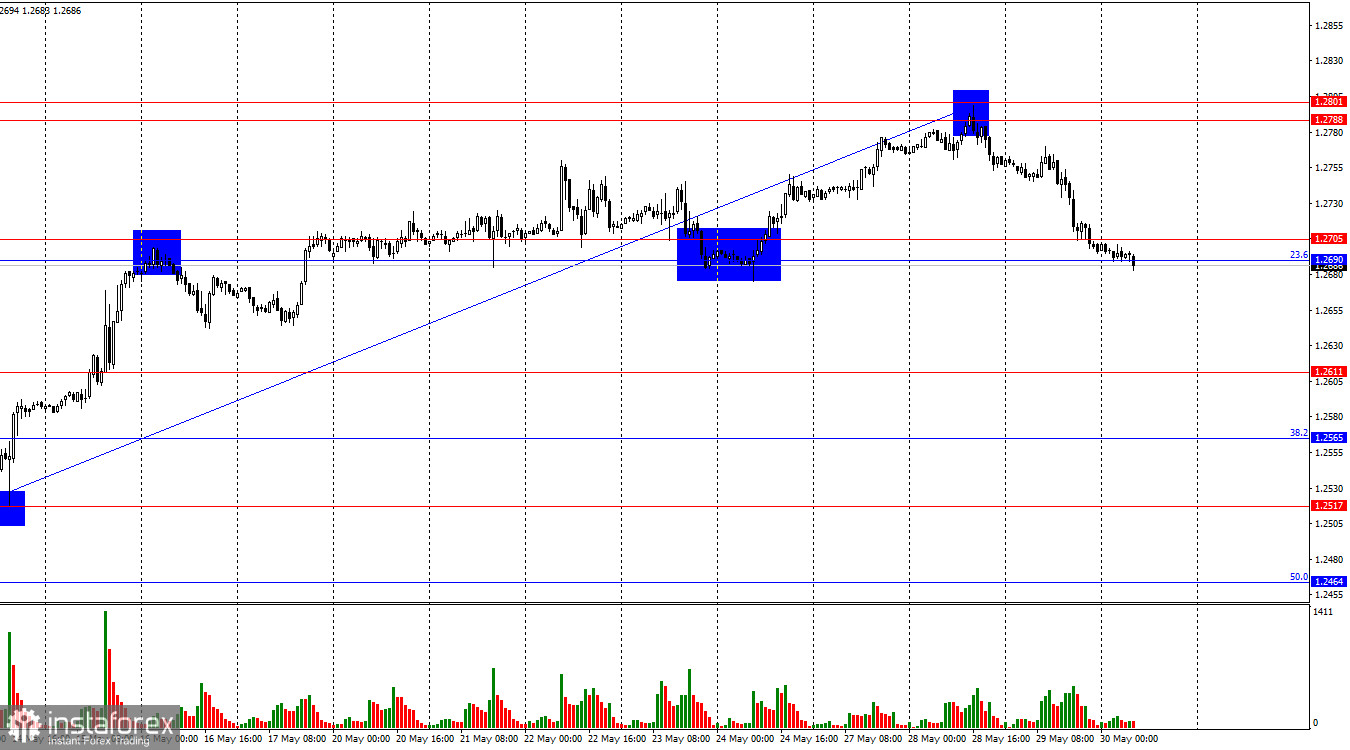

On the hourly chart, the GBP/USD pair continued its decline on Wednesday after rebounding from the resistance zone of 1.2788–1.2801. This morning, the pair fell into the support zone of 1.2690–1.2705. A rebound from this zone will favor the pound and lead to some growth toward the 1.2788–1.2801 zone. If quotes consolidate below this zone, it will support further decline towards the next level of 1.2611. Bulls are starting to retreat from the market.

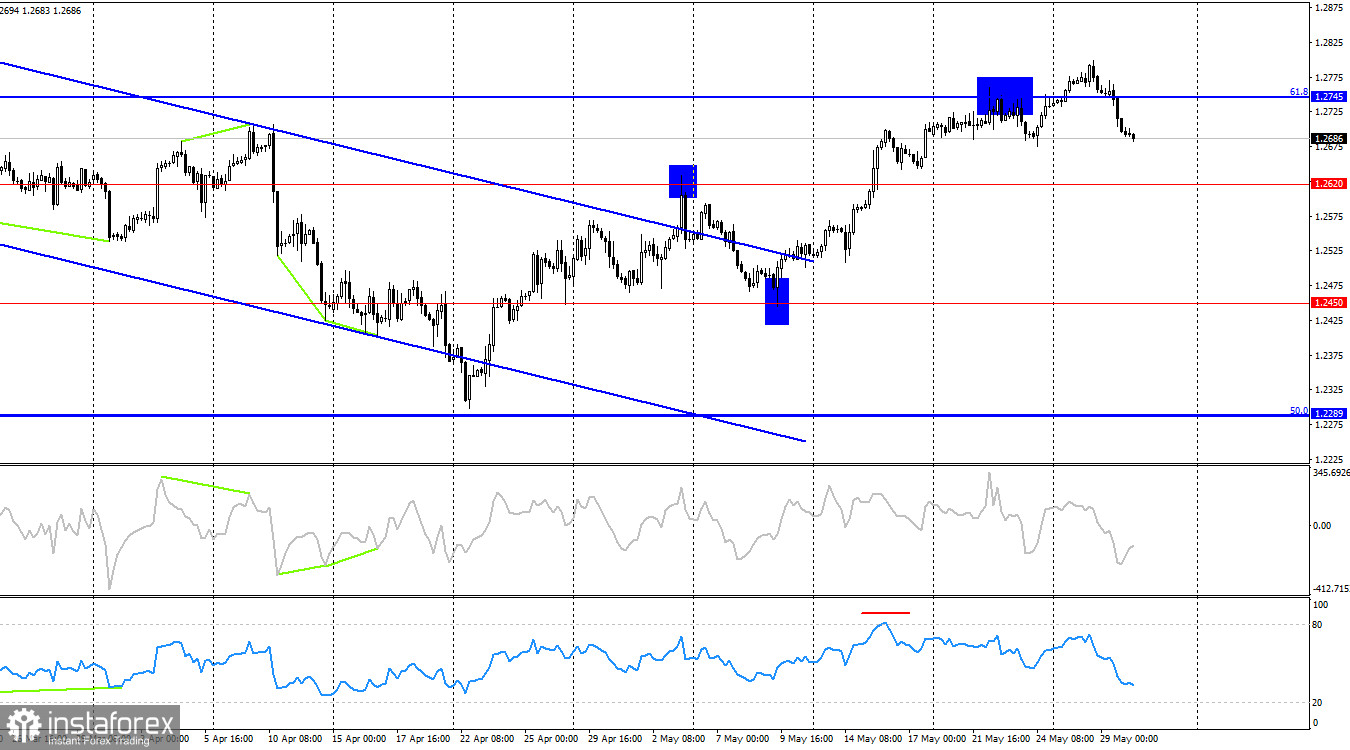

The wave situation remains unchanged for now. The last downward wave ended on May 9 and did not break the low of the previous wave, while the last upward wave broke the peak from May 3. Thus, the trend for the GBP/USD pair remains bullish. The first sign of the end of the bullish trend will appear only when a new downward wave manages to break the low of the previous wave from May 9. However, the waves have been very large in recent months, and I see the possibility that the pound might follow the euro, which has already started forming a bearish trend. Be prepared for a fall in the British pound.

The pound has halted for the first time in a long while and may start forming a bearish trend. The support zone of 1.2690–1.2705 will play a crucial role. This week, there have been no economic events in the UK; in the US, the first reports are due today. Therefore, the pound's decline is not due to the informational background but to traders' desire to sell. This means the bulls are retreating, which is logical after a month and a half of attacks. During this time, the pound has grown significantly, perhaps too much. However, the bears cannot remain in the shadows forever. The pound's decline is unlikely to be observed every day now, but everything currently points to a trend of change towards bearish. For bear traders, it is very important to consolidate below the 1.2690–1.2705 zone today.

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the retracement level of 61.8%–1.2745. Thus, the decline may continue toward the 1.2620 level. No emerging divergences are observed today. In my opinion, consolidation below 1.2620 will be logical within the framework of the new bearish trend.

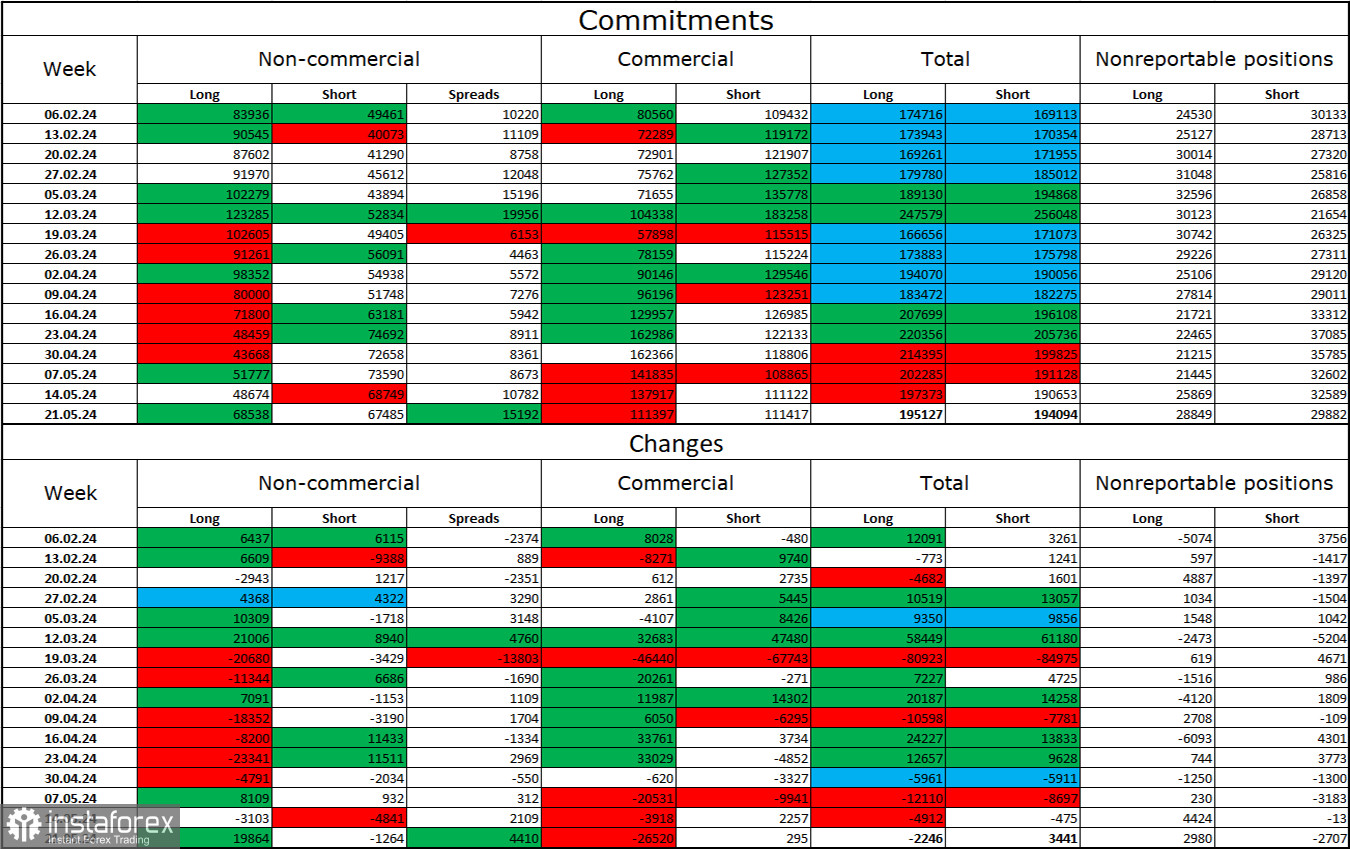

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became less bearish over the last reporting week. The number of long contracts held by speculators increased by 19,864, while the number of short contracts decreased by 1,264. The overall sentiment of large players has changed again, and now neither bulls nor bears have the advantage. The gap between long and short contracts is only one thousand: 68 thousand versus 67 thousand.

The British pound still has prospects for a decline. Over the last three months, the number of long contracts has decreased from 83 thousand to 68 thousand, while the number of short contracts has increased from 49 thousand to 67 thousand. Over time, bulls will continue to reduce their Buy positions or increase their Sell positions, as all possible factors for buying the British pound have already played out. Bears have shown their weakness and complete reluctance to go on the offensive in recent months, making it difficult for the pair to move down.

News Calendar for the US and UK:

- US: GDP for the first quarter (12:30 UTC)

- US: Change in initial jobless claims (12:30 UTC)

The economic events calendar contains two entries on Thursday. Attention should be paid to the US GDP report. The influence of the informational background on market sentiment may be moderate today but more pronounced in the second half of the day.

Forecast for GBP/USD and Trading Advice:

Selling the pound was possible for a rebound from the resistance zone on the hourly chart of 1.2788–1.2801 with a target of 1.2690–1.2705. The target has been achieved. New sales are possible if it closes below 1.2690–1.2705, with targets at 1.2611 and 1.2565. Purchases can be opened on a rebound from the 1.2690–1.2705 zone, targeting 1.2788–1.2801.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română