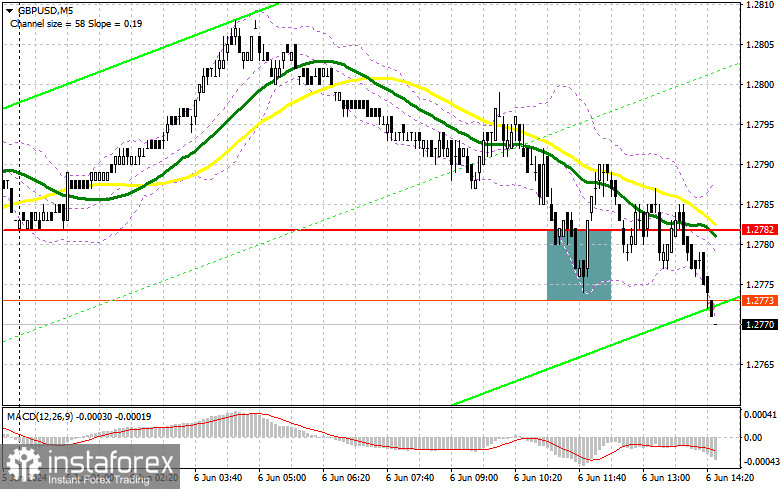

I focused on the 1.2782 level in my morning forecast and planned to make market entry decisions from there. Let's look at the 5-minute chart and see what happened. A decline and the formation of a false breakout led to a buy signal, but after a 12-point upward movement, pressure on the pound decreased. The technical picture for the second half of the day was slightly revised.

For Opening Long Positions in GBP/USD:

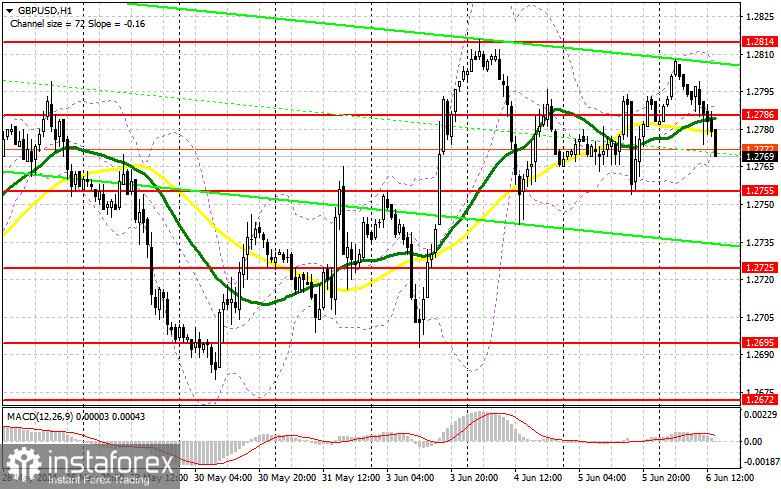

Considering that the pound follows the euro closely, it will likely also react to the European Central Bank's decision, which everyone should be prepared for. Additionally, in the second half of the day, figures on the weekly initial jobless claims in the US and the trade balance are due. Only a significant deviation from expectations can affect the British pound and its prospects. In this context, a decline and the formation of a false breakout around the new support at 1.2755 seem like a well-considered decision. This will provide an entry point for long positions in anticipation of a return and an update to 1.2786 – the resistance formed by the results of the first half of the day. Only a breakthrough and a reverse test from top to bottom of this range will be a suitable entry point to buy the pound, leading to an update to the next resistance at 1.2814 – this month's high. The farthest target will be the area of 1.2853, where I plan to take profit. If GBP/USD falls and there is no activity from the bulls at 1.2755 against strong US statistics, the pound buyers will only have more problems. This will also lead to a decline and an update to the next support at 1.2725, formed by the past week's results. Only the formation of a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the low at 1.2695 with a 30-35 point upward correction target within the day.

For Opening Short Positions in GBP/USD:

The pound is locked in a channel, and the mid-channel breakout in the first half of the day increases the sellers' chances for further correction. The advantage will stay with the sellers as long as trading remains below 1.2786. In the case of weak data, the bears will need to prove their advantage around 1.2786, where the formation of a false breakout will confirm the presence of large sellers in the market and provide an entry point for short positions aiming for a further decline in GBP/USD towards support at 1.2755. A breakthrough and a reverse test from the bottom to the top of this range will give the bears an advantage and another entry point for selling to update 1.2725, where I expect to see more active buyers. The farthest target will be the low at 1.2695, which will lock the pair in a broad sideways channel. There, I will take profit. If GBP/USD rises and there are no bears at 1.2786 in the second half of the day, which is also possible with a strong rise in the euro after the ECB meeting, buyers will regain the initiative, with the potential to update 1.2814. I will sell there only on a false breakout. If there is no activity there either, I recommend opening short positions on GBP/USD from 1.2853, expecting a 30-35 point downward rebound within the day.

Indicator Signals:

Moving Averages:

Trading is around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of moving averages on the hourly H1 chart and differs from the classical daily moving averages on the D1 chart.

Bollinger Bands:

In the case of a decline, the lower boundary of the indicator, around 1.2770, will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

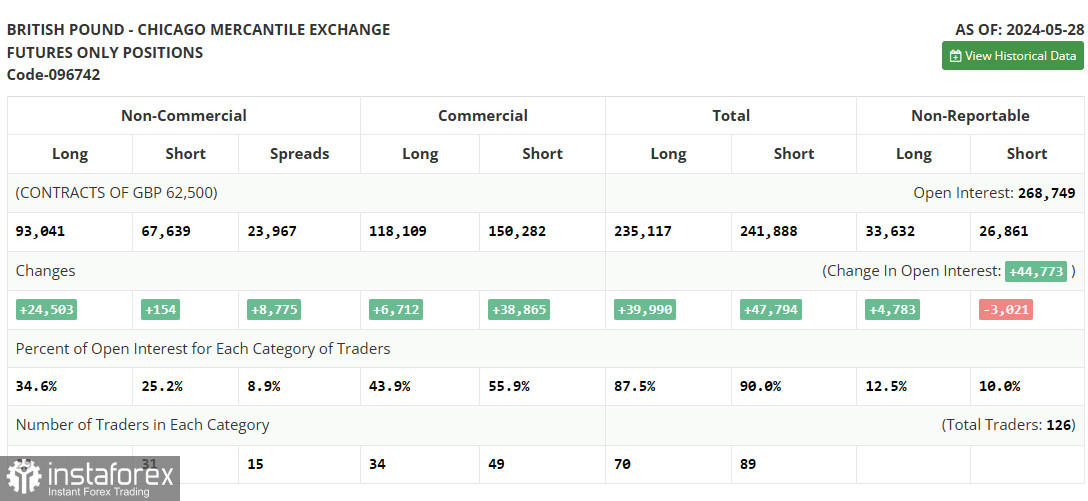

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română