Under the pressure of weak data on industrial production, the rate of decline of which accelerated from -1.2% to -3.0%, the single currency quickly retreated to the values at which it was before the release of U.S. inflation data. In general, everything appears logical. Despite growing confidence that the Federal Reserve will still lower interest rates by the end of this year, the interest rate disparity between Europe and America is not going anywhere. It is more likely to grow in favor of the dollar. In addition, the state of the Eurozone economy is noticeably worse compared to the United States. And these factors will eventually put significant pressure on the euro, which will contribute to its weakness in the long-term.

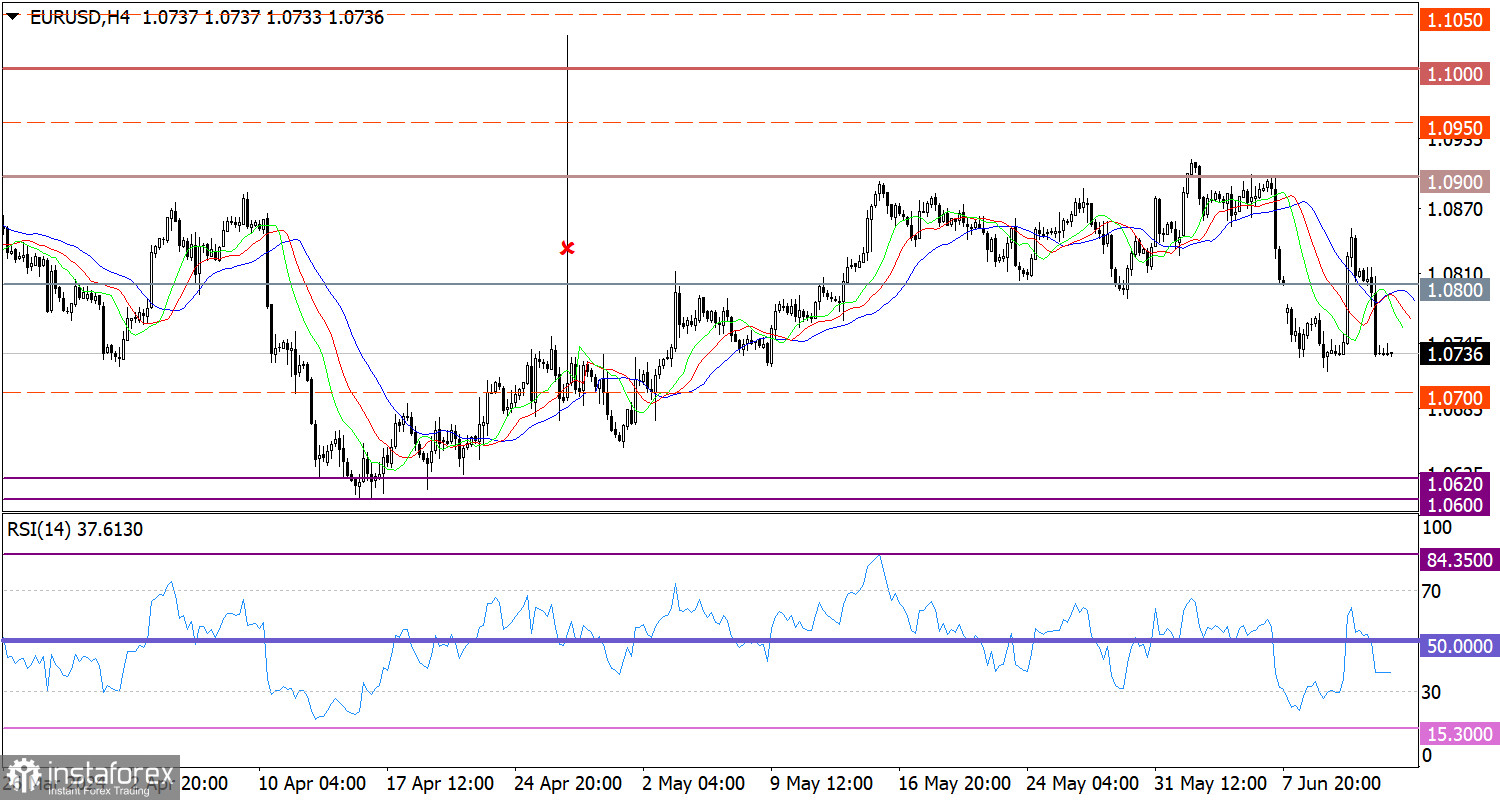

The EUR/USD pair did not just retreat below the level of 1.0800, it actually collapsed to the low of the week. Such an intense movement indicates a persistent bearish bias among market participants.

On the four-hour chart, the RSI technical indicator is hovering in the lower area of 50/70, which points to the growth in the volume of short positions.

On the same chart, the Alligator's MAs are headed downwards.

Outlook

Considering the scale of price changes, short positions may overheat, and the price may pull back. However, in case of testing the week's low, the volume of short positions may continue to grow despite oversold signals. In this case, the quote may fall below the level of 1.0700.

The complex indicator analysis points to a bearish bias in the short-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română