Global Markets Are Fevered As New U.S. Tariffs Slam Stocks, Fuels Gold

Financial markets around the world are suffering a second straight day of sharp declines, while gold is soaring to new all-time highs, driven by an unexpected round of trade tensions initiated by the White House.

The Trump administration announced Wednesday a 25 percent tariff on imported cars and parts. The new measures have heightened tensions on the international stage and caused a stir in Asia, with key indices Nikkei in Japan and KOSPI in South Korea instantly going negative.

American auto giants are losing ground

Investors reacted with alarm to the news, as the largest US auto companies felt a powerful blow. General Motors shares fell by 7.36 percent, while Ford shares fell by 3.88 percent. The American division of Stellantis also ended up in the red, falling by 1.25 percent.

Auto parts companies also came under pressure, with Aptiv and BorgWarner shares falling by about 5 percent, reflecting market concerns about the stability of global supply chains.

Indexes in the minus: Wall Street could not withstand the blow

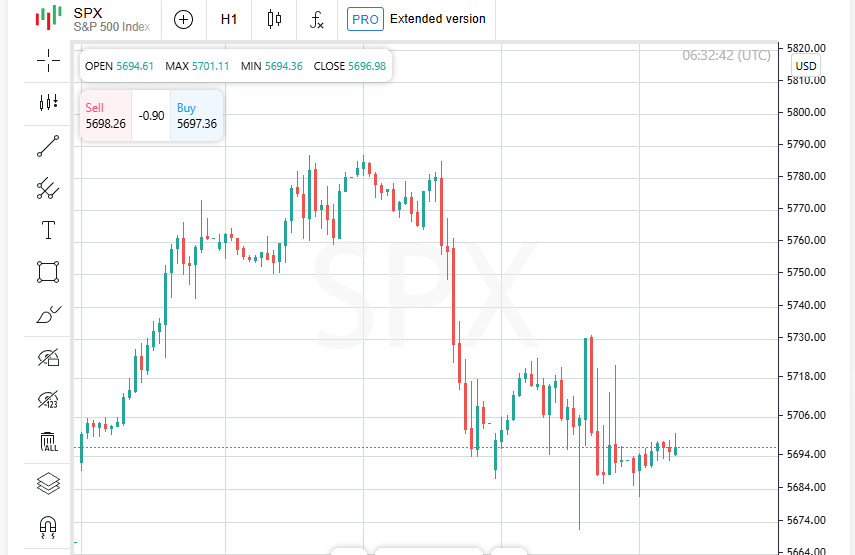

US stock indices ended the session with significant losses. The Dow Jones industrial average fell by 155.09 points (0.37%) and closed at 42,299.70. The broad market index S&P 500 lost 18.89 points (0.33%), falling to 5,693.31, and the high-tech Nasdaq fell by 94.98 points (0.53%), recording a value of 17,804.03.

Alarming trend: the market is on the verge of the first double-month decline in six months

If the dynamics continue, US stock markets risk ending March with a second consecutive month of decline - this has not been seen since October last year. Investors, apparently, are in no hurry to return to risky assets while the trade rhetoric from Washington continues to escalate.

European auto giants under pressure: stocks go into the red

The Old World markets did not escape the wave of negativity. Trading in Europe ended in the "red zone", and the leading automakers felt the fall especially sharply. Volkswagen shares fell by 1.26%, BMW shares lost 2.55%, and Mercedes-Benz fell by 2.69% amid growing concerns about new US tariffs.

Indices are losing ground: a two-week low

The pan-European STOXX 600 index, reflecting the state of the region's largest companies, fell by 0.44% and fell to 546.31 points - this is the worst closing result in the last two weeks. Meanwhile, the global MSCI index, tracking the dynamics of world stocks, also sank, losing 2.77 points (0.33%) and ending the day at 843.19.

Tariffs and Fed policy spook investors

The news of the tariff war widening has affected not only specific industries, but also the overall market sentiment. There are growing concerns that the introduction of new tariffs could slow the global economic recovery and force the Federal Reserve to postpone the interest rate cuts previously expected in the coming months.

Despite recent attempts by markets to stabilize, overall uncertainty remains high, and investors continue to be cautious in their decision-making.

Currency fluctuations: dollar weakens, euro recovers

The dollar index, which measures its strength against six major world currencies, fell by 0.33%, stopping at 104.29. The euro, on the other hand, strengthened, adding 0.4% to reach $1.0795.

The currencies of countries closely linked to the auto industry were unlucky, with the Mexican peso down 0.86% and the Canadian dollar down 0.29%, as economists predict a major blow to those economies if the U.S. auto tariffs are implemented in full.

Canada Prepares Response: Ottawa Warns of Possible Action Against U.S.

Amid escalating trade tensions, Canadian Prime Minister Mark Carney made it clear Thursday that if the Trump administration does impose tariffs on foreign cars, Ottawa will not stand idly by. Carney said Canada's response will be "non-specific but effective," a clear sign of a flexible but decisive approach as the conflict escalates.

The American economy maintains its rhythm despite turbulence

New economic data from the United States shows stability in the labor market. The number of applications for unemployment benefits continues to decline, and the employment rate, according to preliminary estimates, remains stable.

Interestingly, Elon Musk's plans to radically reduce the number of federal employees as part of public administration reform have not yet had a noticeable impact on the statistics, as has the White House tariff policy.

Auto tariffs with specific deadlines: a blow to the schedule

President Donald Trump's plan to introduce 25 percent duties on imported cars and pickups will come into force on April 3. And a month later, on May 3, similar duties will begin to apply to auto parts. Despite the harsh rhetoric, the head of the White House admitted the possibility of adjusting the conditions, which maintains intrigue around the further course of events.

Tech giant cushions market decline

Amid the overall decline in indices, the bright spot was the growth of Apple shares, which added 1.05%. This dynamic slightly smoothed out the losses of the S&P 500 index and kept it from a deeper decline.

Nerves on edge: investors trapped in uncertainty

The unpredictability of Trump's trade initiatives continues to put pressure on Wall Street. Investors are concerned about the risk of disruption of international supply chains, possible capital outflow and rising inflation expectations. All this could seriously undermine confidence in the prospects for global growth.

Dollar Tree surprised the market: shares soared amid candor

On the corporate front, the chain of discount stores Dollar Tree distinguished itself. After admitting problems in its subsidiary brand Family Dollar, which lost about a billion dollars, the company's shares unexpectedly soared by 11%. The reason was the positive forecasts of analysts, who revised the valuation of the shares upward. According to experts, the honesty of the management and the potential revision of the strategy are perceived by the market as a positive signal.

Focus on inflation: investors hold their breath before the new indicator

On Friday, the attention of market participants will be riveted to fresh inflation data - the February value of the consumer price expenditure (PCE) index, which the Federal Reserve traditionally views as a key indicator of inflation pressure. The results of this report may influence the regulator's further decisions on interest rates and set the tone for the second quarter.

US stocks in the red: the worst start to the year since the pandemic

Concerns about the escalation of the trade standoff and uncertainty around monetary policy are already affecting investor sentiment. Traders have significantly reduced their positions in US stocks, and the consequences were not long in coming: the S&P 500 index retreated by about 7% from its record set on February 19, and the tech-heavy Nasdaq fell by almost 12% from its peak in mid-December.

Asia under pressure: Japanese and Korean auto giants drag markets down

Pessimism has also gripped Asian markets. The region's major indexes fell on Friday, with the declines in Japan and South Korea particularly notable. Japan's Nikkei fell more than 2%, dragged down by a slump in shares of Toyota and Honda, two key auto stocks. South Korea's KOSPI also fell, hitting a two-week low amid losses in the auto industry, the backbone of the local economy.

Hong Kong out of trend: China's market reacts differently

Surprisingly, Hong Kong's Hang Seng index rose 0.6% despite global jitters. The market shrugged off the threat of new tariffs, responding to encouraging signals from Washington. President Trump has said he is willing to make concessions on Chinese tariffs if an agreement can be reached to sell TikTok to an American investor unrelated to China's ByteDance.

Auto giants change routes: production is moving away from the blow

A new wave of tariffs initiated by the White House has already begun to change the map of the global auto industry. Several leading manufacturers, including Volvo Cars, Audi (part of the Volkswagen Group), Mercedes-Benz and Hyundai, have officially announced the transfer of part of their production capacities to more stable regions. The reason for this was the potential costs caused by new trade barriers.

The Italian Ferrari, for which global assembly is not an option - all of the brand's cars are made in Italy - has taken a different path: the company plans to increase prices on some models by up to 10% to compensate for potential logistics and export costs.

Dollar Loses Momentum as Markets Worry About U.S. Economic Outlook

The U.S. currency is showing weakness in currency markets. Amid growing concerns about the impact of tariffs on U.S. economic growth, the dollar is heading lower in the first quarter. In particular, the euro is holding steady at $1.07942 and is expected to finish the quarter up about 4%.

Japanese Yen Strengthens: Focus on Bank of Japan Rates

The yen has gained slightly, reaching 150.76 per dollar in early Asian trading. The Japanese currency has also gained momentum since the start of the year, strengthening almost 4% in the quarter. This is due to expectations of interest rate hikes in Japan, a step the country's central bank may take for the first time in a long time.

Tokyo Inflation Supports Tightening Expectations

Data released on Friday showed that core consumer inflation in the Japanese capital accelerated in March. Food prices continue to rise, and inflation remains above the target level set by the Bank of Japan. This only strengthens the position of those market participants who are betting on a tightening of monetary policy in the near future.

Gold shines: the precious metal updates its historical maximum

Amid the escalation of global trade conflicts, gold has once again confirmed its status as the main "safe haven" for investors. On Friday, prices for the precious metal soared to a record high - the spot price reached $ 3,073.31 per ounce, adding 0.58% over the session. The threat of a large-scale trade war is stimulating the transfer of capital from stocks to more conservative assets, and gold is unrivaled here.

Since the beginning of the year, the price of the metal has increased by more than 17%, which brings the first quarter of 2025 closer to the best result since the mid-1980s. The last time such an impressive quarterly growth was observed was in 1986.

Oil under pressure: prices react to geopolitics and supply constraints

While gold is rapidly growing, the oil market is showing more restrained dynamics. American WTI crude oil added 0.39% and was trading at $69.92 per barrel, while North Sea Brent rose to $74.03, having increased in price by 0.33%.

Investors are assessing the dual impact of two factors: on the one hand, geopolitical tensions are increasing concerns about supplies, on the other hand, new trade barriers could slow economic growth and, as a result, reduce demand for energy.

Despite small intraday fluctuations, futures quotes showed a slight decline at the end of the session. Brent contracts fell by 0.07% to $73.98 per barrel, and WTI futures also lost 0.07%, reaching $69.87.

Such volatility reflects the tense anticipation in the market, as market participants try to predict whether the positive effect of supply cuts will outweigh the negative impact of tariff escalation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română