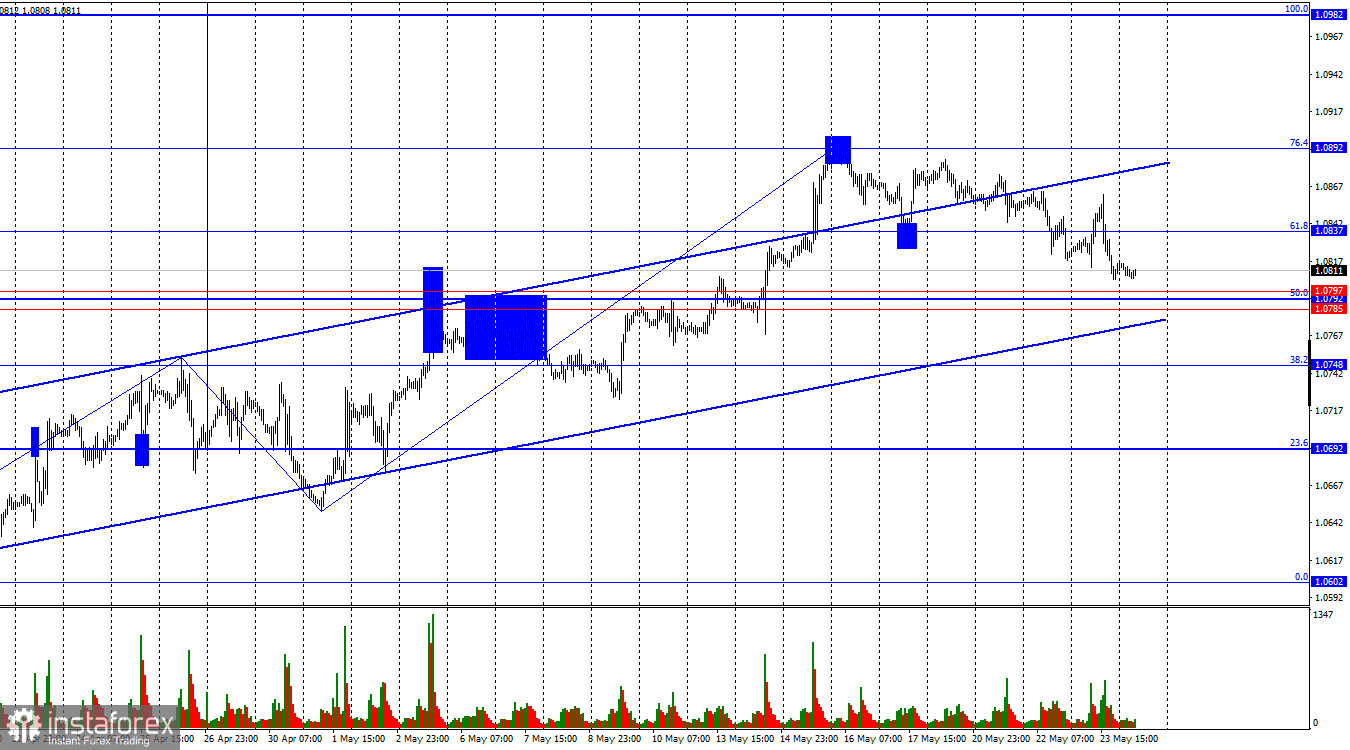

On Thursday, the EUR/USD pair rose by 45 points but then reversed in favor of the US dollar and resumed its decline towards the support zone of 1.0785–1.0797. A bounce from this zone will favor the euro and a resumption of growth towards the Fibonacci 61.8% level at 1.0837. Securing the pair below the ascending trend corridor will signal the end of the "bullish" trend. In this case, the US dollar may rise in the coming weeks.

The wave situation remains clear. The last downward wave ended on May 1 without reaching the low of the previous wave, while the last upward wave broke the peak of the previous wave. Thus, the "bullish" trend persists. I consider this trend quite unstable and believe it will only last for a while. However, the rise in quotes has continued for more than a month, and the bears have yet to push the pair even to the lower line of the corridor. There are currently no signs of the "bullish" trend ending. Such a sign will appear if the new downward wave breaks the low of May 1.

The informational background on Thursday allowed bullish traders to launch a new offensive, but it was short-lived as the S&P business activity indices in the US supported the "home" currency. Business activity in the manufacturing sector rose from 50.0 to 50.9, and in the services sector from 51.3 to 54.8. The data were strong, stronger than traders expected. New home sales volumes were slightly worse than forecasts, but the dollar grew weakly in the second half of the day. Bears have been attacking for five consecutive days but need more strength. They may gain strength if they overcome the strong support zone of 1.0785–1.0797 and secure below the ascending corridor. The dollar must receive only good news from the US in the near future. The bulls haven't left the market; they are waiting for a new opportunity.

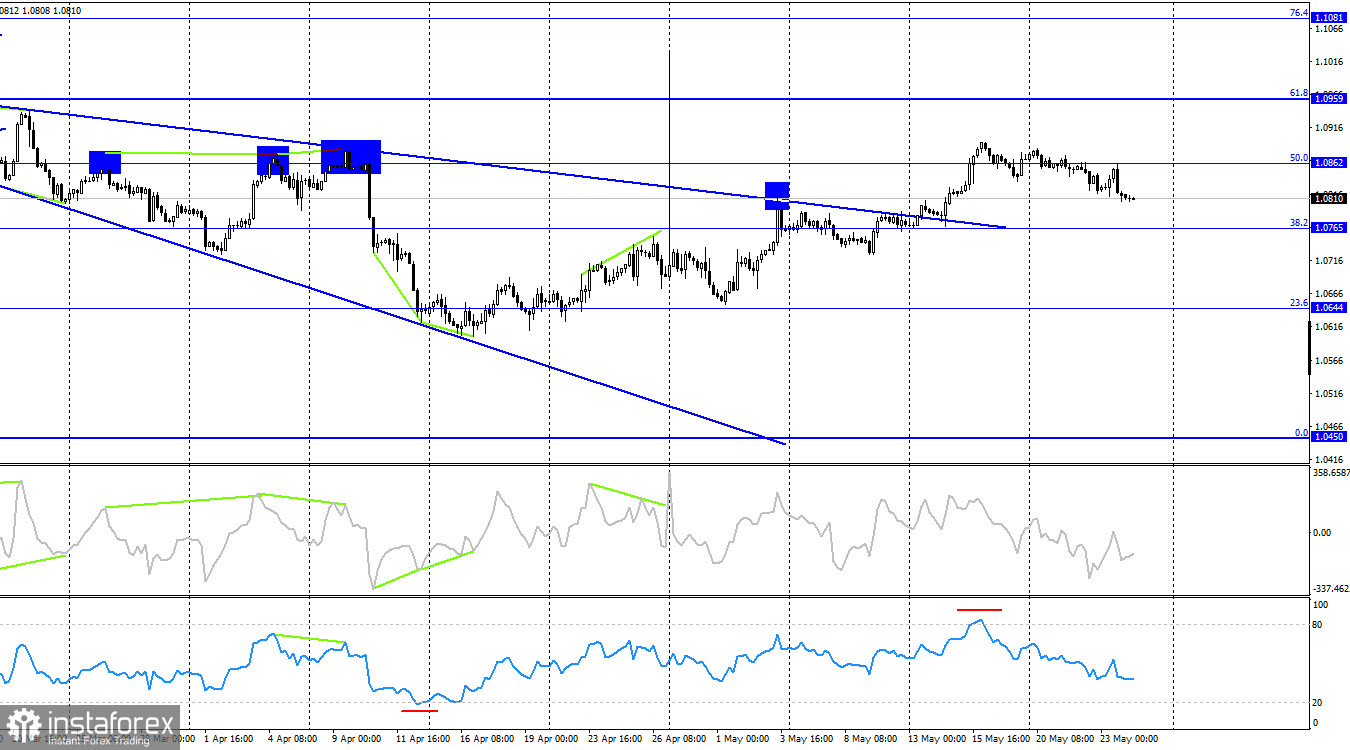

On the 4-hour chart, the pair secured above the "wedge" and rose to the Fibonacci 50.0% level at 1.0862. The latest segment of the euro's growth seems ambiguous, so I am not sure it will continue. No emerging divergences are observed today. If it closes above 1.0862, the growth process may continue toward the next corrective level of 61.8% at 1.0959. It's better to monitor the pair's decline on the hourly chart.

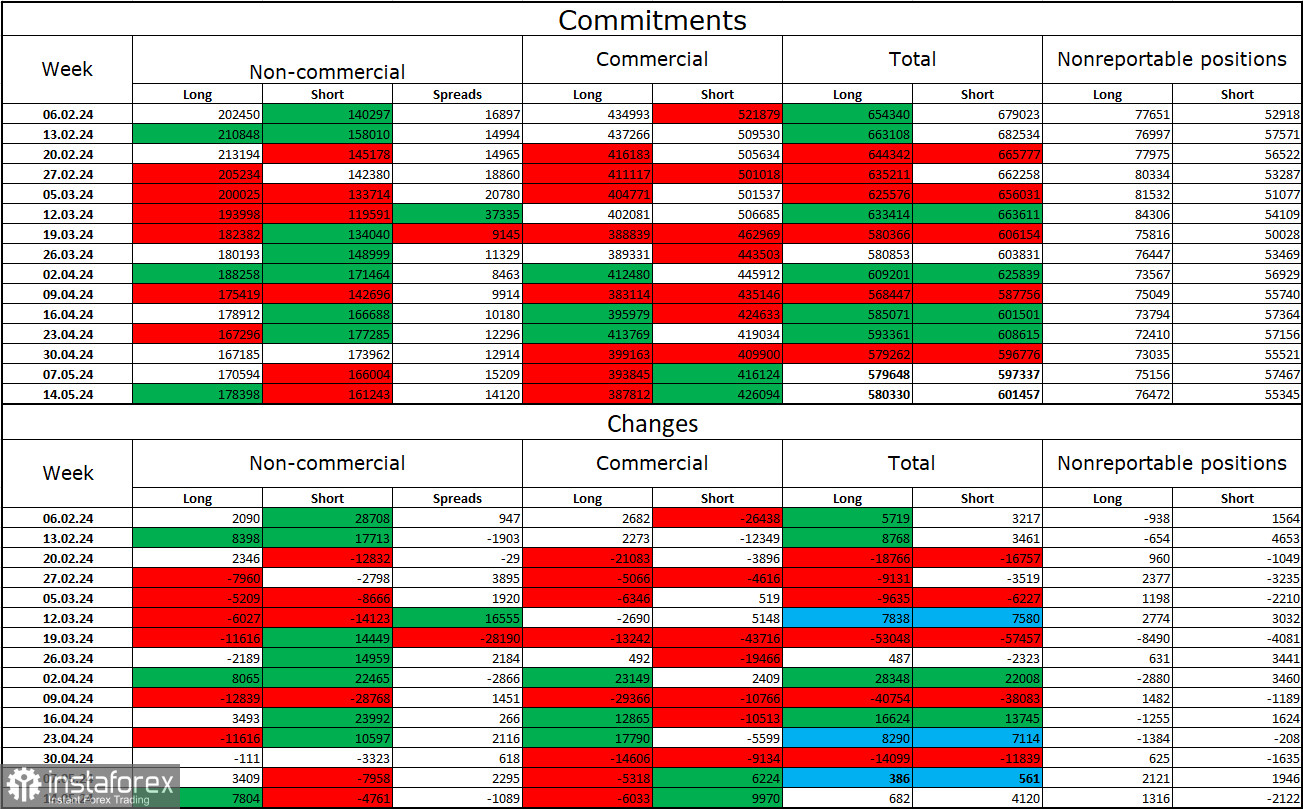

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 7,804 Long contracts and closed 4,761 Short contracts. The sentiment of the "Non-commercial" group turned "bearish" a few weeks ago, but now the bulls have the advantage again. The total number of Long contracts speculators hold is now 178,000, while Short contracts are 161,000. However, the situation will continue to shift in favor of the bears. The second column shows that the number of Short positions has increased from 140,000 to 161,000 over the past three months. During the same period, long positions decreased from 202,000 to 178,000. Bulls have dominated the market for too long, and now they need a strong informational background to resume the "bullish" trend. A series of poor reports from the US supported the euro, but more was needed in the long term.

News Calendar for the US and the Eurozone:

- Eurozone – Q1 GDP in Germany (06:00 UTC).

- USA – Durable Goods Orders Change (12:30 UTC).

- USA – University of Michigan Consumer Sentiment Index (12:30 UTC).

On May 24, the economic event calendar contains several exciting entries. The impact of the informational background on trader sentiment today may be moderate.

EUR/USD Forecast and Trading Tips:

The pair was possible to sell upon closing below the 1.0837 level, with a target of 1.0785. They can now be held. Buying the euro can be considered a bounce from the 1.0785–1.0797 zone on the hourly chart, with targets at 1.0837 and 1.0892.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română