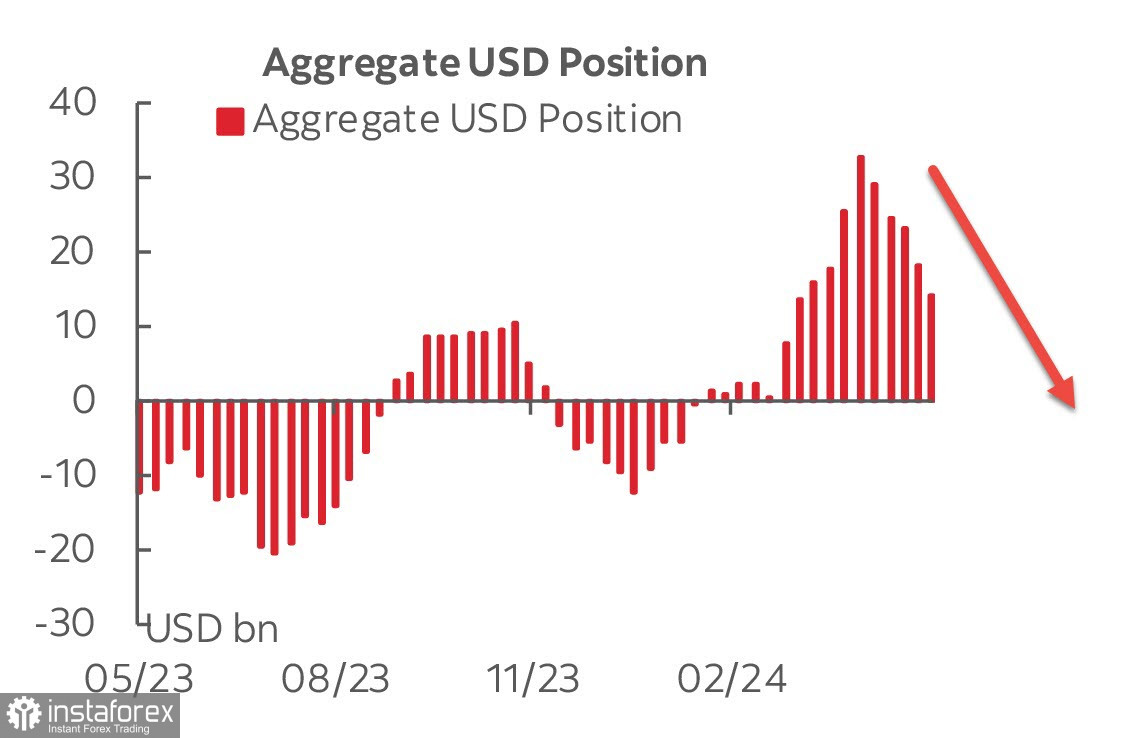

The net long USD position decreased by $3.8 billion to $14.8 billion over the reporting week, marking the fifth consecutive week of decline. The bearish bias remains intact, and the sell-off trend shows no signs of slowing down.

It is notable that the dollar sell-off is happening against the backdrop of nearly unchanged forecasts for the Federal Reserve's rate. As recently as mid-April, the Fed-funds futures were expecting the US central bank to cut its benchmark rate in September, with the second round expected around December or January of the following year. By the end of April, the futures market showed a steady growth in demand for USD.

Currently, expectations remain almost the same, with the first rate cut expected in September and the second in December or January. However, the dollar continues to be sold off. Apparently, a new factor has emerged, changing the forecasts.

This factor is based on growing fears that the US economy is at risk of a recession.

US economic growth for the first quarter was revised down from 1.6% rate to 1.3% due to soft consumer spending. Americans' household savings rate is declining.

Another indicator is the decline in the real estate market. Existing home sales in the US declined 1.9% month-over-month to a seasonally adjusted annualized rate of 4.14 million units in April 2024, which is almost equivalent to the worst period during the financial crisis of 2008-2011. Pending US home sales have dropped to a record low, about 15% lower than in 2008/09, and when adjusted for population growth, more than a quarter lower.

Moreover, the decline in consumer spending has had little impact on inflation. The Personal Consumption Expenditures (PCE) price index, which accounts for the average amount of money consumers spend, rose by 0.3% in April, which is 2.5 times the historical average.

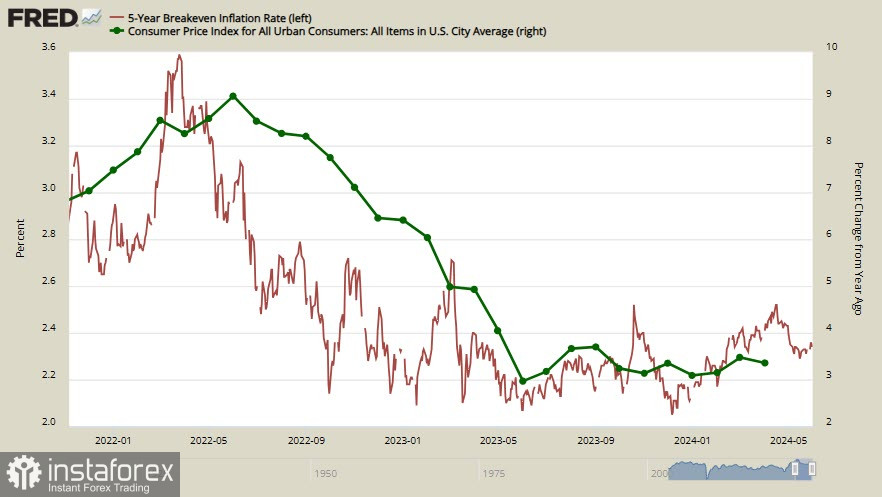

The yield on 5-year TIPS, which is calculated with an inflation adjustment, reached a low on December 6th and has since resumed growth. This is a fairly accurate indicator of inflation sentiments in the business environment, and it is not decreasing. Given that the calculation of the annual inflation rate in May will start considering last year's low base, it can be assumed that US inflation may surprise everyone with its growth in the coming months.

If the risk of a recession becomes apparent, the government will be forced to launch a new stimulus program. However, the budget deficit as a percentage of GDP is already at its highest since 2012, excluding the COVID-19 years of 2020/21. The launch of a stimulus program will increase the budget gap to $3-4 trillion, and this huge amount of securities will have to be sold to someone. Obviously, the Fed is the main buyer, which implies a return to QE.

If events unfold this way, the dollar will become weaker. It is likely that global investors are fearing a similar scenario. Regardless of how accurate our assumptions are, we must pay attention to their actions, which signal increasing volumes of USD sales.

The US dollar remains under pressure, and there are currently no reasons to expect a bullish pivot.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română