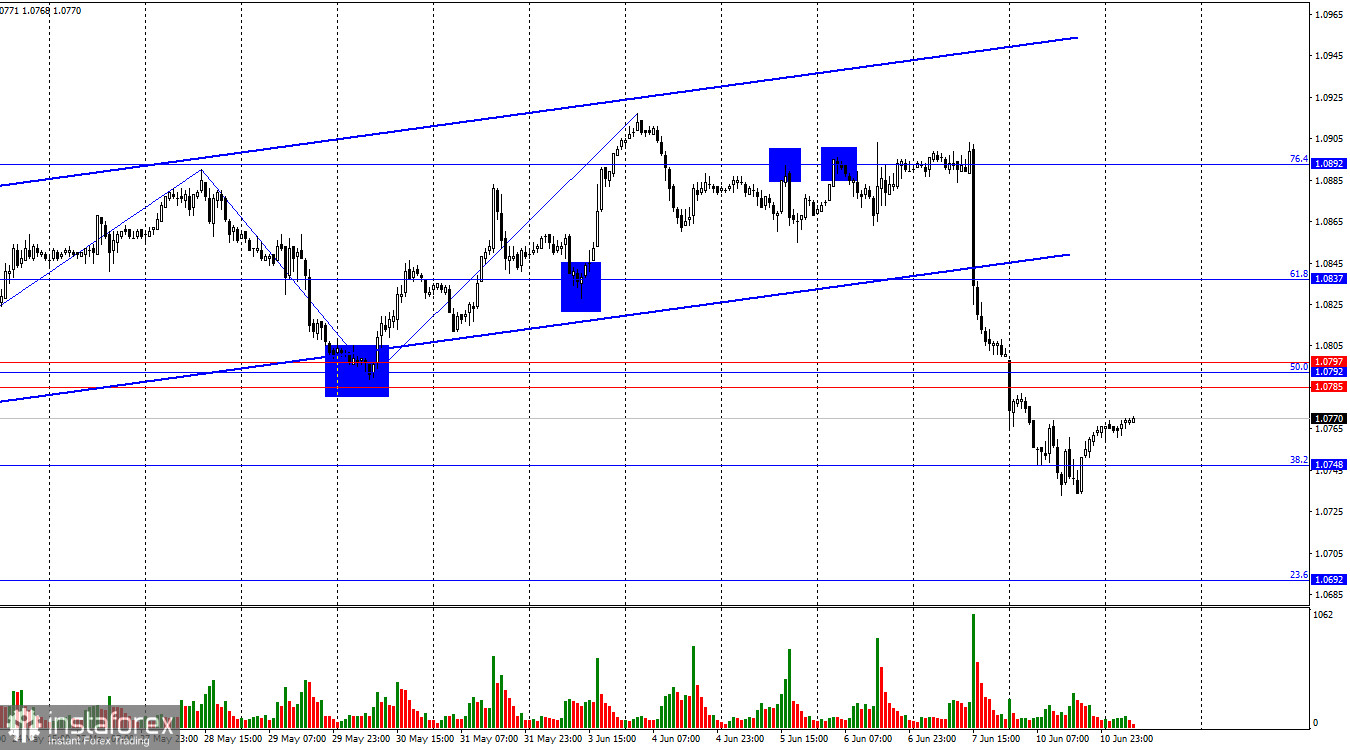

On Monday, the EUR/USD pair broke below the 1.0785–1.0797 support zone and fell to the corrective level of 38.2% (1.0748). A rebound from this level favored the euro, leading to a rise towards the 1.0785–1.0797 zone. A rebound from this zone from below will once again favor the US dollar, leading to a renewed decline towards 1.0748 and 1.0692. Bears have taken the initiative in the market and can now launch new attacks.

The wave situation remains clear. The last completed upward wave broke the peak of the previous wave, while the new downward wave already broke the low of the last wave from May 30. Thus, we have an obvious sign of a trend change from bullish to bearish. Additionally, the pair has settled below the trend corridor, which it couldn't leave for almost two months. Everything indicates that we are at the beginning of a strong bearish trend.

There was no significant news on Monday. However, this did not prevent the bears from developing their success achieved on Friday. Bears had been in the shadows for too long, gathered enough strength, and chose a good moment to strike at the bulls. I remind you that last week's Nonfarm Payrolls report was much stronger than traders expected, and the ECB predictably began easing its monetary policy. These two factors allowed the bears to start their offensive. Moving forward, the factor of the ECB starting to ease monetary policy in the Eurozone may support the US dollar. The ECB's rate, initially lower than the Fed's, will continue to decrease, increasing the divergence between them. The lower the central bank rate, the less attractive the currency is in the global market. Therefore, I expect the US dollar to continue growing. Currently, not only does the informational background support this scenario, but so does the graphical analysis.

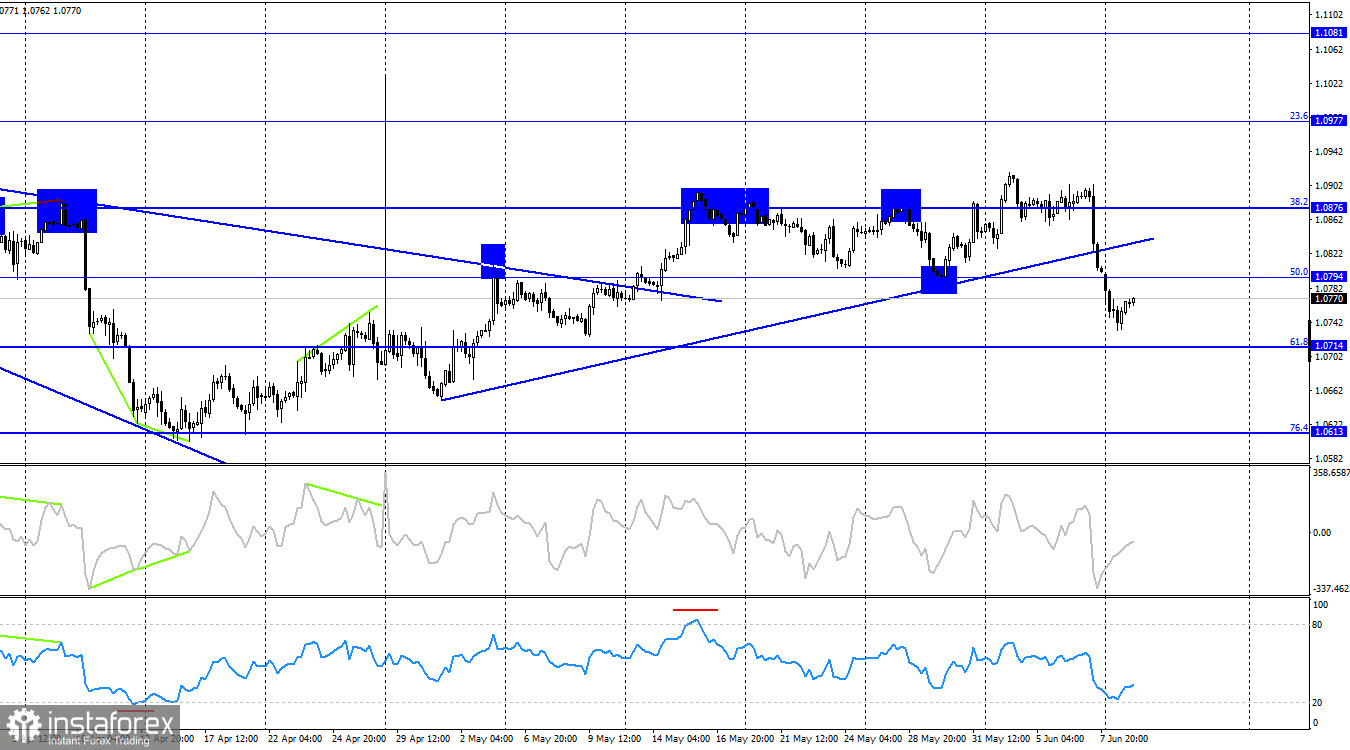

On the 4-hour chart, the pair reversed in favor of the US dollar and settled below the ascending trend line. Thus, the 4-hour chart also shows all the signs of a trend change to bearish. The decline may continue toward the corrective level of 61.8% (1.0714). A rebound from this level will favor the euro and a slight rise towards 1.0794. However, since the trend has changed to bearish, a fall towards the 76.4% Fibonacci level at 1.0613 is more likely.

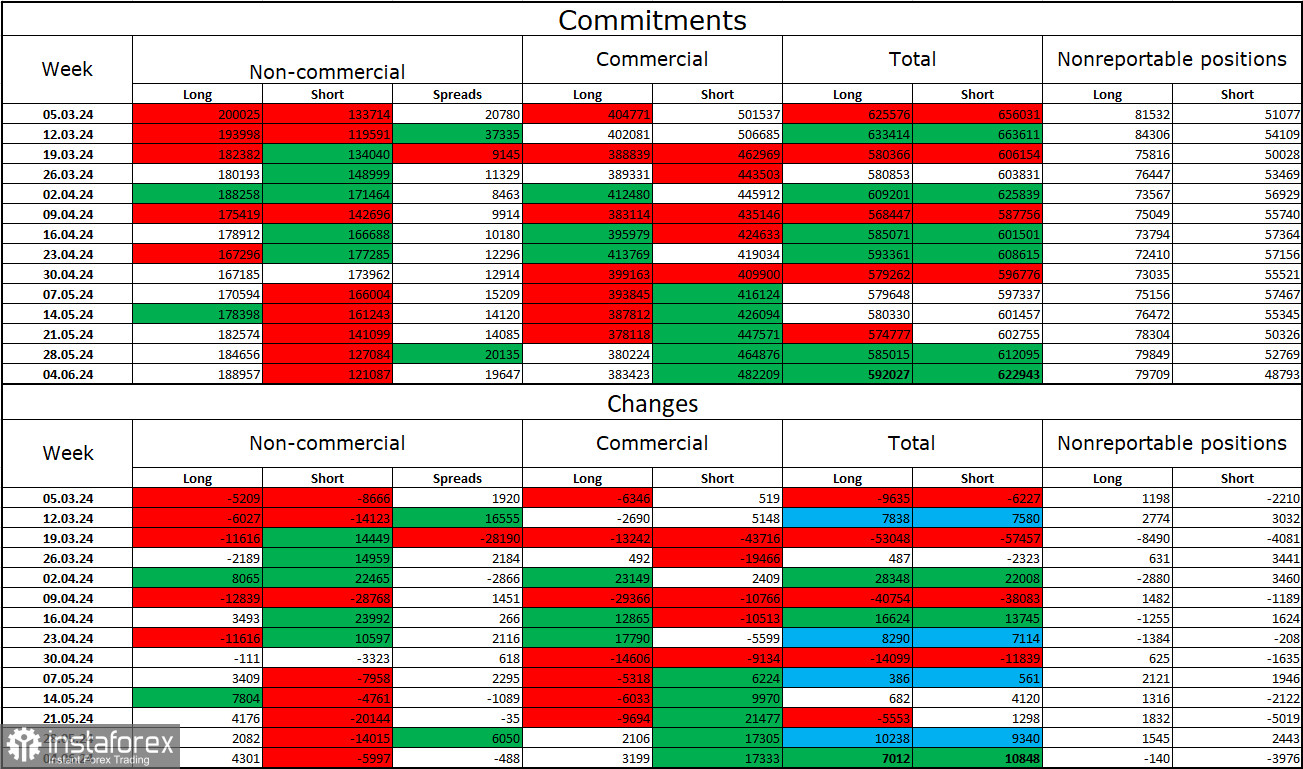

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 4,301 Long contracts and closed 5,997 Short contracts. The sentiment of the "Non-commercial" group turned bearish several weeks ago, but now the bulls have regained and increased their advantage. The total number of Long contracts held by speculators now stands at 189,000, while Short contracts are at 121,000. The gap is widening again in favor of the bulls.

However, the situation will continue to shift in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB has started to ease its monetary policy, which will reduce the yield on bank deposits and government bonds. In America, yields will remain high for several more months at least, making the dollar more attractive to investors.

News Calendar for the US and Eurozone:

On June 11, the economic events calendar does not contain any noteworthy entries. The impact of the informational background on traders' sentiment will be absent today.

Forecast for EUR/USD and Advice to Traders:

Selling the pair was possible on rebounds from the 1.0892 level on the hourly chart with a target of 1.0837. This target and the next two have been reached. New sales are possible upon closing below the 1.0748 level with a target of 1.0692. Or on a rebound from the 1.0785–1.0797 zone with targets at 1.0748 and 1.0692. Buying the euro was possible on a rebound from the 1.0748 level on the hourly chart with a target of 1.0785–1.0797. However, purchases cannot be prioritized now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română