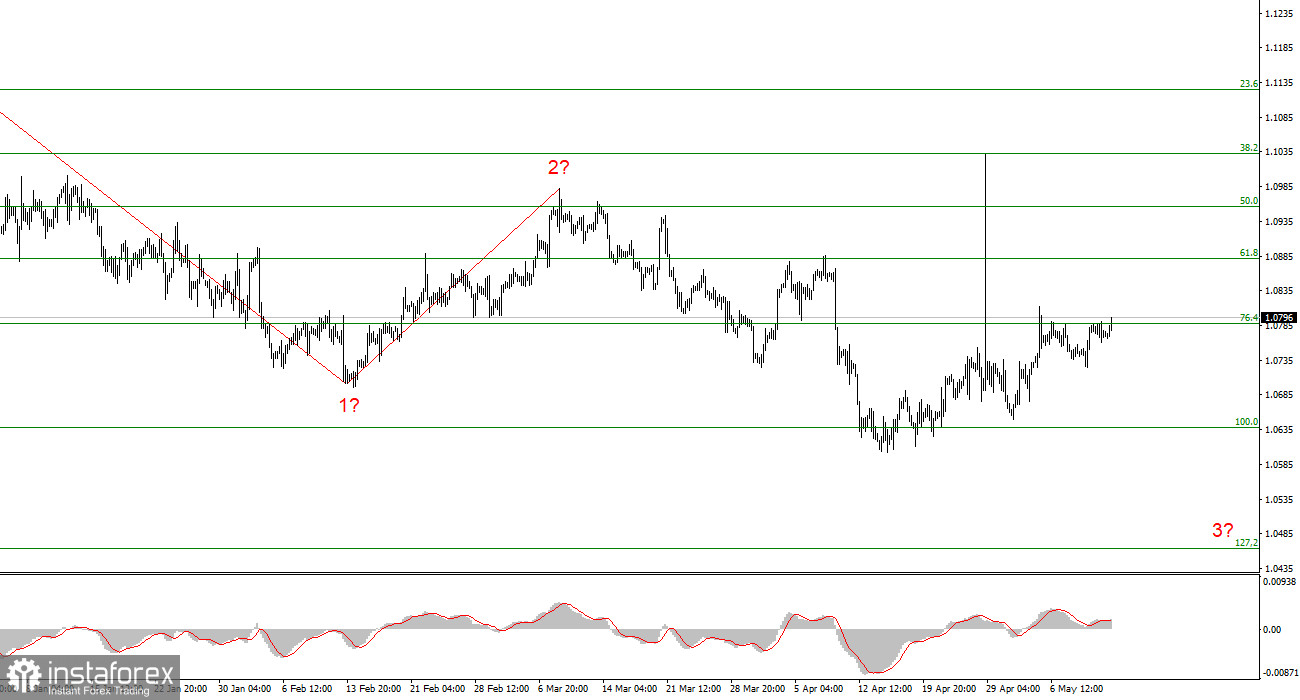

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. At the moment, we observe the construction of the presumed wave 3 in 3 or c of the downward trend section. If this is indeed the case, the decline in quotes will continue for quite some time, as the first wave of this section completed its construction around the 1.0450 mark. Therefore, the third wave of this trend section should end below it.

The 1.0450 mark is a target only for the third wave. If the current downward trend section becomes impulsive, then we can expect a total of five waves, and the euro could easily fall below the 1.0000 mark. Certainly, it isn't easy to expect such a development of events now, but there have been enough surprises in the currency market in recent years. Anything is possible.

Can the wave analysis be changed? There is always one. However, if, since October 3 of last year, we have observed a new upward trend section, then the previous downward wave does not fit into any structure. Therefore, an upward section is only possible with a significant complication of the wave analysis. Such a scenario seems unlikely to me at the moment, so I will proceed with the basic analysis.

The prospects for the dollar remain favorable, but the market thinks differently.

The EUR/USD pair rate rose by 30 basis points on Monday. The range today was again low, but demand for the European currency is slowly but surely growing. This fact worries me because I am expecting an opposite movement. The news background confirms my point of view because almost every day, the market receives new evidence that the Fed's rate will not start decreasing anytime soon, and the ECB's rate will start decreasing as early as next month. By the way, there was no news background at all on Monday, but the market found reasons for new purchases.

Austan Goolsbee, President of the Federal Reserve Bank of Chicago, once again indicated last week that the American regulator is in no hurry to soften monetary policy. He noted that it is not short-term progress in reducing inflation that matters but long-term progress. Thus, he tried to divert the market's attention from the fact that inflation in the United States significantly exceeds the target level and has not decreased for almost a year. Why FOMC members believe that the consumer price index will decrease in the future is unclear to me.

Based on Mr. Goolsbee's speech, it is absolutely obvious to me that the Fed may not only not lower the interest rate in 2024 but may also raise it one or two more times. There is simply no other way out of the situation when the fight against inflation has reached a dead end. The question is: does the market understand this? Judging by the fall of the dollar, apparently not.

General conclusions.

Based on the analysis of the EUR/USD, the construction of a bearish set of waves continues. Waves 2 or b and 2 in 3 or c are completed, so in the near future I expect a resumption of the construction of an impulsive downward wave 3 in 3 or c with a significant decrease in the pair. I continue to consider sales with targets near the calculated mark of 1.0462. An unsuccessful attempt to break through the 1.0787 mark, which is equivalent to 76.4% Fibonacci, indicates the market's readiness for new sales, but the second attempt to break through may be successful.

On the larger wave scale, the presumed wave 2 or b, which in length exceeded 61.8% Fibonacci from the first wave, may be completed. If this is indeed the case, then the scenario with the construction of wave 3 or c and a decrease in the pair

below the 4-figure mark has begun to be implemented.

The main principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play; they often bring changes.

- If there is confidence in what is happening in the market, it is better to avoid entering it.

- There is never one hundred percent certainty in the direction of movement, and there never can be. Remember protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română