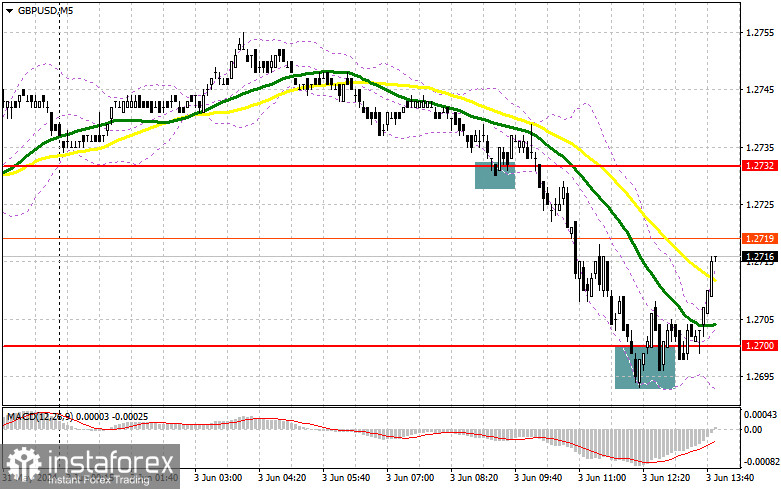

In my morning forecast, I paid attention to the 1.2732 level and planned to decide to enter the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown there led to a signal to buy the pound, but it never reached growth, which resulted in fixing losses. After a strong fall in the pound, the bulls showed themselves around 1.2700, which allows you to take about 16 points of profit from the market at the time of writing. In the afternoon, the technical picture still needed to be revised.

To open long positions on GBP/USD, you need:

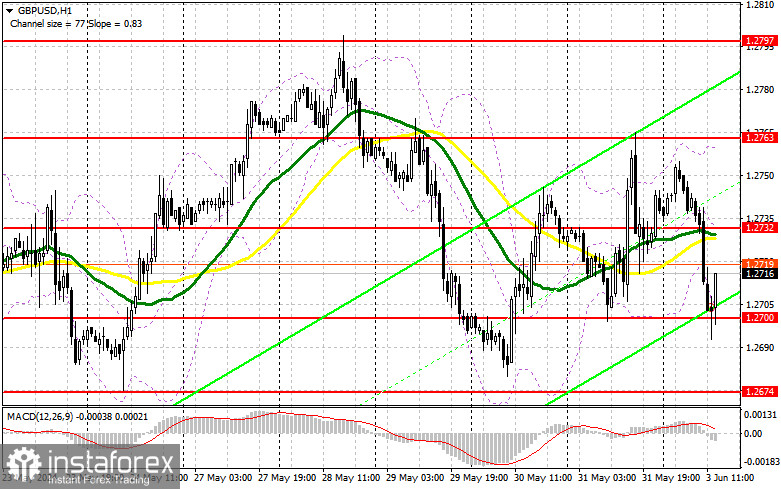

Weak data on activity in the UK manufacturing sector put pressure on the pound, which resulted in a major drop in the pair. The focus will shift to similar reports, but only for the United States. The figures on the ISM manufacturing index may be very disappointing, which will return demand for risky assets and put pressure on the dollar. In addition, there are indicators of changes in the volume of expenditures in the construction sector and the total volume of car sales in the United States. Strong data will send the pair to the 1.2700 area, where I expect another manifestation of buyers, although this level has already been worked out. Only the formation of a false breakdown there will allow you to get a good entry point into long positions, capable of growth to 1.2732, where the moving averages are located, already playing on the sellers' side. A rush and a top-down test of this range will allow GBP/USD growth with the 1.2763 update. In the case of an exit above this range, we can talk about a breakthrough to 1.2797, where I will fix profits. In the scenario of GBP/USD falling and no buyers at 1.2700 in the afternoon, the pressure on the pound will return, leading to a downward movement to the support area of 1.2674. Forming a false breakout will be a suitable option for entering the market. Opening long positions on GBP/USD immediately on a rebound from 1.2646 to correct 30-35 points within a day is possible.

To open short positions on GBP/USD, you need:

If the pair grows against the background of weak statistics for the United States, which cannot be ruled out since production activity is also not good there, I'm going to act only after the formation of a false breakdown in the resistance area of 1.2732, which acted as support in the morning. This will lead to an entry point into short positions to reduce GBP/USD to the support area of 1.2700. A breakout and a reverse test from the bottom up of this range will increase the pressure on the pair from the second time, giving the bears an advantage and another entry point to sell to update 1.2674, where I expect a more active manifestation of buyers. A longer-range target will be a minimum of 1.2646, which will indicate the formation of a new bearish trend. I will fix the profit there. With the option of GBP/USD growth and the absence of bears at 1.2732 in the afternoon, buyers will regain the initiative, having the opportunity to update 1.2763. I will also serve there only on a false breakdown. Without activity there, I advise you to open short positions on GBP/USD from 1.2797, counting on the pair's rebound down by 30-35 points within the day.

Indicator signals:

Moving averages

Trading is below the 30 and 50-day moving averages, indicating a pound drop.

Note: The author considers the period and prices of the moving averages on the hourly chart H1, which differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the indicator's lower limit, around 1.2700, will act as support.

Description of the indicators

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

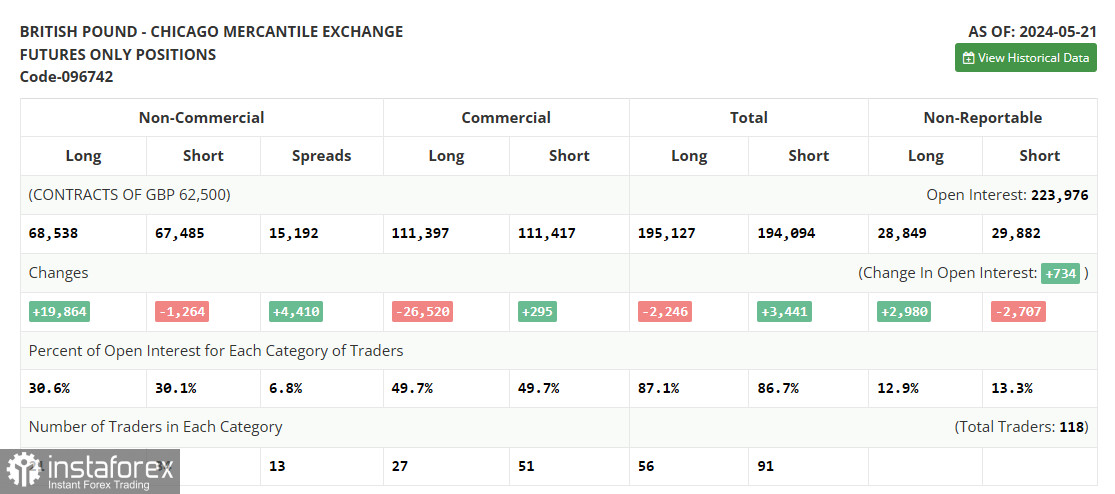

• Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română