The EUR/USD pair has been on the rise since April 16. This growth raises many questions as bullish traders continue their attacks under almost any conditions. The information background has varied recently, but in most cases, we've seen the euro appreciate. What might be causing this, and how much longer will this growth continue?

The market realizes that the ECB will start easing its monetary policy in June, making it extremely difficult for the euro to continue growing after that. Currently, the ECB's rate is 4.5%, while the FOMC's rate is 5.5%. The difference is already evident. The currency of the central bank with a higher rate should depreciate, not appreciate. However, we are seeing the opposite movement. Without a doubt, while the Fed's rate was higher, the dollar couldn't show growth. But now we are interested in what will happen after the ECB meeting this June, which is happening this week. A logical question arises: is the current euro growth a preparation for a prolonged decline?

Apart from the ECB and Fed rates, other information backgrounds also concern traders. This week, the ECB meeting will take place, and in addition, a large amount of statistical information will come from America, as is typical of the first week of each month. Today, the important ISM Manufacturing PMI will be released, which I will analyze now.

The ISM index is expected to be 49.8 points in May, indicating a rise of 0.6 points compared to April. If the forecast is met, we likely won't see a strong dollar appreciation, as the market tends to price in significant data a bit in advance. If the ISM index exceeds 49.8 points, stronger dollar growth is possible. Conversely, if it falls below this level, a new decline might occur.

The last ISM index was released on May 1 and elicited almost no reaction from traders, even though it was below expectations (49.2 versus 50.0). However, on April 1, when it was revealed that the ISM index in the manufacturing sector rose from 47.8 points to 50.3 points, the US dollar gained 40 pips in just a couple of hours. On March 1, the dollar fell by 40 pips when the index dropped from 49.1 to 47.8, against expectations of a rise to 49.5. Therefore, for the dollar to show good growth today, the index needs to exceed 50.0–50.2. For a significant intraday decline, the index needs to fall below 49.5–49.2.

Conclusion:

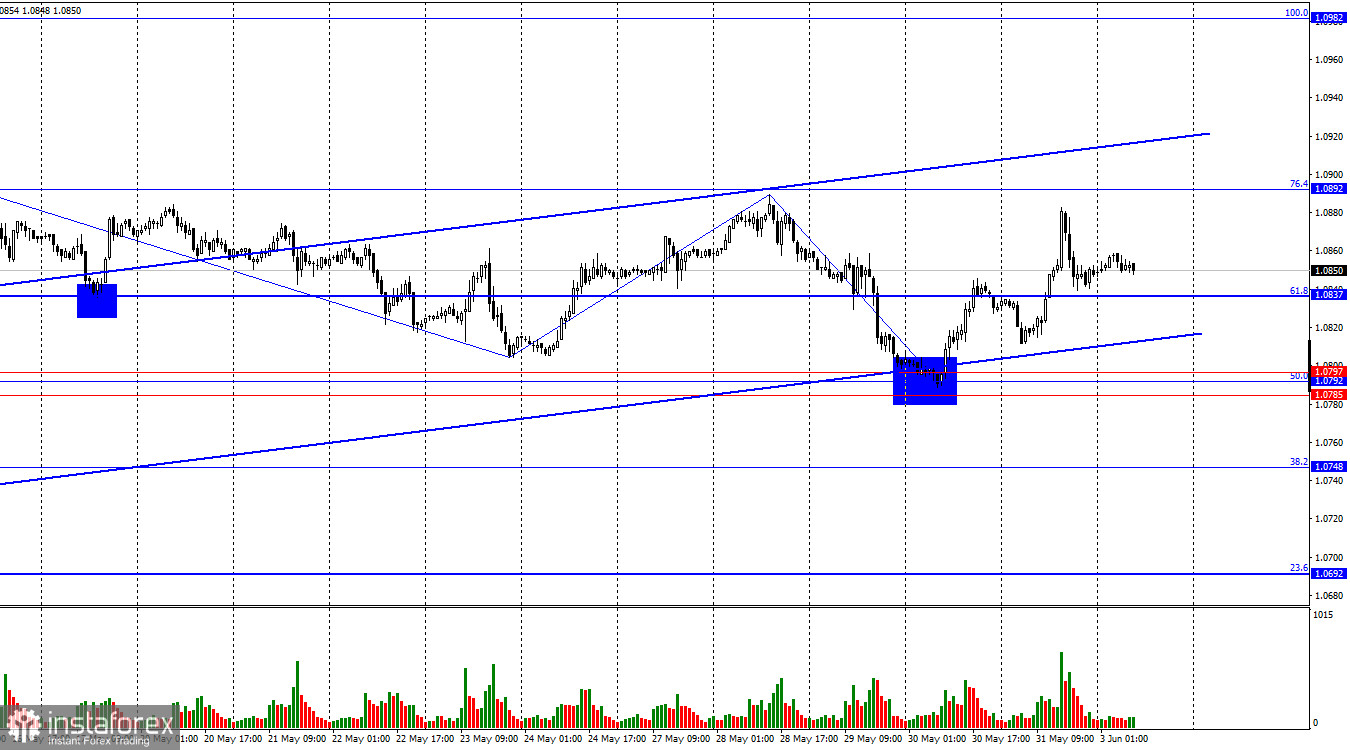

This morning, the business activity indices in the Eurozone and Germany for the manufacturing sectors were released. In both cases, the index values fully or almost matched traders' expectations. Since both indices remained below 50.0, the euro couldn't show growth. I expect a similar market reaction to the ISM index. For the US dollar to continue its rise, the ISM index must exceed the forecast by at least a few tenths of a point. Then, we could expect a bearish attack towards the support zone of 1.0785–1.0797. After this zone is tested, Tuesday's movement will depend on the JOLTS report in the US regarding job openings. However, bears might need stronger data to break through the 1.0785–1.0797 zone.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română