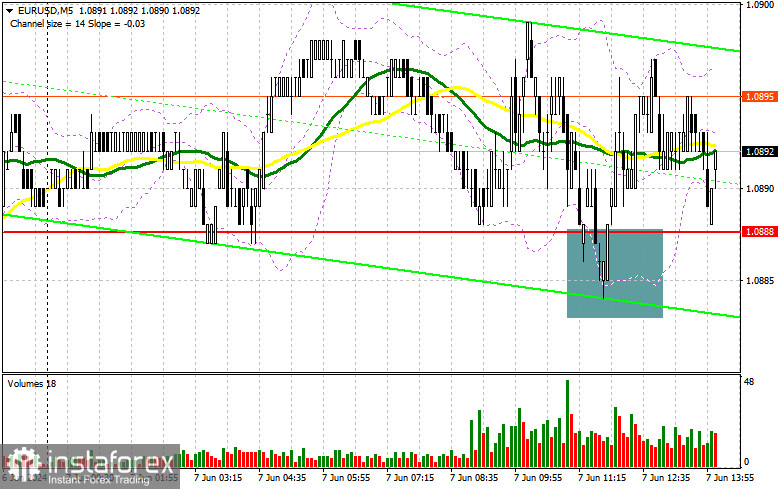

In my morning forecast, I paid attention to the level of 1.0888 and planned to make market entry decisions from there. Let's look at the 5-minute chart and see what happened. A decline and the formation of a false breakout provided an excellent signal to buy euros, but before important US data, it seems buyers decided not to rush. After moving up by 10 points, trading again shifted to the area of 1.0878. As a result, a decision was made to exit the market and wait for the release of important data. The technical picture for the second half of the day still needs to be revised.

For opening long positions on EUR/USD:

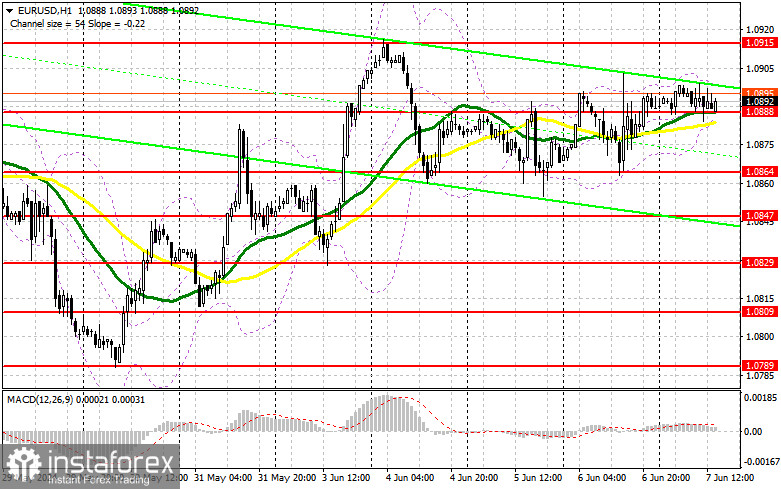

Ahead are data on the US labor market. If we see another sharp slowdown in job growth, it could be a cold shower for the Federal Reserve, which maintains an ultra-aggressive monetary policy. This will also lead to a sharp rise in risky assets, including the euro. If the data indicates a return to labor market stability and an increase in Americans' average wages, there is no reason not to buy the dollar again, as expecting a dovish Fed in the near future is unlikely. In case of a decline in the pair, only a false breakout formation around 1.0888, similar to what was discussed above, will provide a long entry point capable of returning EUR/USD to the 1.0915 level. A breakthrough and upward retest of this range will lead to a strengthening of the pair with a chance of a surge to 1.0942. The farthest target will be a new monthly high of 1.0960, where I will take profits. If EUR/USD falls and there is no activity around 1.0888 in the second half of the day, trading could shift into a wide sideways channel, significantly increasing pressure on the euro and leading to a decline in the pair. In this case, I will only enter after a false breakout around the next support at 1.0864. I plan to open long positions immediately on a rebound from 1.0847, aiming for an intraday correction of 30-35 points.

For opening short positions on EUR/USD:

Sellers have a chance to regain market control, but this requires good US statistics that dispel all doubts about the Federal Reserve's actions. Before selling, it is best to wait for a false breakout around the resistance at 1.0915, which will provide a short entry point with the prospect of the euro declining and support at 1.0888 being updated. A breakthrough and consolidation below this range, along with a retest from below, will provide another selling point, aiming for a move towards the 1.0864 minimum, where I expect to see more active buyer responses. The farthest target will be the 1.0847 minimum, where I will take profits. If EUR/USD rises in the second half of the day and there are no bears around 1.0915, a new bullish wave will start. In this case, I will postpone selling until testing the next resistance at 1.0942. There, I will also sell, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0960, aiming for a downward correction of 30-35 points.

Indicator Signals:

Moving Averages

Trading is around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of the moving averages are considered by he author on the H1 hourly chart and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0880, will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period: 50. Marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing out volatility and noise. Period: 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period: 12. Slow EMA period: 26. SMA period: 9.

- Bollinger Bands: Period: 20.

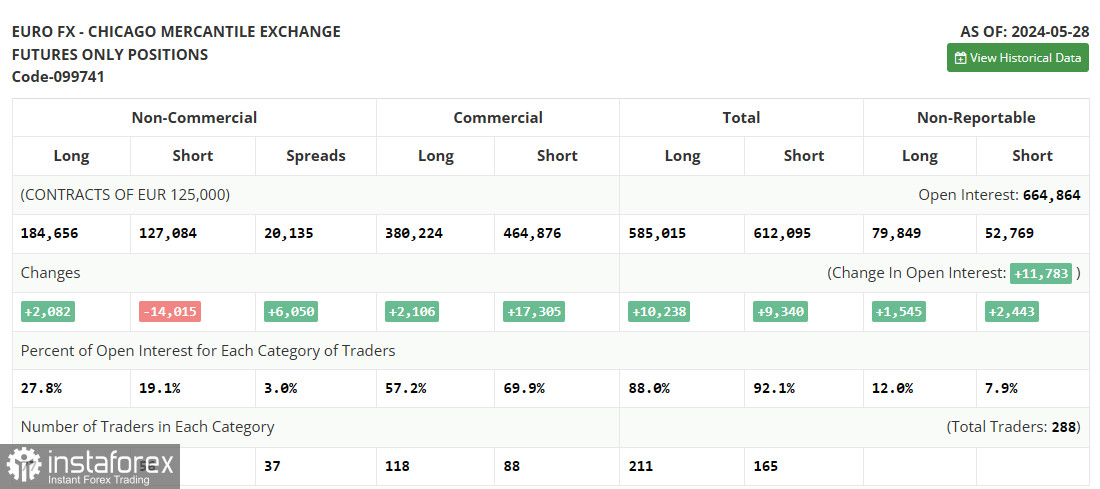

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română