The euro grew in response to a survey from the European Central Bank. The report reads that inflation expectations in the eurozone fell in April this year, allowing the regulator to move on to its plans to cut interest rates at a meeting scheduled for next week.

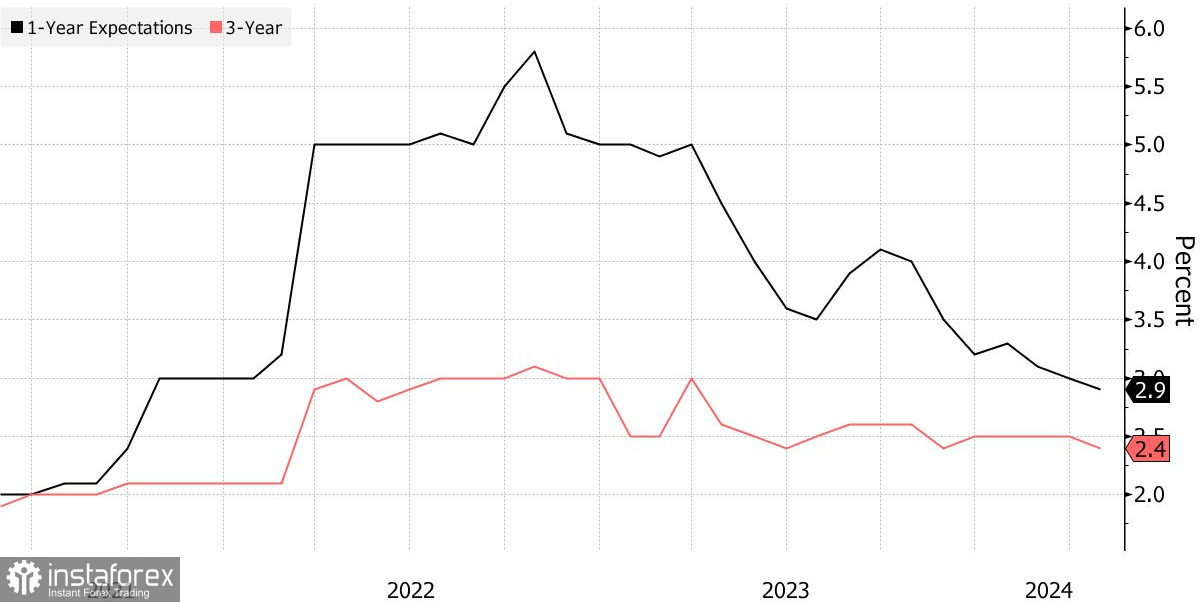

Consumer prices are expected to rise by 2.9% over the next 12 months, down from the estimated 3% in the survey released in March, central bank economists predict. The latest estimate is the lowest annual rate since September 2021. The three-year CPI rate also inched down to 2.4% from 2.5%, the level inflation had been at for the past four months.

With the first cut in borrowing costs on June 6 looking like a done deal, some ECB officials are trying to determine the future pace and timing of subsequent steps towards monetary easing, thereby providing support to risky assets, including the European currency. Commonly, this, on the contrary, would weaken buying activity, but now, the economy requires stimulus measures. For a reason, this issue was recently raised by a representative of the German Bundesbank Isabel Schnabel. It turns out that the euro can and will respond to news about imminent rate cuts with growth.

Obviously, ECB policymakers are also discussing a second rate cut, which could happen as early as July this year, as ECB representatives Francois Villeroy de Galhau and Philip Lane told in their public comments.

Let me remind you that at the beginning of the week, Bank of France Governor Francois Villeroy de Galhau said that the ECB should not rule out rate cuts in both June and July, although hawkish policymakers, including Executive Board member Isabelle Schnabel, have recently spoken out against such steps.

As for the inflation data, we are talking about actual figures. The annual CPI in the eurozone remained at 2.4% in April. Analysts estimate price growth in May at 2.5%. The inflation report will be released this Friday.

Last week, the ECB reported that a key indicator of wages in the eurozone failed to slow down in early 2024, as the regulator had anticipated. That's why policymakers are now more focused than ever on wages, corporate profits, and productivity. This will allow them to assess the disinflationary trend.

Today's ECB survey also showed less pessimism among consumers about the economy. Pollees forecast a contraction of economic growth of 0.8% over the next 12 months - down from -1.1% in the previous survey. Expectations for the 12-month unemployment rate rose to 10.9% from 10.7%. At the same time, consumers expect the price of their homes to rise by 2.6%, stronger than a 2.4% rise in the previous poll. Expectations for mortgage interest rates remained unchanged at 5%.

Regarding the current technical picture of EUR/USD, the euro will still have chances to assert strength. Now buyers need to think about how to take the level of 1.0890. Only this will allow them to challenge the 1.0920 level. From there, the price can climb to 1.0945, but doing this without support from major players will be quite problematic. The farthest target will be a high of 1.0960. If the trading instrument declines only in the area of 1.0865, I expect some serious actions from large buyers. If there is no one there, it would be a good idea to wait until the low 1.0840 is updated, or open long positions from 1.0820.

As for the current technical picture of GBP/USD, pound buyers will continue to control the market. The bulls need to take the nearest resistance at 1.2800. This will allow them to target 1.2845, but it will be quite problematic to climb higher. The farthest target will be 1.2890, after which we can talk about a sharper surge of GBP/USD to 1.2920. If the instrument falls, the bears will try to take control of 1.2755. If they manage all right, a breakout of this level will deal a serious blow to the positions of the bulls and push GBP/USD to a low of 1.2715. The next move would be a low of 1.2670.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română