On Wednesday, EUR/USD continued to trade in the usual manner. The price once again crossed the moving average line, which shows that the pair does not pay any attention to it. Volatility was weak once again. The market had an illogical reaction to the only economic report on Wednesday. By the end of the day, the pair consolidated below the moving average line, but this consolidation does not inspire confidence at the moment. We can only expect the pair to show a substantial decline if the price consolidates below the level of 1.0803.

To start with, the euro was falling on Wednesday morning. However, this didn't last long. A report on German inflation was published at the beginning of the US session. Although it did not boost the single currency, it did stop the euro from falling. It is obvious that EUR/USD needs to move downwards The single currency manages to trade higher even when the European Central Bank is preparing to lower the key rate. Furthermore, the state of the European economy is much worse than that of the US. Regardless of these facts, the euro still rises more often than it falls, but within the framework of the downward trend that began last year. The euro continues to grow on practically any macroeconomic report or fundamental event.

The Consumer Price Index (CPI) in Germany increased from 2.2% to 2.4% in May. The report's value fully matched the forecast, so there should have been no market reaction at all. Accelerated inflation means absolutely nothing for the euro, as the ECB has already decided to start easing monetary policy in June. It's unlikely that any ECB official seriously believes that inflation will only decrease each month. Therefore, one month with a slight increase does not necessarily imply a new round of accelerated inflation. And in any case, the actual value matched the forecast, so there should have been no reaction at all.

The EUR/USD pair still fell by several dozen of pips on Wednesday. However, overall, the euro continues to appreciate at practically any opportunity, defying common sense and logic. Yesterday's decline looks more like an exception to the rule. The pair's volatility is approaching record low levels. With such movements, it becomes extremely difficult to trade every day. One has to either hold a trade in the market for several weeks to have a chance of getting at least 70-80 pips of profit, or choose to not enter the market at all. Unfortunately, it is very difficult to say when this unfavorable period will end. Traders who trade on "pure" technical analysis can continue buying when the price is above the moving average. We still expect the downtrend to resume.

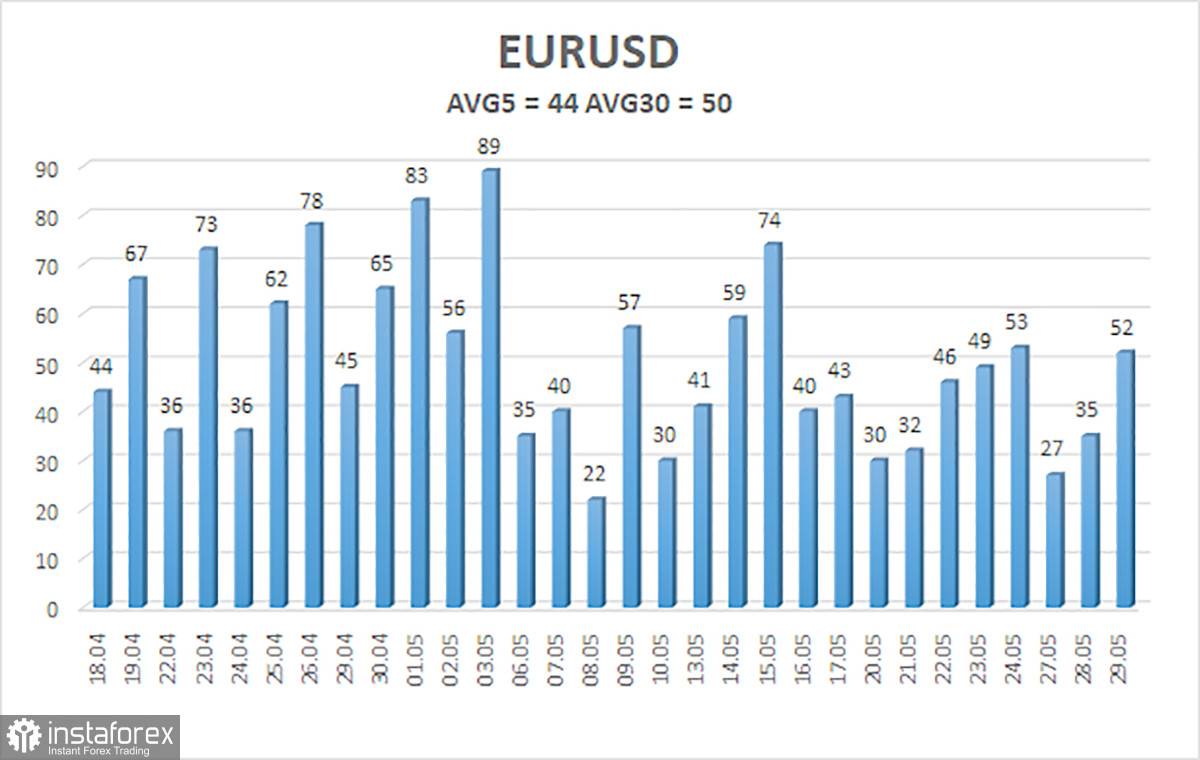

The average volatility of the EUR/USD pair over the last five trading days as of May 30 is 44 pips, which is considered low. We expect the pair to move between 1.0769 and 1.0857 on Thursday. The long-term linear regression channel is directed downward, so the global downward trend remains intact. The CCI indicator entered the oversold area last month, which triggered the upward movement. However, the bullish correction has lasted long enough so it's difficult to expect it to end anytime soon.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

The EUR/USD pair maintains a downtrend, but the bullish correction remains intact. We cannot confirm that it has surely ended. The euro should resume its downward movement in the medium term, but the market continues to interpret almost every event against the dollar. The single currency often rises even in the absence of news and reports. We believe that this will not last forever. In terms of selling, it is necessary to wait for the price to firmly consolidate below the moving average. If the price continues to fall, the euro could become much cheaper in the next few months, as the fundamental and macroeconomic background continues to support the dollar. A global downtrend also persists on the 24-hour TF.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română