GBP/USD

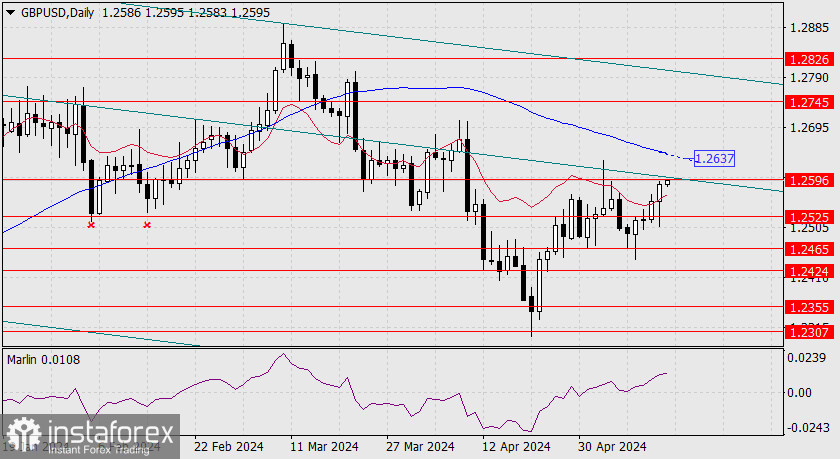

Yesterday, after the pound sharply fell, which represented a false move piercing the 1.2525 support (related to the increase in unemployment data), it turned around for a strong rise and nearly reached the target level of 1.2596 (related to the rise in US producer prices for April).

The magnetic point where this level intersects with the price channel line is a bit further away, coinciding with May 17, but the price might reach this line today and then fall. If the pound prefers to rise further, it could be restrained by the MACD line (1.2637). Only a consolidation above the MACD line will open the target level of 1.2745. The Marlin oscillator is advancing ahead of the price, so the price may reach 1.2637. This movement would look like a false breakout of the embedded price channel line since the rise from April 22 appears erratic.

On the 4-hour chart, there is strong growth above both indicator lines with the Marlin oscillator showing a jagged rise. Overall, an upward trend prevails. However, today, the US retail sales data for April and the CPI for the same period will be released. Retail sales are expected to grow by 0.4%, the CPI is forecasted to decrease from 3.5% YoY to 3.4% YoY, and the core CPI may decrease from 3.8% YoY to 3.6% YoY. As a result, the dollar might strengthen.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română