The EUR/USD pair is trading weakly at the beginning of the new week. Bears try their best to push the pair down, but they are met with strong resistance from the bulls, who only let the quotes fall with a supportive information background. Last Friday's information background showed me that bulls can attack under any conditions. Therefore, even if traders receive economic data this week that supports the dollar, it is not guaranteed that bear traders will be able to or want to take advantage of it.

This week, the most important report is the EU inflation data. Although the decision to cut the ECB rate has almost been made, an unexpected acceleration in inflation will delay the European regulator's decision. If inflation exceeds the forecast, the European currency could continue to rise, as the ECB's monetary policy could remain "hawkish" for approximately 1.5 months until the next regulator meeting. Therefore, it is important to understand how the market might react to the inflation report, which will be released on Friday, May 31.

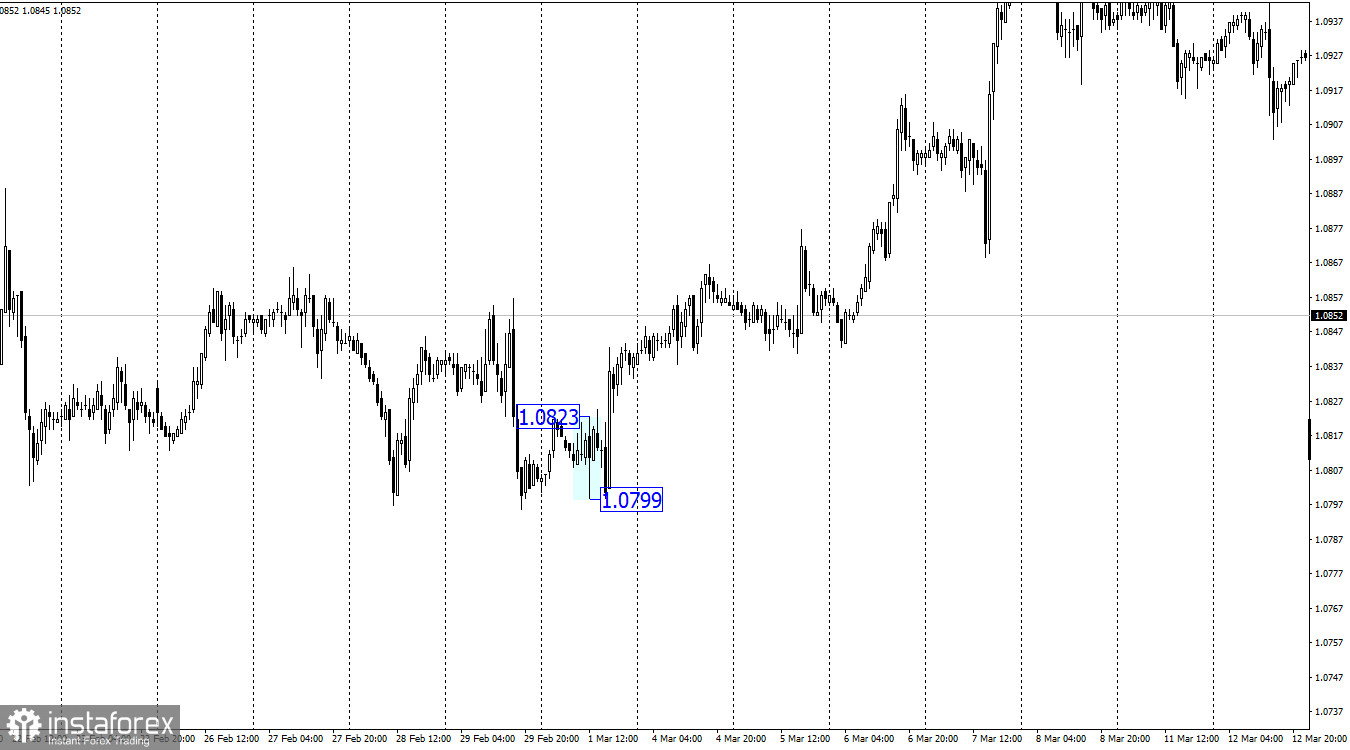

The February EU inflation report, released on March 1, showed a slowdown from 2.8% YoY to 2.6% with a forecast of 2.5%. At the same time, core inflation slowed from 3.3% to 3.1%, with a forecast of 2.9%. Both reports could have been stronger, but as shown above, European traders reacted very weakly to this report. In the first hour after its release, activity was only 24 pips. Only in the second half of the day did the euro see a stronger rise.

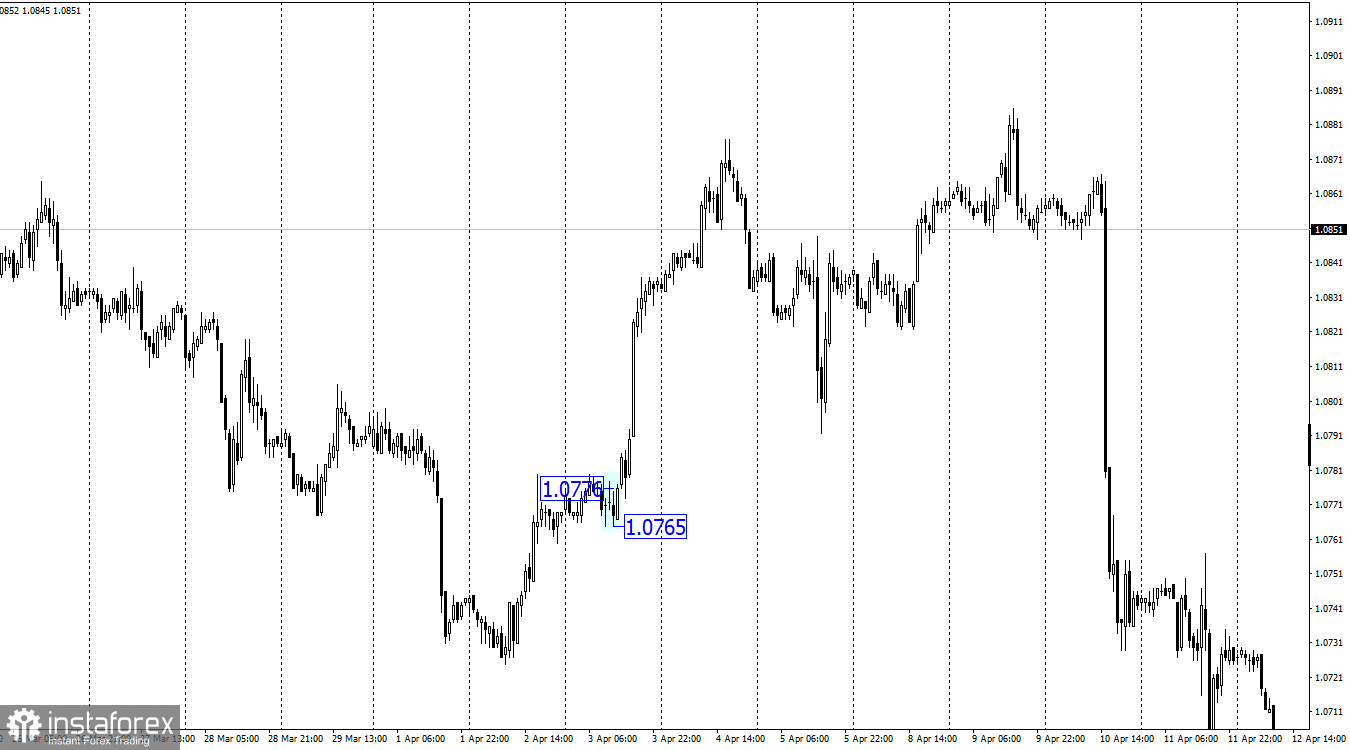

The March inflation report, released on April 3, showed the following values. Inflation slowed from 2.6% YoY to 2.4%, with forecasts of 2.6%. Core inflation slowed from 3.1% to 2.9%, with a forecast of 3%. Thus, both indicators showed a stronger slowdown compared to traders' expectations. Once again, European traders barely reacted, while American traders actively bought the euro.

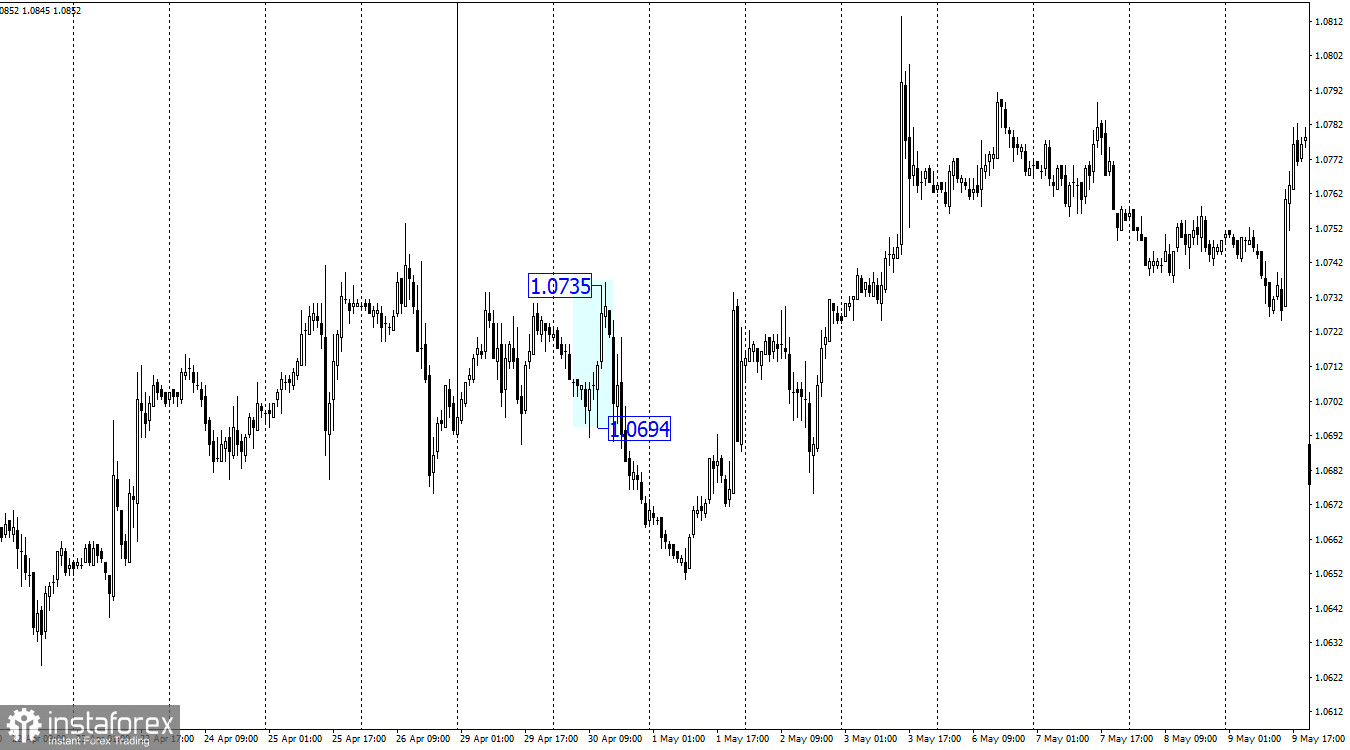

On April 30, the April EU inflation report was released. This time, the main indicator did not change - 2.4%, which was also the forecasted value. Core inflation slowed from 2.9% to 2.7%, with a forecast of 2.6%. European traders responded with euro purchases of about 40 pips, but American traders answered with sales.

Conclusion:

In all three cases, European traders' reaction was quite weak. In all three cases, the actual values were only slightly different from the forecasts. If inflation slowed more significantly, the euro rose. If it slowed less, it also rose. I have mentioned this in other articles. The bulls are currently too strong, so it does not matter to them what data they buy the euro on.

This Friday, inflation in the European Union is expected to accelerate to 2.5%. Core inflation may remain unchanged at 2.7%. If traders previously bought the euro on slowing consumer price index growth, they might buy it even more eagerly on its acceleration. The EUR/USD pair currently has a strong support zone at 1.0785 – 1.0797. Above this, bulls will certainly maintain an advantage in the market. If the pair does not close below this zone by Friday, I believe almost any value from the report will trigger a new rise in the euro. The exception could be a new slowdown in inflation below 2.4% and 2.7%, respectively, which traders are not currently expecting. In this case, the 1.0785 – 1.0797 zone could be reclaimed by the bears, who could then use it as support in forming a downward wave.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română