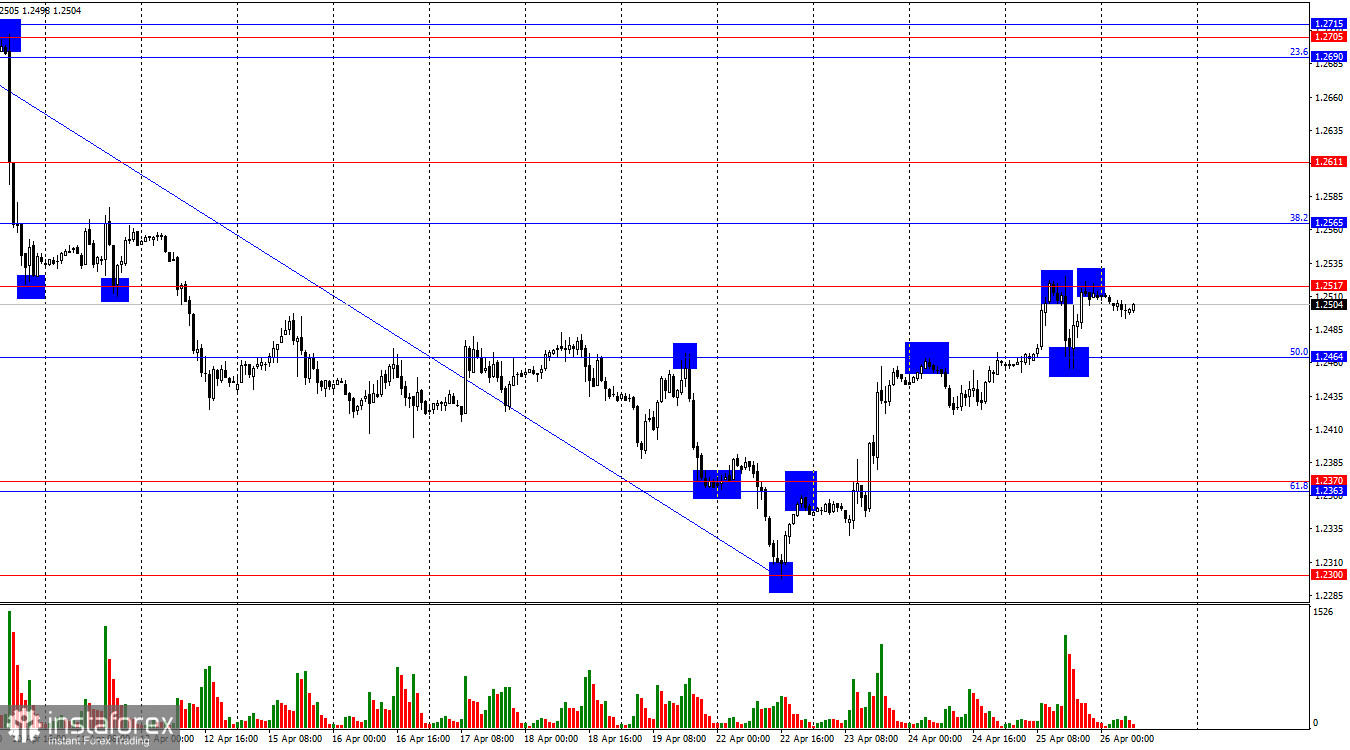

The wave situation remains unchanged. The last completed downward wave broke the low of the previous wave, and the new upward wave has yet to approach the last peak from April 9th. Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion at the moment. The first sign of a transition to an uptrend could be a breakout of the peak from April 9th, but bulls need to overcome a distance of about 220 pips to the zone of 1.2705–1.2715. It is unlikely that a trend change to "bullish" should be expected in the coming days. A new downward wave, if weak and does not break the low from April 22nd, can also indicate a trend reversal.

On Thursday, the US GDP report greatly helped bullish traders maintain a short-term positive sentiment. Despite the fact that the British pound has been rising for four consecutive days, the previous wave was much larger, so the initiative remains with the bears. Not all reports from the US this week have been positive, with most contributing to the decline of the American currency. Today, there will be at least two interesting reports in America. The core personal consumption expenditure index and the University of Michigan consumer sentiment index. If these two reports at the end of the week turn out to be stronger than traders' expectations, the dollar may start forming a new upward wave. This will be a logical development of the situation.

On the 4-hour chart, the pair consolidated above the level of 1.2450. Thus, the upward process may continue towards the next level of 1.2620, but most likely, it will end in the near future, and the pair will not exit the descending trend corridor. There are no emerging divergences observed today in any indicator. A rebound of the pair's exchange rate from the upper line of the corridor will work in favor of the American currency.

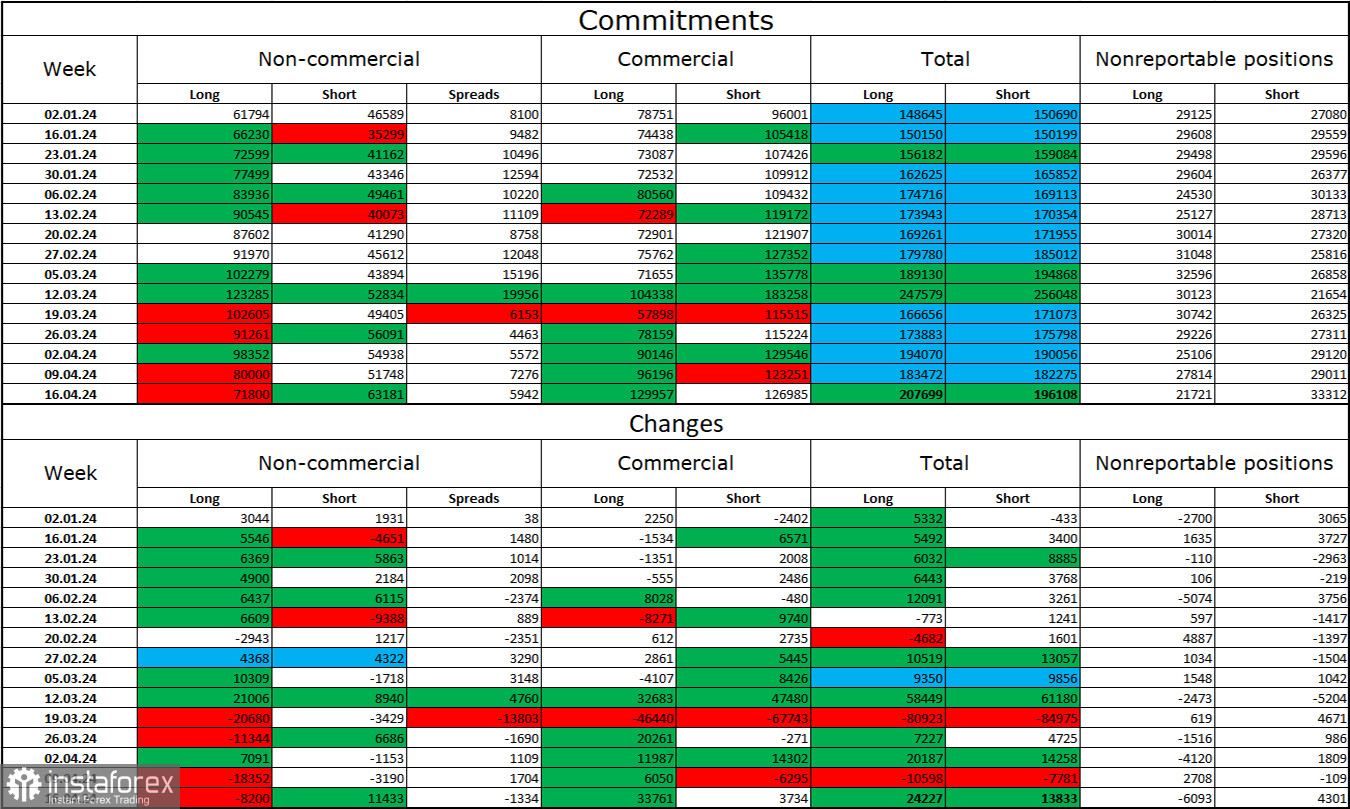

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category for the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 8200 units, while the number of short contracts increased by 11433 units. The overall sentiment of large players remains "bullish" but has been weakening in recent weeks. The gap between the number of long and short contracts is almost nonexistent: 72 thousand versus 63 thousand.

There are prospects for a decline in the British pound. Over the past 3 months, the number of long positions has increased from 62 thousand to 72 thousand, while the number of short positions has increased from 47 thousand to 63 thousand. This explains the relatively weak decline of the British pound. Over time, bulls will start getting rid of buy positions or increasing sell positions, as all possible factors for buying the British pound have already been worked out. Bears have demonstrated their weakness and complete unwillingness to go on the offensive in recent months, but inflation reports in the US and UK may give them new strength.

News Calendar for the US and UK:

US - Core Personal Consumption Expenditure Price Index (12:30 UTC).

US - Personal Income and Spending Change (12:30 UTC).

US - University of Michigan Consumer Sentiment Index (14:00 UTC).

On Friday, the economic events calendar contains only three entries in the US. The impact of the news background on the market sentiment today may be of moderate strength.

Forecast for GBP/USD and trader advice:

Sales of the British pound are possible today on an hourly chart rebound from the level of 1.2517 with targets at 1.2464 and 1.2363-1.2370. Purchases of the pair were possible on consolidation above the level of 1.2464 with a target of 1.2517. This target has been reached. New purchases are possible on a rebound from the level of 1.2464 or a close above 1.2517 with a target of 1.2565.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română