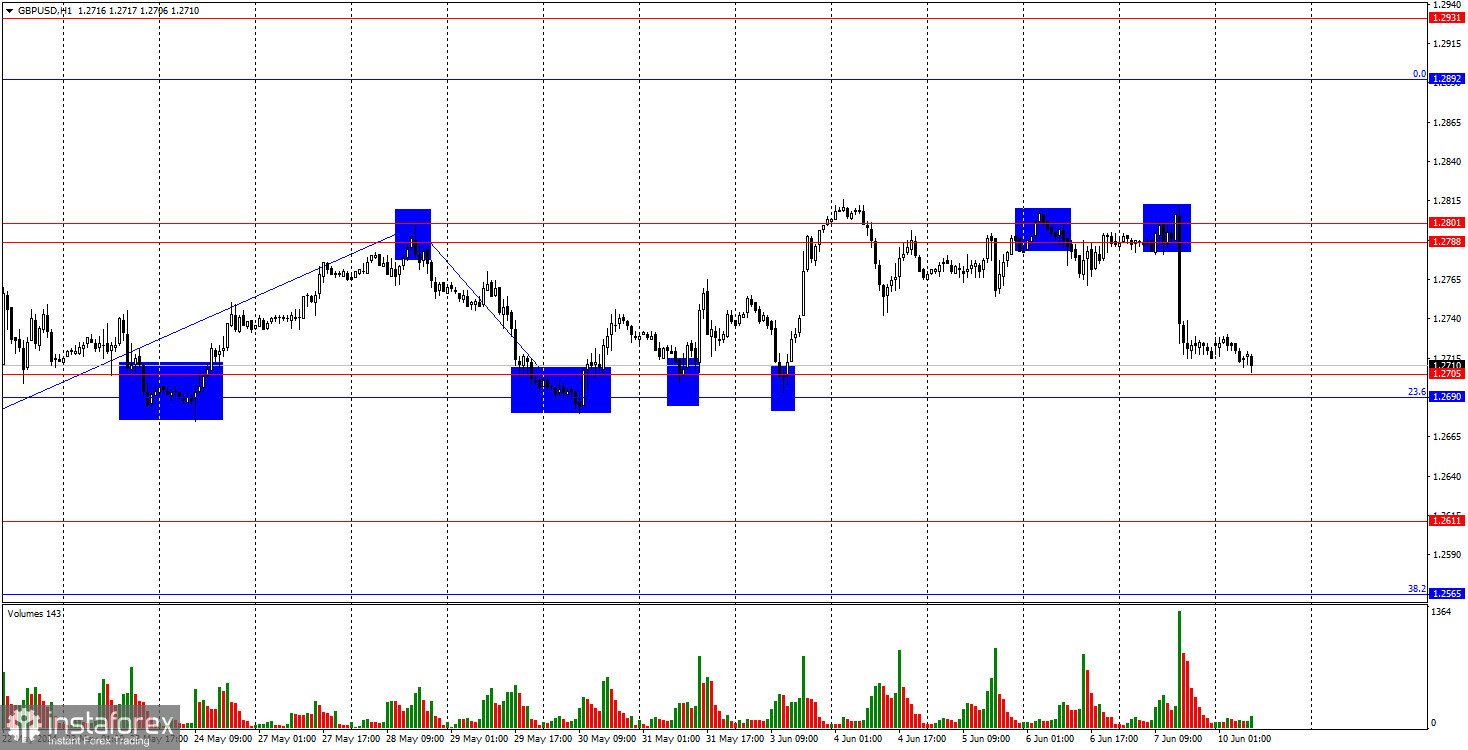

On the hourly chart, the GBP/USD pair performed a new rebound from the resistance zone of 1.2788–1.2801 on Friday, turning in favor of the US dollar and falling to the support zone of 1.2690–1.2705. A rebound from this zone will keep the pair within a horizontal corridor. Securing the pair below the 1.2690–1.2705 zone will favor the US currency and continue the decline towards the 1.2611 level.

The wave situation remains unchanged. The last upward wave broke the peak from May 3, while the last completed downward wave did not even break the 1.2788–1.2801 zone. Thus, the trend for the GBP/USD pair remains bullish, with bulls having the upper hand. The first sign of the end of the bullish trend will appear only when a new downward wave breaks the low of the previous wave from May 30. I believe we should be prepared for a decline in the pound sterling, but first, the bears need to at least break through the 1.2690–1.2705 zone.

The information provided on Friday was favorable for the dollar. Besides the Nonfarm Payrolls report, which significantly exceeded traders' expectations, there was another report supporting the bears. Wages in the US rose by 0.4% m/m and 4.1% y/y in May. In both cases, traders' expectations were exceeded. What do these figures mean? Wages are rising, growing faster than expected, and accelerating in their growth. If wages are rising, it means that consumers will potentially spend more money, driving inflation. Thus, a secondary wage indicator is practically as important as the Nonfarm Payrolls. Wages in the US are rising, and inflation may accelerate with them, which negates any prospect of the Fed easing its monetary policy soon. For the pound, the bullish trend remains unbroken, but the bears' prospects significantly improved on Friday.

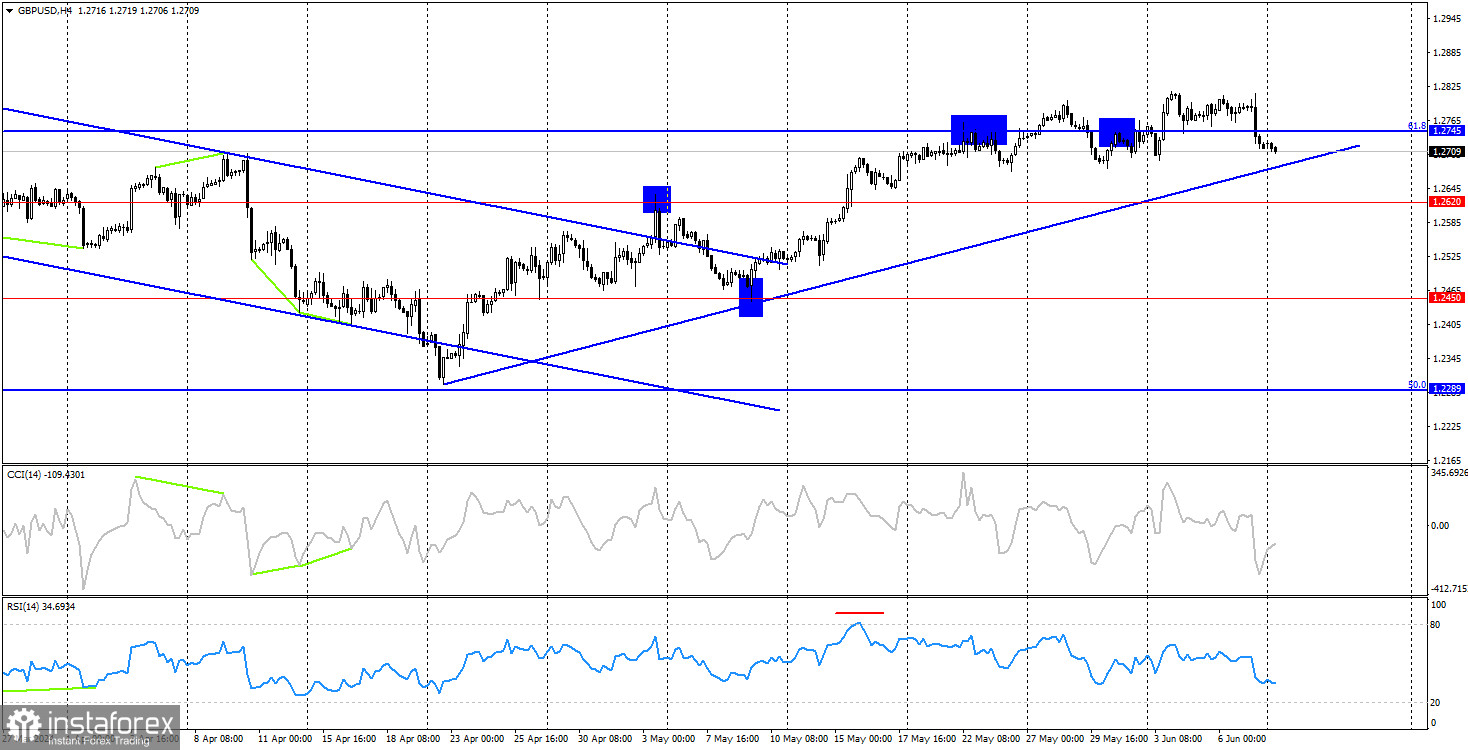

On the 4-hour chart, the pair turned in favor of the dollar and began falling toward the upward trend line. It's better to determine the dynamics and trends on the hourly chart. The horizontal corridor, which is currently the most important graphical structure, is clearly visible there. There are also two important zones on the hourly chart. Securing below the trend line would suggest a strong decline in the pound towards the 1.2620 and 1.2450 levels.

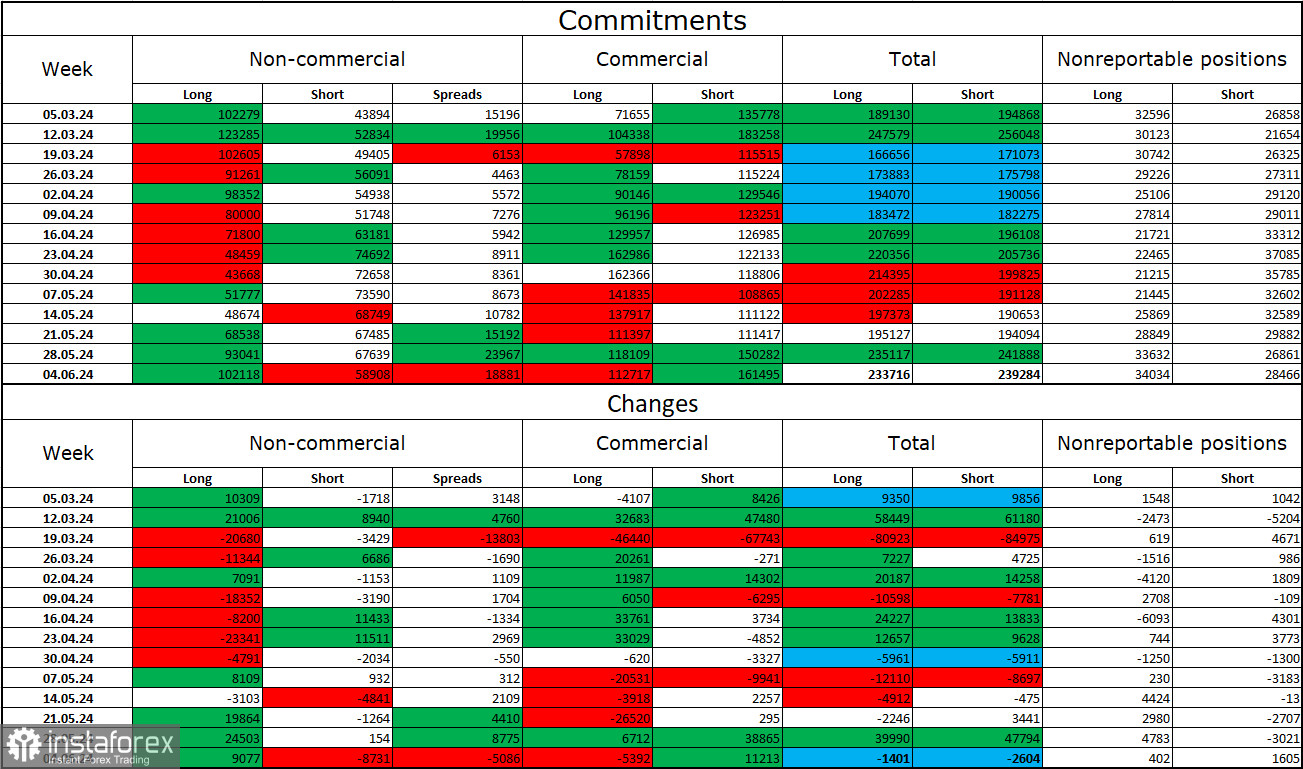

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became more bullish in the latest reporting week. The number of long contracts held by speculators increased by 9,077 units, while the number of short positions decreased by 8,731 units. The overall sentiment of major players has changed again, with bulls once again holding a solid advantage. The gap between the number of long and short contracts is 43,000: 102,000 against 59,000.

The pound still has good prospects for a decline, but the bears are still not ready to advance. Over the past three months, the number of long positions has remained unchanged, while the number of short positions has increased from 44,000 to 59,000. Over time, bulls will continue to get rid of Buy positions or increase Sell positions since all possible factors for buying the British pound have already been exhausted. However, the key factor will be the willingness and ability of the bears rather than the information background or COT report data.

News Calendar for the US and UK:

The economic event calendar contained no entries on Monday. Therefore, the influence of the information background on market sentiment will be absent today.

Forecast for GBP/USD and Trading Tips:

Sales of the pound were possible after a rebound from the 1.2788–1.2801 zone with a target of 1.2690–1.2705. This target has been reached. New sales should be made if the pair closes below the 1.2690–1.2705 zone with a target of 1.2611. Purchases can be opened on a rebound from the 1.2690–1.2705 zone with a target of the 1.2788–1.2801 zone.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română