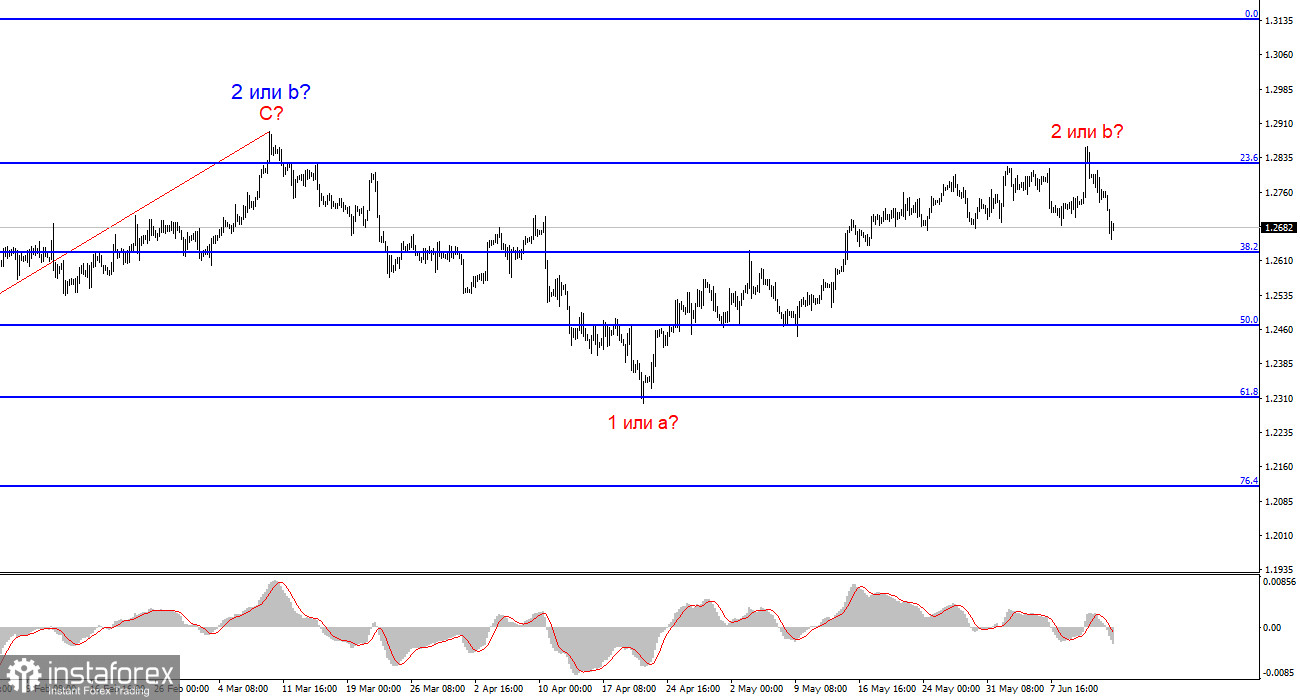

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has not yet been canceled. Since the instrument bounced around the 1.2822 mark, as well as near the peak of the supposed wave 2 or b, you may consider short positions with initial targets around the 1.2315 mark. However, proceed with caution, as it is still difficult to guarantee that the market has definitely turned bearish.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română