EUR/USD

US unemployment rose from 3.9% to 4.0% in May as the labor force participation rate fell from 62.7% to 62.5%, non-farm payrolls added 272k new jobs vs. a forecast of 182k and hourly wage growth of 0.4%. Gold fell by 3.45%, copper by 4.94%, Brent crude oil -0.54%, wheat -1.92%, the S&P 500 -0.11%, the yield on 5-year US government bonds jumped from 4.29% to 4.46%, the euro lost 0.78% of its value. Such a "tectonic" shift towards the dollar can be understood no other way than as a delayed reaction to the European Central Bank rate cut. Even the trading volume was noticeably higher compared to Thursday.

If we look at the weekly chart, we can agree that the term "tectonic" was not exaggerated at all. The price reached the support of the MACD line, consolidating below which may become the start of a long-term decline to the area close to parity. The end of the first branch of such a movement is seen at 1.0369 - at the August 2022 high.

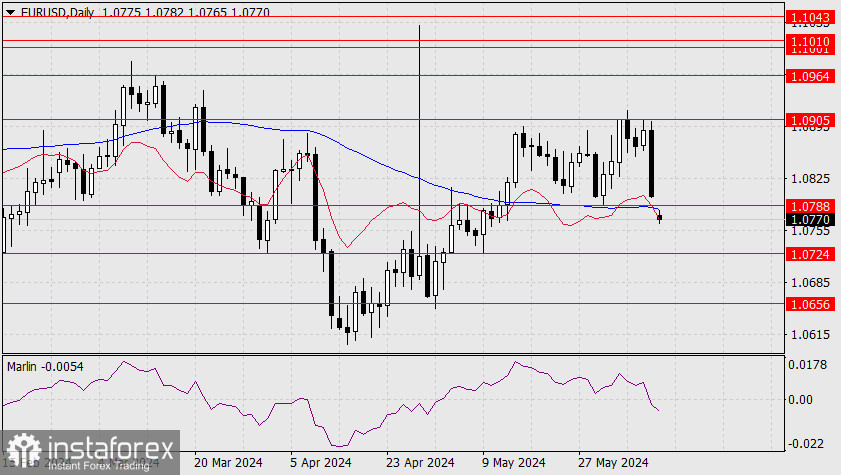

On the daily chart, the signal line of the Marlin oscillator has moved into the bearish territory. The price from the market opening with a gap overcame the support at 1.0788, reinforced by the MACD line. Overcoming the level opens the nearest target at 1.0724 - also a strong support, valid from December to May.

On the 4-hour chart, the Marlin oscillator has either entered or is close to the oversold area. The opening gap is 25 pips. We are waiting for the market to close this gap, that is, the euro to start a correction, after that we expect the price to consolidate below the level of 1.0788 and fall towards 1.0724.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română