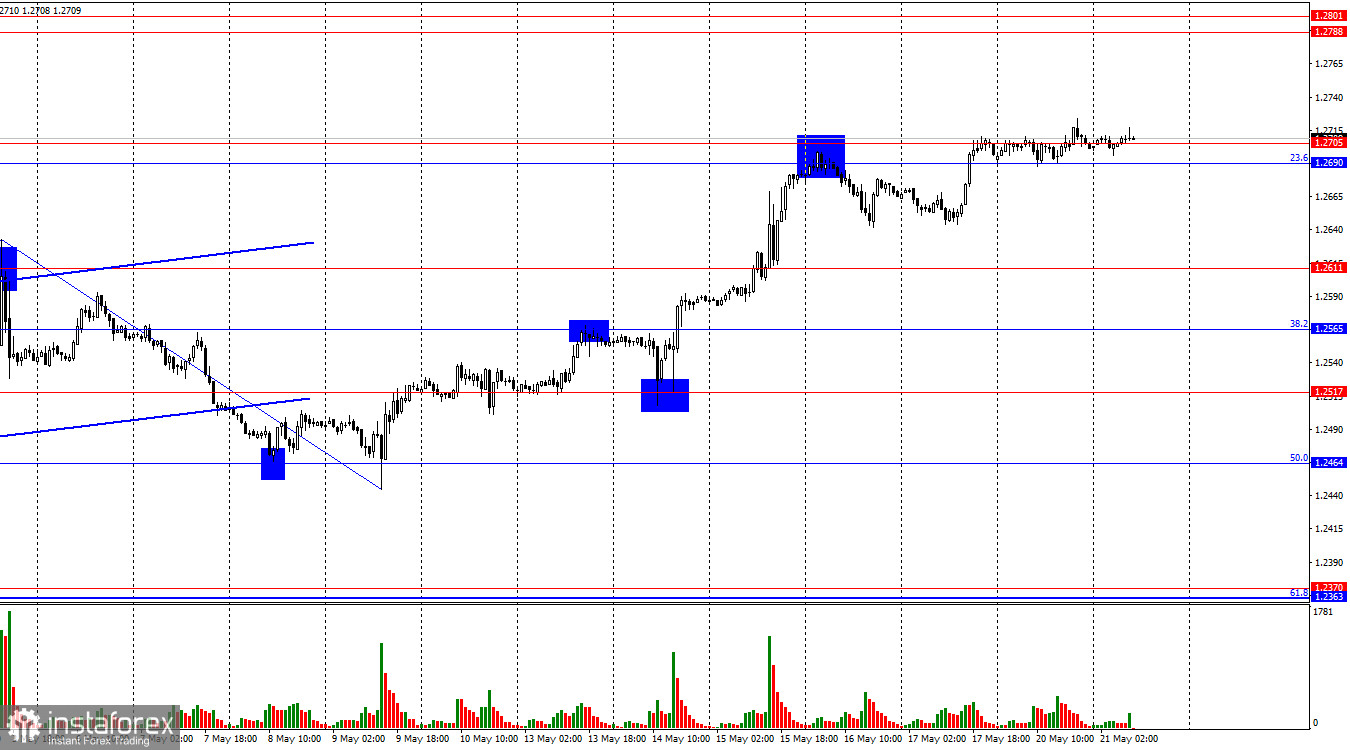

On the hourly chart, the GBP/USD pair traded within the 1.2690–1.2705 range on Monday, and only today did it consolidate above this range. Since there was no rebound from this zone, the growth process might continue toward the next resistance zone at 1.2788–1.2801. Consolidation below the 1.2690–1.2705 zone will favor the US dollar and lead to a potential decline toward the 1.2611 level.

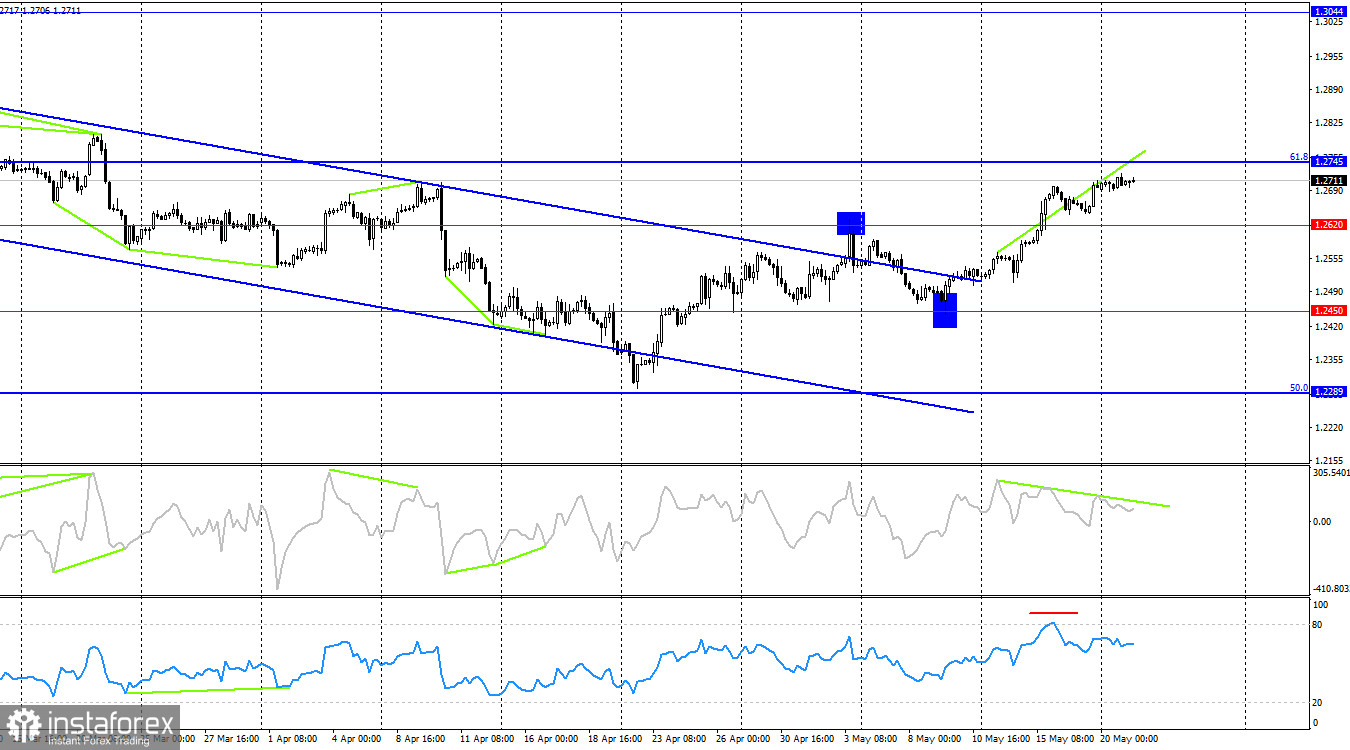

The wave situation remains unchanged. The last downward wave ended on May 9 and did not break the low of the previous wave, while the new upward wave broke the peak on May 3. Thus, the trend for the GBP/USD pair has shifted to a "bullish" trend and remains so. However, the "bullish" trend might be short-lived, as I don't consider the current informational background strong enough for the pound to see several more upward waves. Nevertheless, the first sign of the end of the "bullish" trend will only appear when a new downward wave breaks the low of the previous wave from May 9. For this to happen, the pound must fall 250–280 points from the current price.

The pound continues to grow almost without pause. Even on Monday, when traders were reluctant to trade, the pound gained little. Today, Bank of England Governor Andrew Bailey is set to speak. His speech will occur in the evening, and trader activity might again be very weak during the day. However, bulls anticipate supportive comments. What might these comments include? First, Bailey could state that the Bank of England must still be ready to start easing monetary policy. Second, the inflation report for April, which will be released tomorrow morning, will be known after this evening. This report could show a significant slowdown in inflation in Britain, but before its release, bulls might launch a final attack. The inflation report may not trigger bear activity, as it has been extremely weak recently, but there is a formal reason to expect a decline tomorrow.

On the 4-hour chart, the pair has consolidated above the 1.2620 level, allowing for continued growth towards the 1.2745 correction level. I need help to imagine an informational background that would continue to support the bulls. However, it cannot be denied that the pound may continue to rise as it has exited the descending trend channel. A rebound from the 1.2745 level might cool down the bulls, who have been very aggressive lately. The emerging "bearish" divergence is strong and increases the likelihood of a rebound from the 1.2745 level.

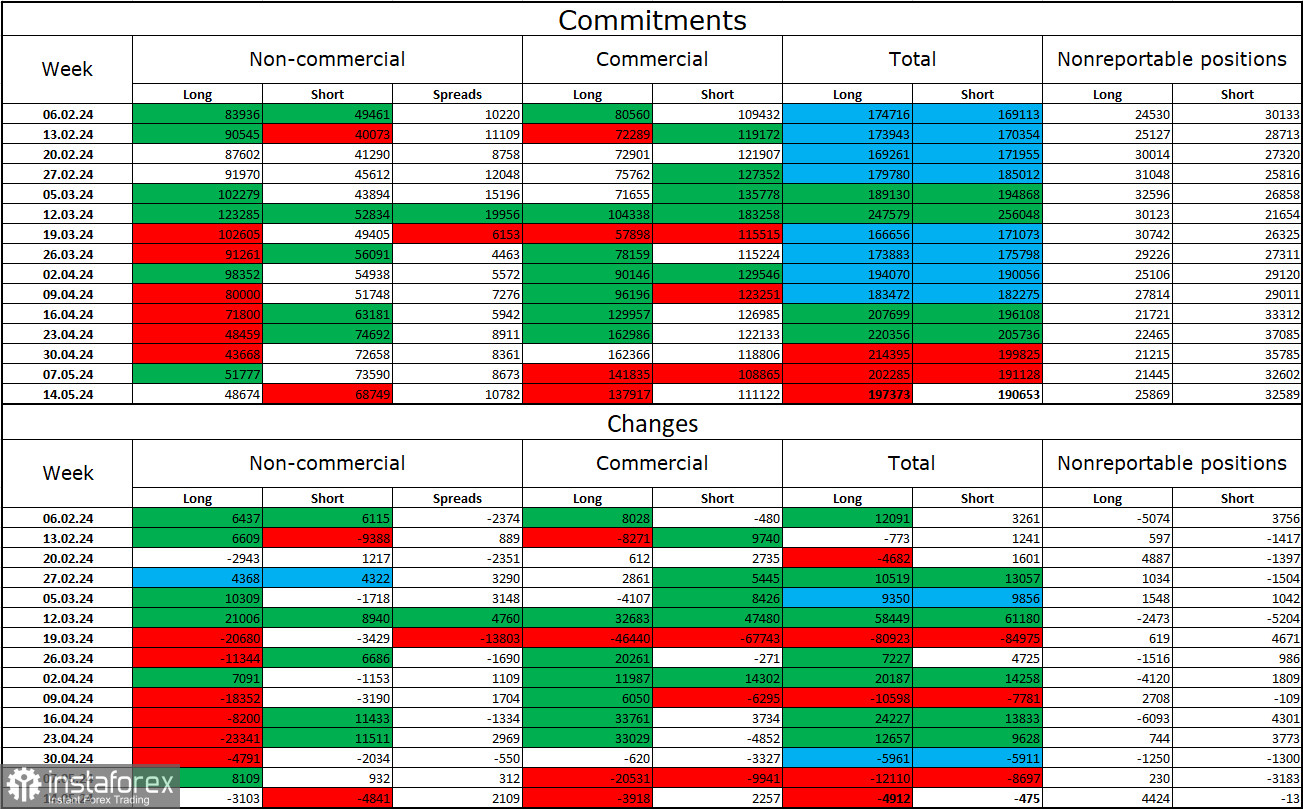

Commitments of Traders (COT) Report:

The sentiment among "non-commercial" traders has become less "bearish" over the past reporting week. The number of long contracts held by speculators decreased by 3,103, while the number of short contracts decreased by 4,841. The overall sentiment of large players has shifted, and now the bears are dictating their terms in the market. The gap between the long and short contracts is 20 thousand: 48 thousand versus 68 thousand.

The pound still faces prospects of decline. Over the past three months, the number of long positions has decreased from 83 thousand to 48 thousand, while the number of short positions has increased from 49 thousand to 68 thousand. Over time, bulls will continue to reduce their buy positions or increase their sell positions, as all possible factors supporting the British pound have already been accounted for. Bears have demonstrated weakness and complete reluctance to attack in recent months, but I expect the pound to start falling.

News Calendar for the US and UK:

United Kingdom – Speech by Bank of England Governor Andrew Bailey (17:00 UTC).

On Tuesday, the economic events calendar contains a few interesting entries. The influence of the informational background on market sentiment will be absent for the rest of the day.

Forecast for GBP/USD and Trader Recommendations:

Selling the pound was possible when closing below the resistance zone on the hourly chart at 1.2690–1.2705, with targets at 1.2611 and 1.2565. Buying can be considered when closing above the 1.2705 level with a target of 1.2788–1.2801. Alternatively, buying can be considered in case of a rebound from the 1.2611 level on the hourly chart with a target of the 1.2690–1.2705 zone.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română