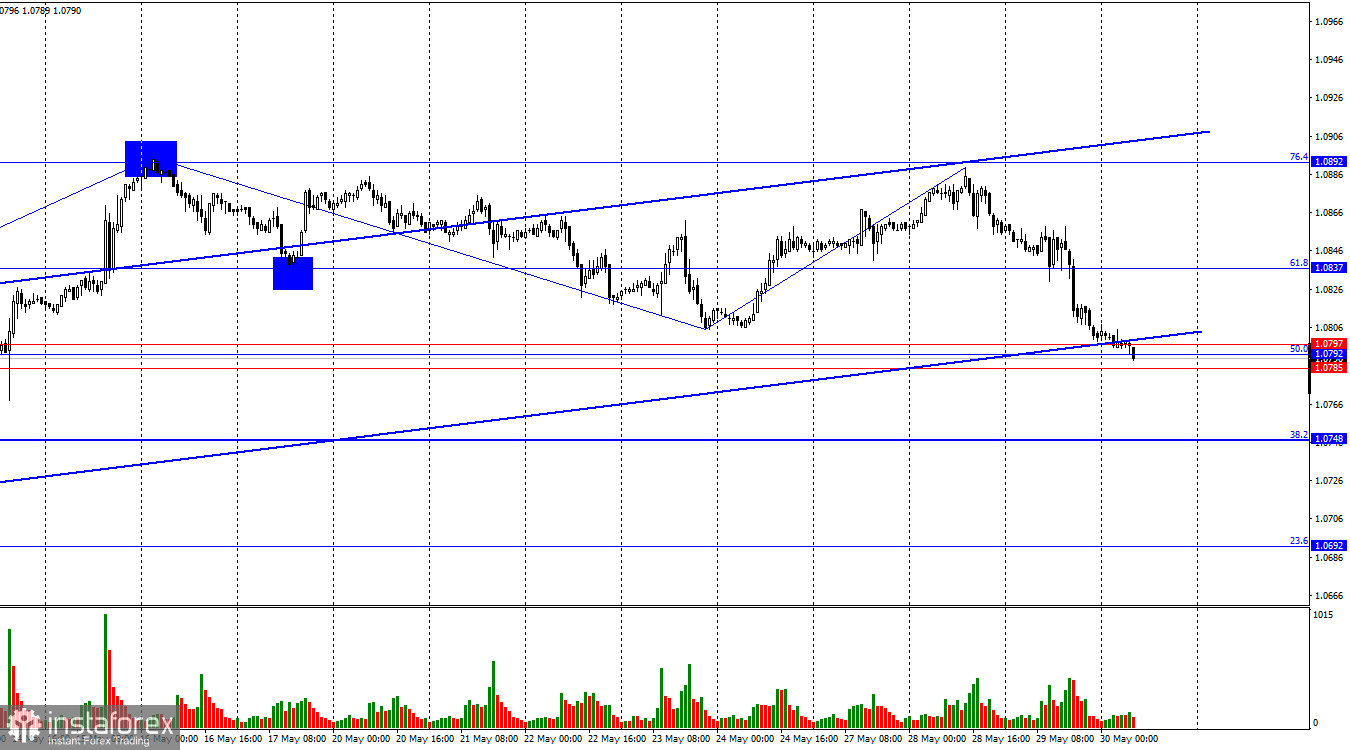

On Wednesday, the EUR/USD pair continued to decline almost all day, and it consolidated below the retracement level of 61.8%–1.0837. Currently, the quotes are trading in the support zone of 1.0785–1.0797. Consolidation below this zone will favor further decline towards the next Fibonacci level of 38.2%–1.0748. A rebound from the 1.0785–1.0797 zone will support a reversal in favor of the euro and some growth toward the 1.0837 retracement level. Bulls are beginning to lose their grip on the market.

The wave situation remains clear. The last completed upward wave did not break the peak of the previous wave, while the new downward wave broke the low from May 23. Thus, we have the first sign of a trend change from bullish to bearish. Consolidation below the ascending trend channel will confirm the bears' offensive. The market is currently undergoing a reversal. In my opinion, the new bearish trend could be quite strong, as the euro's recent growth has raised many questions.

The informational background on Wednesday was very weak, but the fact that the bears managed to take the offensive is encouraging. The Consumer Price Index in Germany increased from 2.2% year-on-year in May to 2.4%, which fully matched traders' expectations. Thus, there was practically no reaction to this report. Inflation in the Eurozone has already decreased enough for the ECB to consider easing monetary policy. A slight increase in consumer prices no longer plays a significant role. Moreover, while German inflation is certainly important, the Eurozone inflation data, to be released tomorrow, will indicate the market's direction soon. If we do not see the euro rise on increasing inflation in the Eurozone, the bears fully control the market.

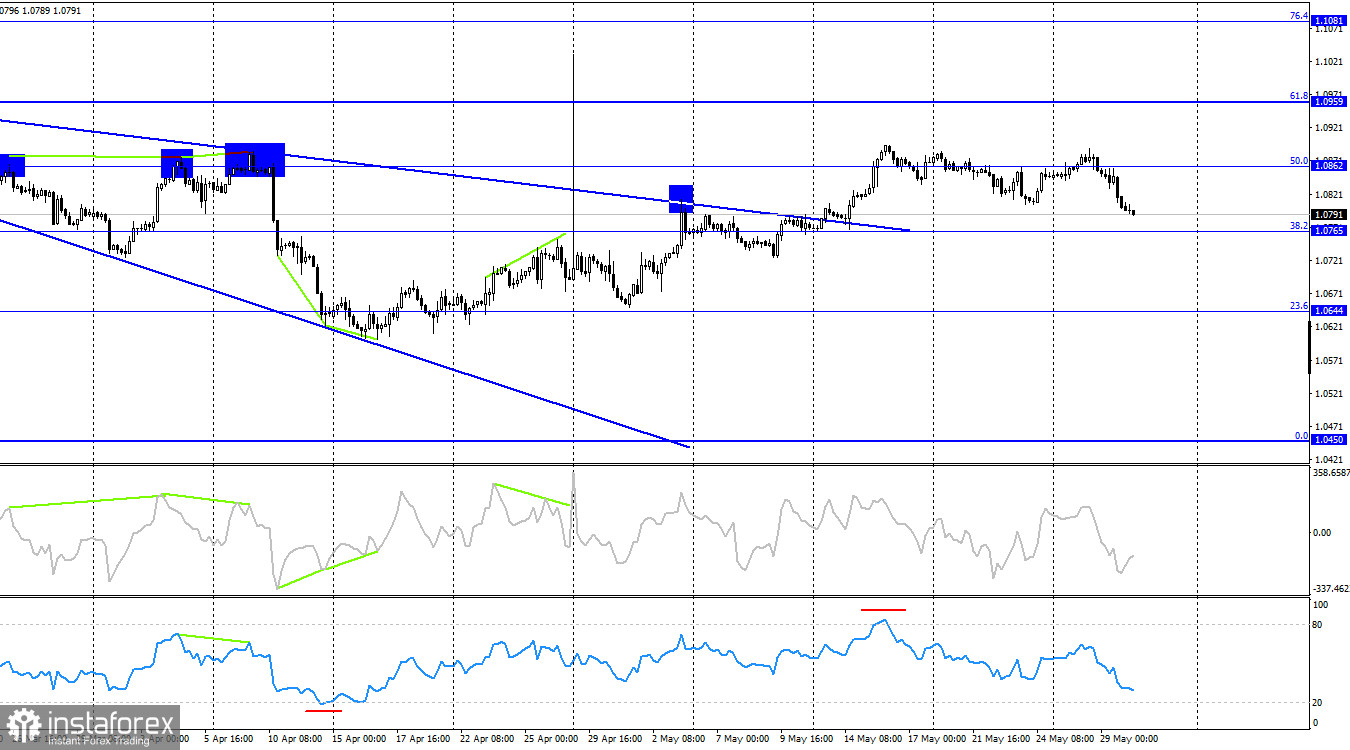

On the 4-hour chart, the pair rebounded from the Fibonacci level of 50.0%–1.0862 and reversed in favor of the US dollar. Despite exiting the "wedge," I anticipate that a bearish trend may form in the coming weeks and months, as the informational background is contradictory and does not support the bulls. Next month, the ECB is set to begin easing monetary policy, a strong bearish factor for the euro. Consolidation below the Fibonacci level of 38.2%–1.0765 will increase the likelihood of further decline towards the next retracement level of 23.6%–1.0644.

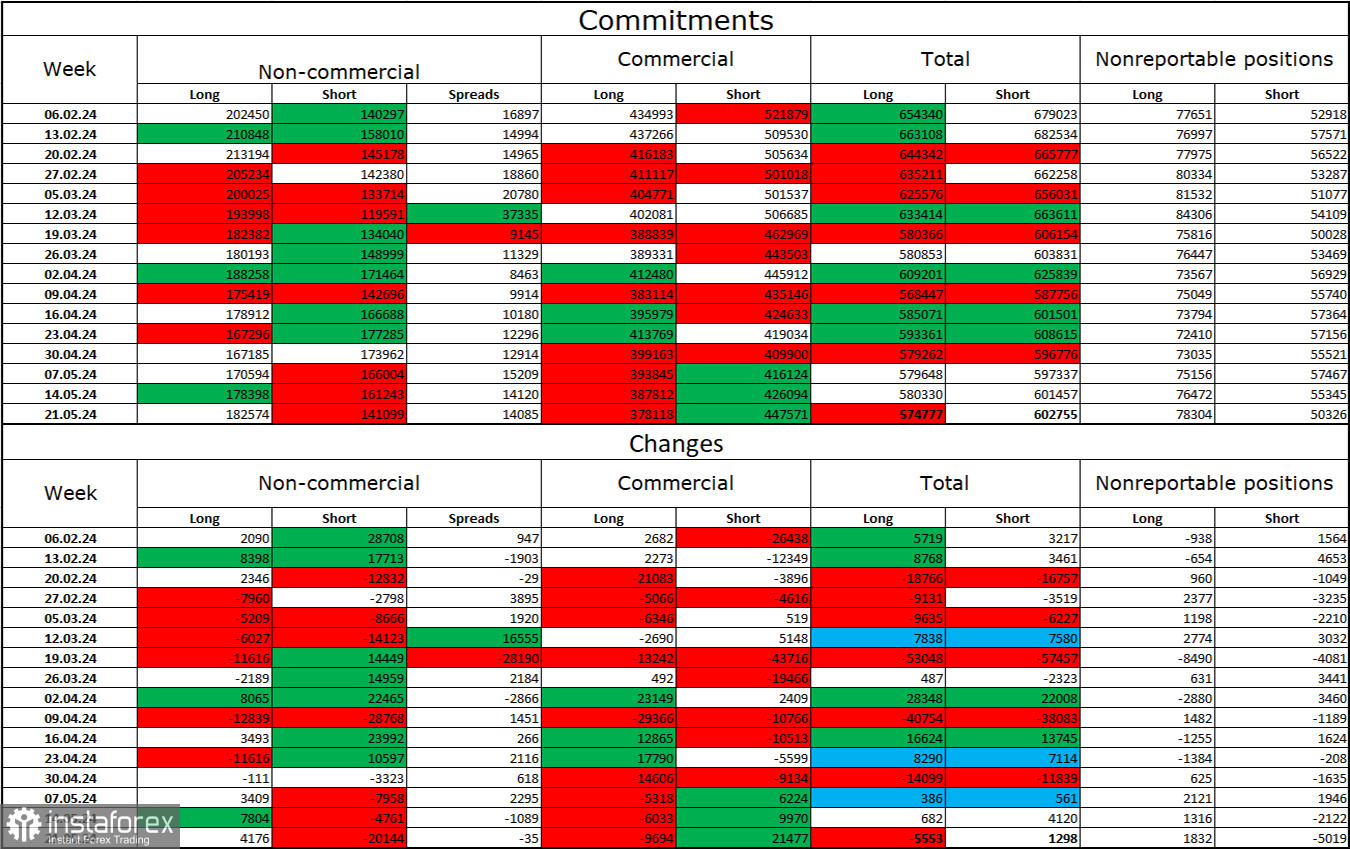

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 4,176 long contracts and closed 20,144 short contracts. The sentiment of the "Non-commercial" group turned bearish a few weeks ago, but now the bulls have regained the upper hand. The total number of long contracts speculators hold is now 182,000, while short contracts amount to 141,000. The gap is widening again in favor of the bulls.

However, the situation will continue to shift in favor of the bears. I do not see long-term reasons to buy the euro, as the ECB is already set to begin easing monetary policy, which will reduce the yield on bank deposits and government bonds. In the US, yields will remain high, making the dollar more attractive to investors. However, it is important to react to the graphical analysis and COT report data, which indicate a persistent bullish sentiment.

News Calendar for the US and Eurozone:

- Eurozone: Unemployment rate (09:00 UTC)

- US: GDP for the first quarter (12:30 UTC)

- US: Change in initial jobless claims (12:30 UTC)

The economic events calendar for May 30 includes several entries, with the GDP report standing out. The impact of the informational background on traders' sentiment today may be moderate.

Forecast for EUR/USD and Trading Advice:

Selling the pair was possible upon consolidation below the 1.0837 level, targeting the support zone of 1.0785–1.0797. This target has been reached. Upon consolidation below this zone, new sales are possible, targeting 1.0748 and 1.0692. Buying the euro is possible today if it rebounds from the 1.0785–1.0797 zone, targeting 1.0837. The euro's growth may be very weak as bears are taking control of the market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română