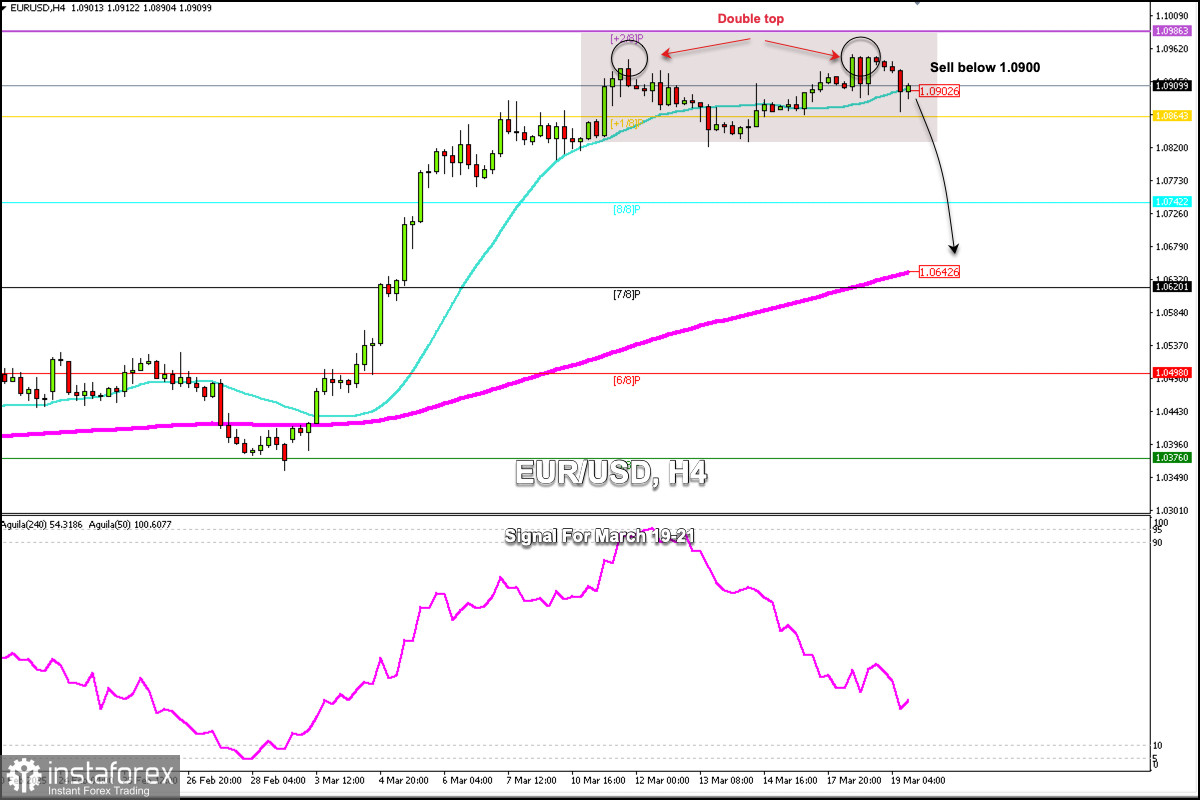

Early in the American session, the euro is trading around 1.0909, undergoing a technical correction after reaching the 1.0954 level. The H4 chart shows that the euro is showing signs of exhaustion.

On the chart, we can see the formation of a double top pattern, which indicates that a short-term technical correction could occur toward the 1.0642 area, where the 200 EMA is located and acts as dynamic support.

If the euro falls and consolidates below 1.09 and below the 21 SMA in the coming hours, this could be seen as an opportunity to sell with targets at 1.0830, the Murray 8/8 level, around 1.742, and finally 1.0642.

On the other hand, the Federal Reserve will announce its policy decision in the United States. This could give the euro a bullish boost, but it could be momentary, as traders expect a technical correction in the coming days due to overbought conditions.

The eagle indicator is reaching overbought levels, so we expect a technical correction to an important support level at 1.0742. Then, EUR/USD could resume its bullish cycle.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română