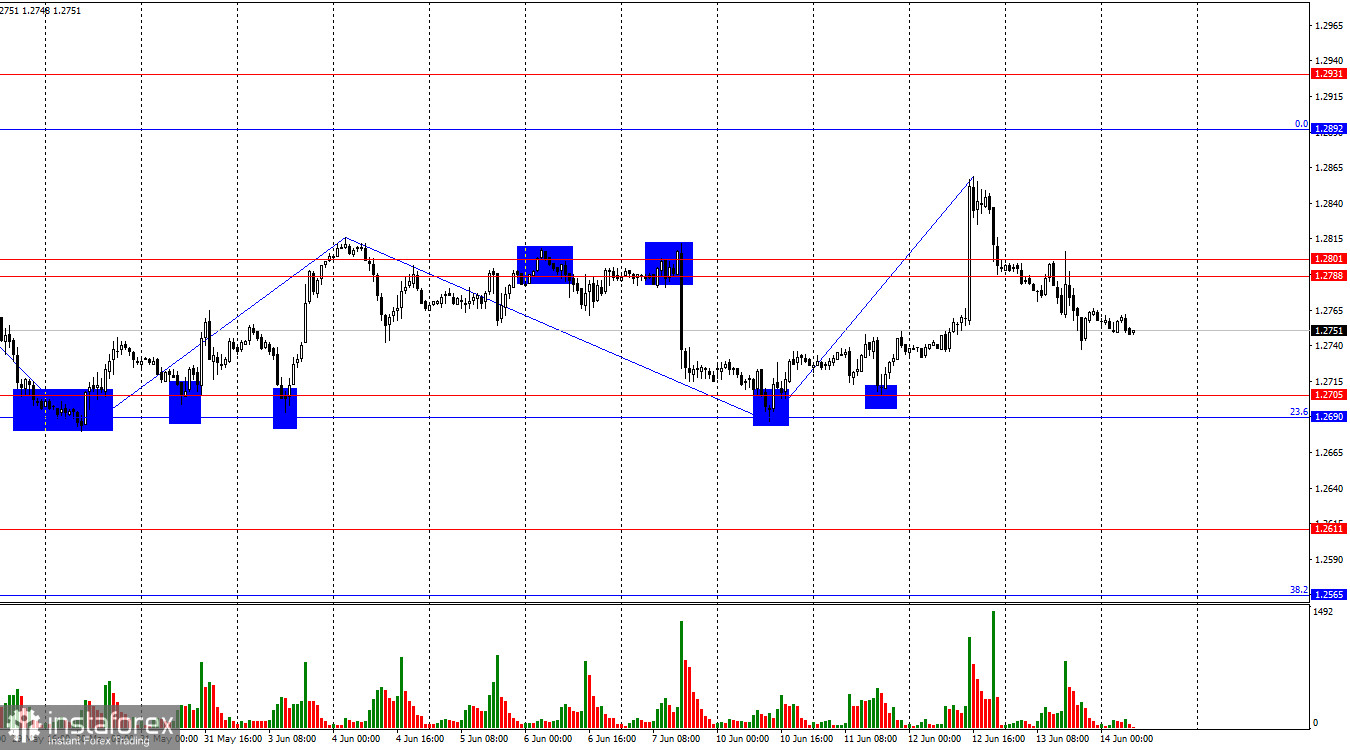

On the hourly chart, the GBP/USD pair on Thursday consolidated below the support zone of 1.2788-1.2801 and continued its decline towards the 1.2690-1.2705 zone. A seventh rebound from this zone will again favor the British pound and potentially lead to a new upward wave towards 1.2858 (the peak of the last upward wave) and 1.2892. A consolidation below the 1.2690-1.2705 zone will allow the bears to launch a large-scale offensive with initial targets at 1.2611 and 1.2565.

The wave situation remains unchanged. The last downward wave did not break the low from May 30. The new upward wave managed to break the wave's peak on June 4. Thus, the trend for the GBP/USD pair remains bullish, with the bulls having an overwhelming advantage. However, in recent weeks, we have observed almost horizontal movement, with wave peaks and lows either not breaking previous extremes or doing so very weakly and rarely. Under current circumstances, it's better to focus on two zones: 1.2690-1.2705 and 1.2788-1.2801, and trade from them.

Thursday's information backdrop was more favorable for the bulls to attack, as the US Producer Price Index, which came out in the second half of the day, showed a lower value than traders expected. I want to remind you that on Wednesday, a slightly lower inflation rate for May caused a significant drop in the dollar. The Producer Price Index is not as crucial a report as inflation, but it could still lead to a new bull attack. The initial jobless claims report, which exceeded forecasts, also worked against the dollar. However, the bulls decided to give the bears some leeway, allowing them to return to the 1.2690-1.2705 zone, where the fate of the pound and the dollar will be decided for the seventh time in a few weeks. Today, the information backdrop will be weak, but the bears still have an opportunity to attack due to the hawkish stance of the Federal Reserve.

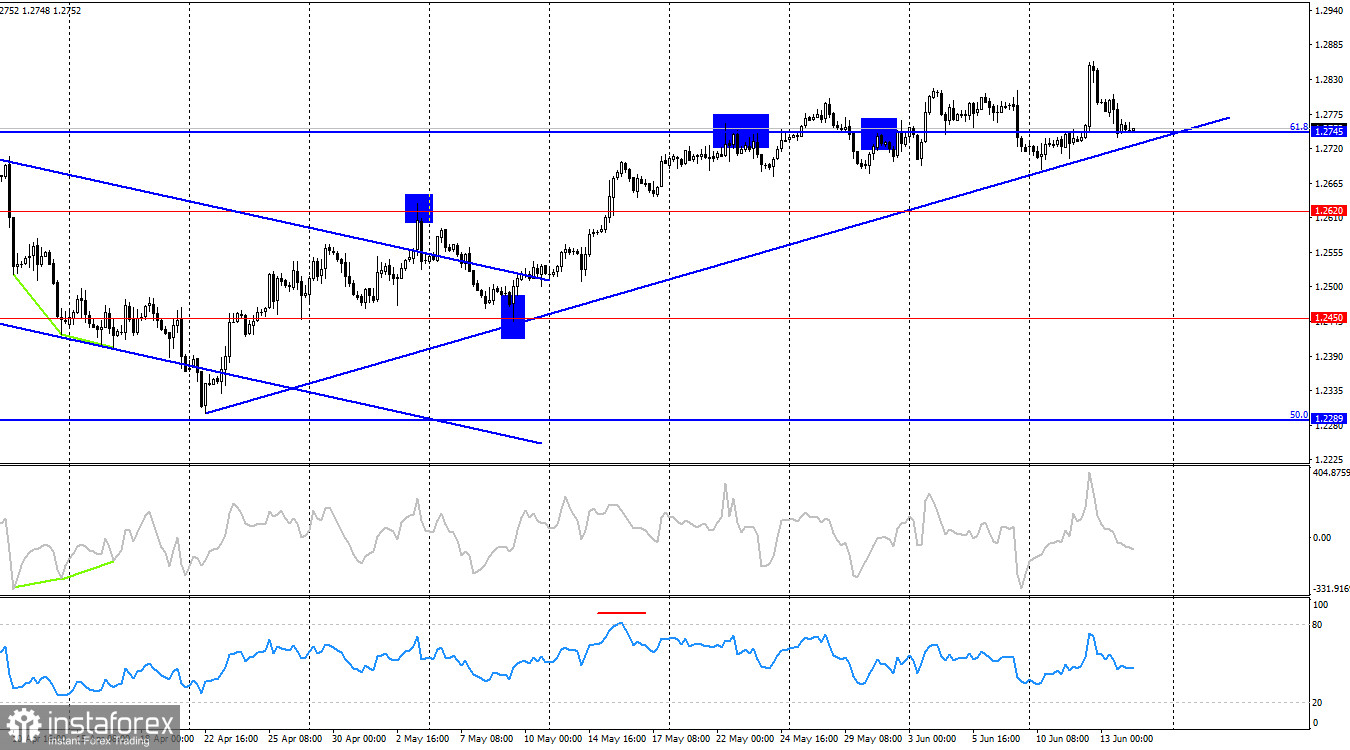

On the 4-hour chart, the pair has made a new reversal in favor of the pound and resumed its growth. Since there has been no closing below the ascending trendline, the pound may continue to rise towards 1.3044. A new rebound from the trendline will only increase the likelihood of the pound's growth towards 1.3044. A consolidation below the trendline may change the market sentiment to bearish. In this case, I expect a significant decline in the pair with targets at 1.2620 and 1.2450.

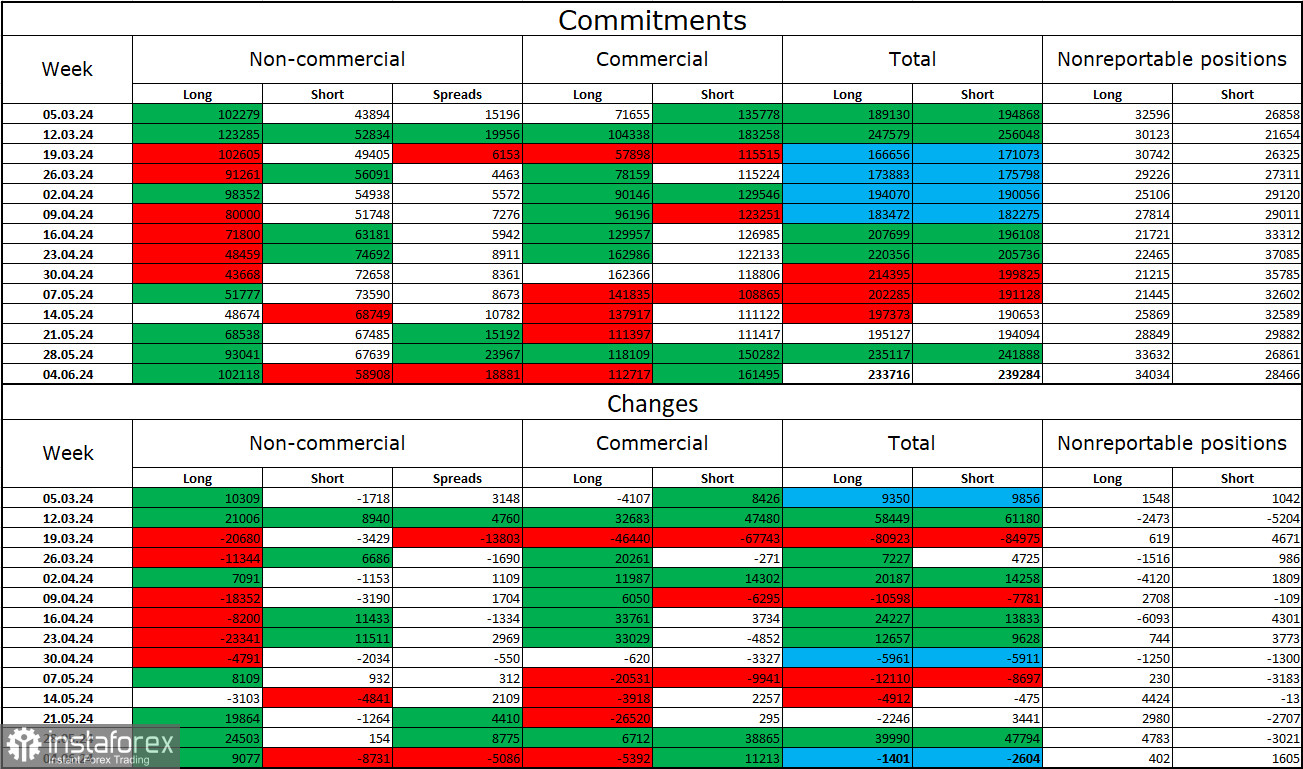

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became more bullish over the past reporting week. The number of long contracts held by speculators increased by 9,077 units, while the number of short contracts decreased by 8,731 units. The overall sentiment of large players has changed again, and now the bulls have a solid advantage. The gap between the long and short contracts is 43 thousand: 102 thousand against 59 thousand.

The pound still has good prospects for a decline, but the bears are not yet ready for an offensive. Over the past three months, the number of long contracts has remained unchanged, while the number of short contracts has increased from 44 thousand to 59 thousand. Over time, the bulls will continue to reduce their buy positions or increase their sell positions, as all possible factors for buying the pound have already been accounted for. However, the key factor will be the bears' willingness and ability, not the information backdrop or COT report data.

News Calendar for the US and the UK:

US: University of Michigan Consumer Sentiment Index (14:00 UTC).

On Friday, the economic events calendar contains only one entry. The influence of the information backdrop on market sentiment for the remainder of the day will be weak.

Forecast for GBP/USD and Trading Tips:

Sales of the pound were possible upon closing below the 1.2788-1.2801 zone with a target of 1.2690-1.2705. These trades can be kept open. Upon consolidation below the 1.2690-1.2705 zone, new sales can be made with a target of 1.2611. Purchases can be made upon a rebound from the 1.2690-1.2705 zone with a target of the 1.2788-1.2801 zone.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română