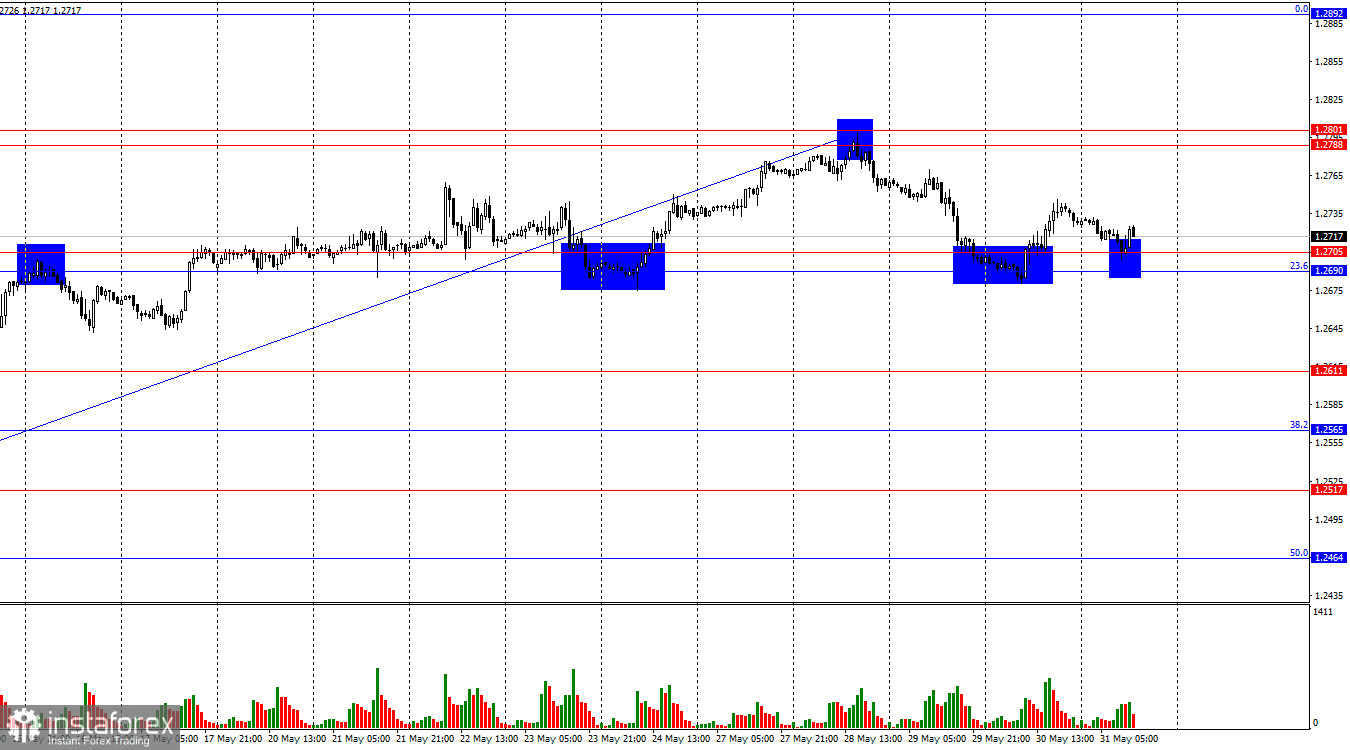

On the hourly chart, the GBP/USD pair fell into the support zone of 1.2690–1.2705 on Thursday, but the bears lacked the strength to continue their attack, and the US GDP report supported the bulls. Today, the pair's quotes returned to this zone, and the bears couldn't close below it again. Thus, until a close below this zone occurs, the pound can resume its upward movement toward the resistance zone of 1.2788–1.2801 at any moment.

The wave situation remains unchanged. The last downward wave ended on May 9 and did not break the low of the previous wave, while the last upward wave broke the peak from May 3. Therefore, the trend for the GBP/USD pair remains "bullish." The first sign of the end of the "bullish" trend will appear only when a new downward wave breaks the low of the previous wave from May 9. However, waves have been very large in recent months, and I allow for the possibility that the pound may follow the euro, which could already be starting to form a "bearish" trend. We must be prepared for the pound sterling to fall. But first, the bears must at least break through the 1.2690–1.2705 zone.

The pound may soon begin to form a "bearish" trend. However, if the bears continue to show weakness and the news background continues to create obstacles for dollar growth, the price will not be able to close even below the 1.2690–1.2705 zone, which is the nearest to the recent peaks. Thus, after reaching the latest peak, the pair failed to show even a correction, let alone a full corrective wave. The news background might change soon, but no one knows for sure. Today, the pound rose together with the euro. The rise in the British currency was weak, but the important thing is that we did not see a fall, not even a corrective one. At this point, I cannot say that the "bullish" trend is over.

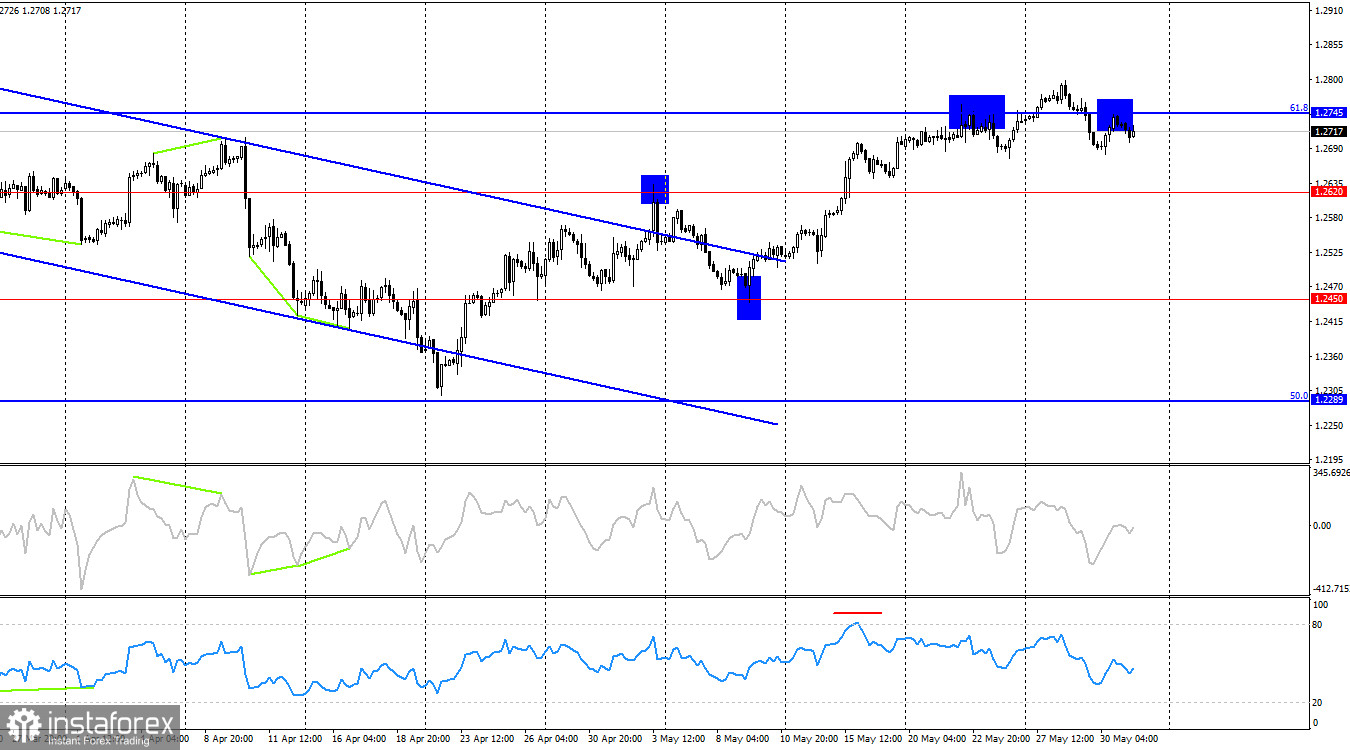

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the 61.8% retracement level – 1.2745. Thus, the downward process may continue toward the 1.2620 level. However, the 1.2690–1.2705 zone is now crucial for the pair and traders. Without breaking it, the pound's decline will not happen. No impending divergences are observed in any indicators today.

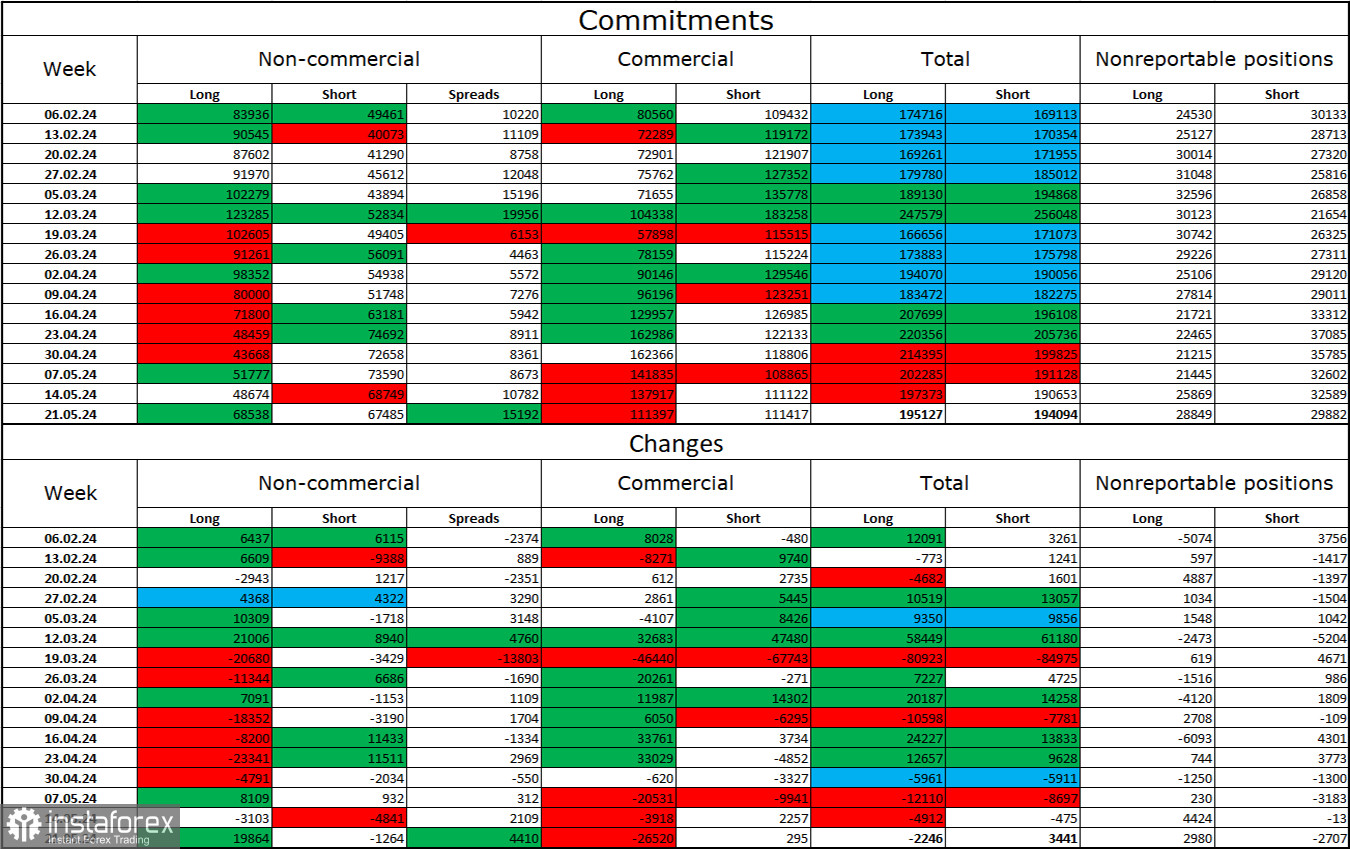

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became less "bearish" in the last reporting week. The number of Long contracts held by speculators increased by 19,864 units, while the number of Short contracts decreased by 1,264. The overall sentiment of large players has changed again, and now neither bulls nor bears have the advantage. The gap between the number of Long and Short contracts is just one thousand: 68,000 versus 67,000.

The pound still has the potential for a decline. Over the last 3 months, the number of Long positions has decreased from 83,000 to 68,000, while the number of Short positions has increased from 49,000 to 67,000. Over time, bulls will continue to reduce their Buy positions or increase their Sell positions, as all possible factors for buying the British pound have already been exhausted. Bears have shown their weakness and complete unwillingness to go on the offensive in recent months, which significantly hinders the pair's downward movement.

Economic Calendar for the US and UK:

- US – Personal Consumption Expenditures Price Index (12:30 UTC)

- US – Changes in Personal Spending and Income (12:30 UTC)

The economic events calendar contains two entries on Friday, neither of which is important. The news background may weaken market sentiment today.

GBP/USD Forecast and Trading Advice:

Selling the pound was possible in case of a rebound from the resistance zone on the hourly chart of 1.2788–1.2801 with targets of 1.2690–1.2705. The target has been reached. New sales are possible upon closing below 1.2690–1.2705 with targets of 1.2611 and 1.2565. Purchases can be opened on a rebound from the 1.2690–1.2705 zone with targets of 1.2788–1.2801.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română