EUR/USD

Analysis:

The main pair of the European currency has been forming a "descending pennant" since last summer. Currently, wave (C) is developing. In early May, the price bounced off the upper boundary of a significant potential reversal zone on the weekly timeframe. The correction structure appears complete, but there are no signals of an imminent reversal on the chart.

Forecast:

The euro is expected to move within a narrow corridor between the nearest opposing zones in the coming week. In the initial days, pressure may be on the resistance zone, with a brief breach of its upper boundary not ruled out. Subsequently, a reversal and resumption of the downward trend are anticipated.

Potential Reversal Zones

- Resistance: 0.0900/0.0950

- Support: 1.0710/1.0660

Recommendations:

- Buying: No conditions for such trades.

- Selling: This could become the main trading direction after confirmed reversal signals appear near the resistance zone.

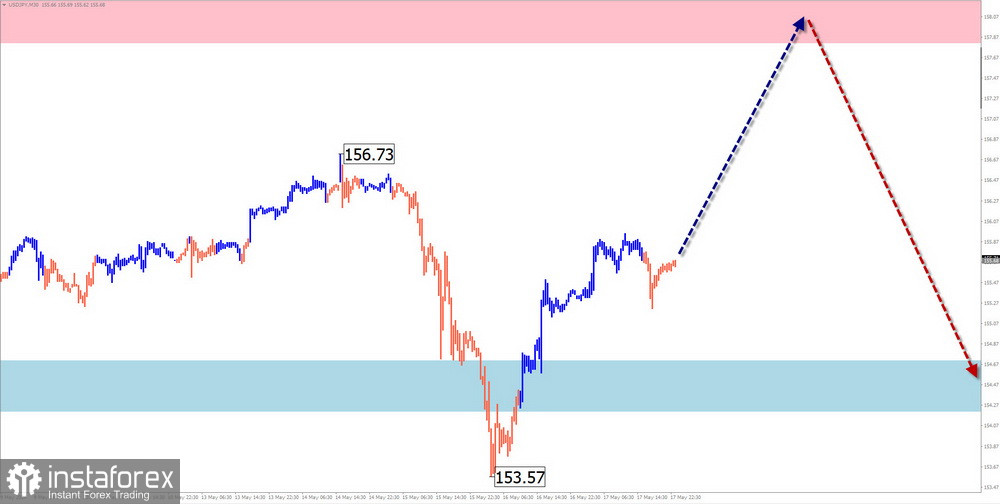

USD/JPY

Analysis:

Since December last year, an ascending wave algorithm has determined the overall price movement of the major pair of Japanese yen. The structure analysis shows the formation of a corrective part in late April. The upward segment from May 2nd represents an intermediate pullback. After its completion, another decline is expected.

Forecast:

A slight upward movement is expected at the beginning of the week, with the price reaching the calculated resistance boundaries. A sideways movement is likely in this zone, forming conditions for a direction change. A decline might begin closer to the weekend.

Potential Reversal Zones

- Resistance: 157.80/158.30

- Support: 154.70/154.20

Recommendations:

- Buying: Risky with limited potential.

- Selling: This can be considered after appropriate signals appear near the calculated resistance.

GBP/JPY

Analysis:

In recent years, the dominant direction in the GBP/JPY pair has been an ascending wave. Its ongoing segment started in December last year. Since late April, a corrective part (B) has been forming, resembling a shifting plane.

Forecast:

Expect a flat movement at the start of the week, with a potential downward vector not exceeding the calculated support boundaries. The bullish trend will likely resume in the week's second half. A volatility spike may occur during the release of economic data.

Potential Reversal Zones

- Resistance: 199.50/200.00

- Support: 195.40/194.90

Recommendations:

- Selling: High risk with low potential; safer to reduce the trading lot.

- Buying: Premature until confirmed signals appear on your trading system.

USD/CAD

Analysis:

Since September last year, USD/CAD has been drifting sideways. The wave's extremes form a "descending pennant." The structure does not indicate completion. Last week, the pair moved into a flat intermediate pullback.

Forecast:

At the beginning of the week, an upward price movement is likely, with the upper boundary indicated by the calculated resistance. A direction change is likely toward the weekend, with a potential price decline within the weekly period down to the calculated support.

Potential Reversal Zones

- Resistance: 1.3680/1.3730

- Support: 1.3550/1.3500

Recommendations:

- Buying: Possible with a fractional volume in individual sessions.

- Selling: Becomes relevant after confirmed reversal signals appear near the support zone.

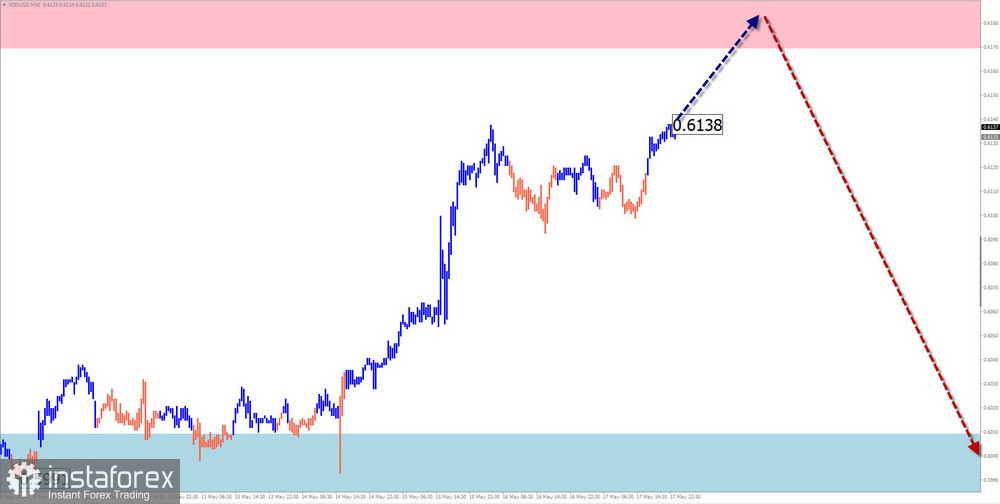

NZD/USD

Brief Analysis:

Since late April this year, NZD/USD has been forming a bullish wave. At the end of last week, a corrective pattern, a "shifting plane," began forming within the wave. The descending section from May 16th has reversal potential.

Weekly Forecast:

A bullish movement is likely at the beginning of the week, with the upper boundary indicated by the calculated resistance. In the second half, the likelihood of a direction change increases, with a price decline expected within the weekly period down to the calculated support.

Potential Reversal Zones

- Resistance: 0.6170/0.6220

- Support: 0.6010/0.5960

Recommendations:

- Buying: Possible with a fractional lot in individual sessions.

- Selling: Becomes relevant after confirmed reversal signals appear near the resistance zone.

Gold

Analysis:

Since September last year, gold has been following a bullish wave algorithm. Since December, a corrective from the lower boundary of a significant resistance zone has been forming. The wave extremes form a "shifting plane," lacking a final part.

Forecast:

After likely pressure on the resistance zone, a reversal and a downward movement are expected in the coming days. Active decline is more probable by the end of the week, coinciding with the release of significant economic news.

Potential Reversal Zones

- Resistance: 2420.0/2435.0

- Support: 2335.0/2320.0

Recommendations:

- Buying: No conditions for such trades.

- Selling: This can be considered after confirmed reversal signals appear near the resistance zone.

Explanation:

In simplified wave analysis (SWA), all waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed for each timeframe. Expected movements are shown with a dashed line.

Note: The wave algorithm does not account for the duration of instrument movements over time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română