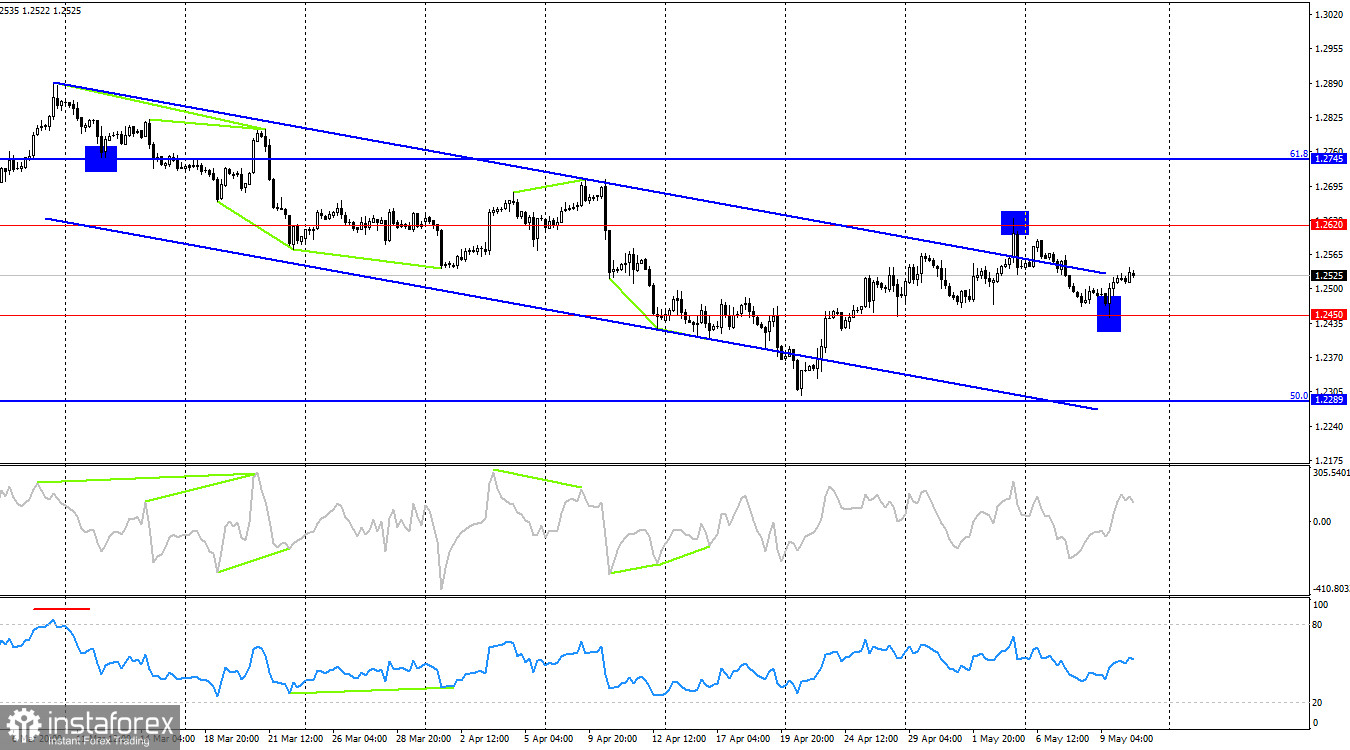

On the hourly chart, the GBP/USD pair on Thursday executed the second bounce from the corrective level of 50.0% (1.2464) and resumed its upward movement. Already today, consolidation above the level of 1.2517 was achieved, which allows counting on further growth towards the next Fibonacci level of 38.2% at 1.2565. A bounce of quotes from this level or consolidation below 1.2517 will favor the US dollar and the resumption of the downward movement towards the corrective level of 61.8% (1.2363).

The wave situation remains unchanged. The last completed upward wave did not break the peak of the previous wave, and the new downward wave is still too weak to break the low of April 22. Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion. The first sign of bulls transitioning to an offensive could be the breakout of the peak from May 3. A new downward wave, if it turns out to be weak and does not break the low of April 22, could also indicate a trend change. But for now, I cannot consider it 100% completed. Waves in recent months have been quite large, so it is necessary to scale down the hourly chart to understand the current trend clearly.

The results of the Bank of England's third meeting in 2024 were supposed to help the bears go on the offensive. Andrew Bailey stated that the interest rate could be lowered early in June. Even if this does not happen at the next meeting, Bailey believes that the Bank of England will ease monetary policy faster than the markets expect. Both of these statements are "dovish," which should have given confidence to the bears. But instead of the expected decline in the pound, we saw its rise. The growth continued today but was already very weak, although I would have supported the bulls today. The British economy in the first quarter showed growth of 0.6% against traders' expectations of 0.4%. Industrial production grew by 0.2% in March, although traders expected a volume decrease. In general, "the British mind is incomprehensible."

On the 4-hour chart, the pair bounced off the level of 1.2620, which suggests a decline in the pound. However, the bounce from the level of 1.2450 allowed quotes to rise slightly, so they again found themselves near the upper line of the corridor. This line has already been breached but is still not worth burying the "bearish" trend. It is difficult to say why bullish traders may continue to attack in the coming months, especially when the Bank of England is preparing for monetary easing.

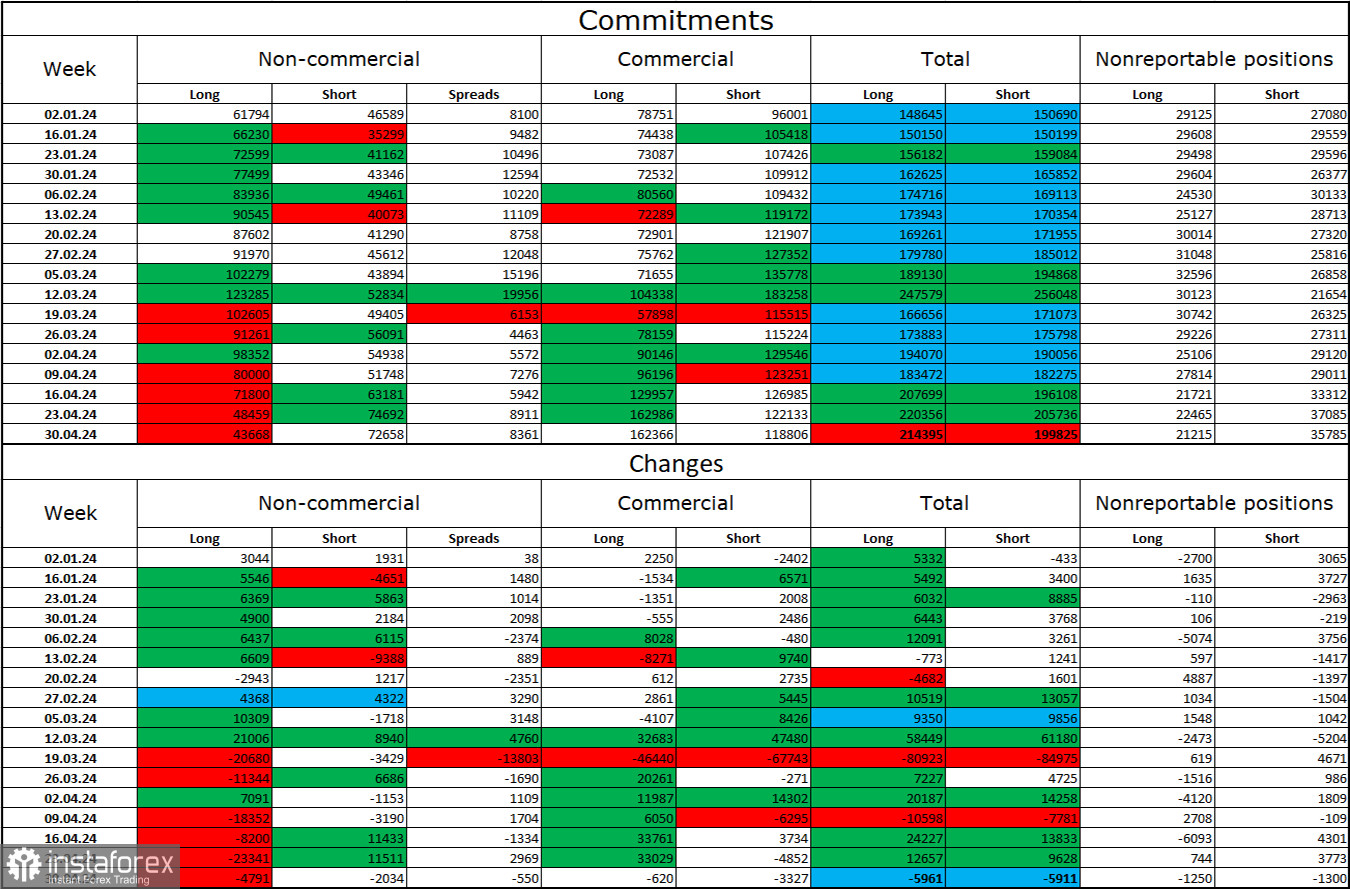

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category for the last reporting week has become more "bearish." The number of Long contracts held by speculators decreased by 4791 units, and the number of Short contracts decreased by 2034. The overall sentiment of major players has changed, and now bears are dictating their terms in the market. The gap between the Long and Short contracts is 30,000: 43,000 versus 73,000.

There are prospects for a decline in the pound. Over the past three months, the number of Long contracts has decreased from 62,000 to 43,000, while the number of Short contracts has increased from 47,000 to 73,000. Over time, bulls will start getting rid of Buy positions or increasing Sell positions, as all possible factors for buying the British pound have already been exhausted. Bears have demonstrated their weakness and complete unwillingness to go on the offensive in recent months, but I still expect the pound to experience a more significant decline.

News Calendar for the US and UK:

UK - Change in GDP volume in the first quarter (06:00 UTC).

UK - Changes in industrial production volumes (06:00 UTC).

US - University of Michigan Consumer Sentiment Index (14:00 UTC).

On Friday, the economic events calendar contains several important entries, two of which have already become available. The impact of the news background on market sentiment for the rest of the day will be weak.

GBP/USD Forecast and Trader Advice:

Sales of the pound are possible upon closing below the level of 1.2517 or upon a rebound from 1.2565 on the hourly chart with a target of 1.2464. Purchases could have been considered upon a rebound from the level of 1.2464 on the hourly chart with targets of 1.2517 and 1.2565. The first target has been achieved, and the second one remains.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română