USD/JPY

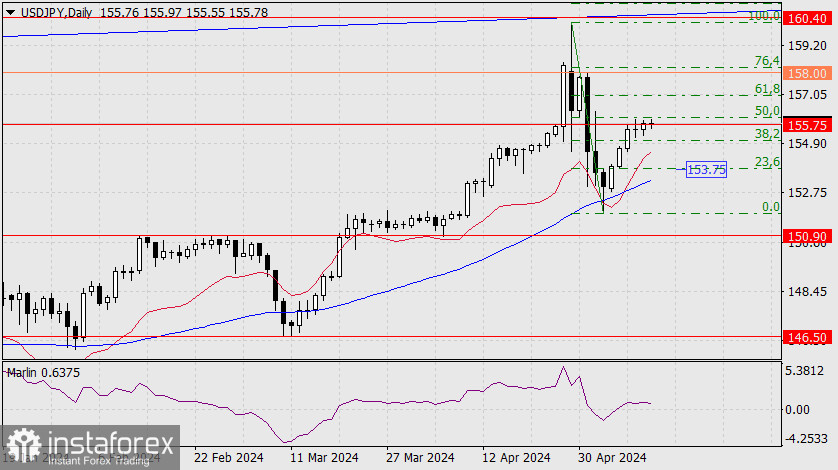

As of today, the USD/JPY pair has formed complex and contradicting conditions for both a simultaneous rise and fall. In favor of growth, we have a powerful price drop due to the Bank of Japan's currency interventions, which cleared the way for new buyers to aim for 160.40 and above (163.85), as well as the Marlin oscillator returning to the uptrend territory.

Supporting a decline, we have had a sharp slowdown in growth in the last two days, with the target resistance at 155.75 and before the Fibonacci level of 50%. From these positions, we noticed that the Marlin oscillator has a tendency to return below the zero line. We need a signal from the price itself, and for this, the daily candle must close above or below the level of 155.75, which is currently where it is. In case the price chooses the bearish scenario, the first target will be the MACD line around the 153.75 mark, very close to the Fibonacci level of 23.6%. As for the bearish scenario, the target will be the intermediate level of 158.00 - the May 1 peak.

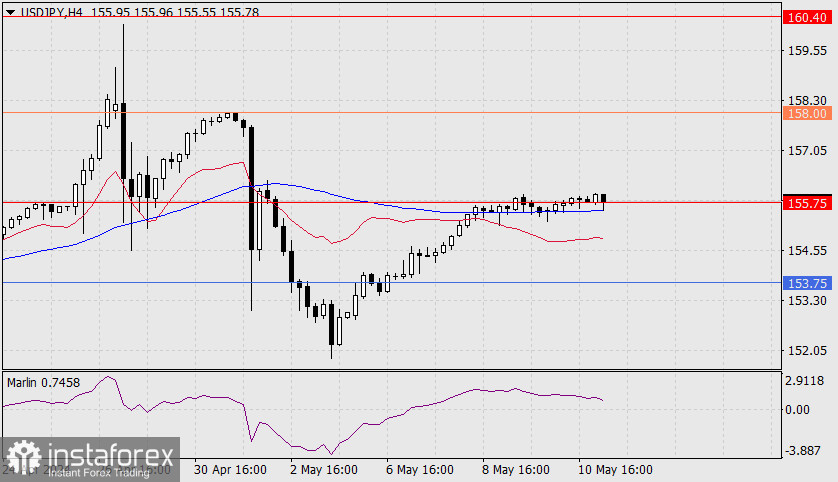

On the 4-hour chart, the price consolidates at the level of 155.75 and on the MACD line. The Marlin oscillator is gradually descending towards the boundary of the downtrend territory, prompting prices to choose a bearish scenario. In order to clarify the situation, we should let at least a day pass.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română