Yesterday, the euro and the British pound extended losses against the US dollar, weighed down by data showing a sharp increase in US retail sales. Adding to this were statements from Federal Reserve officials, creating a scenario that seemed quite unlikely at the beginning of this year.

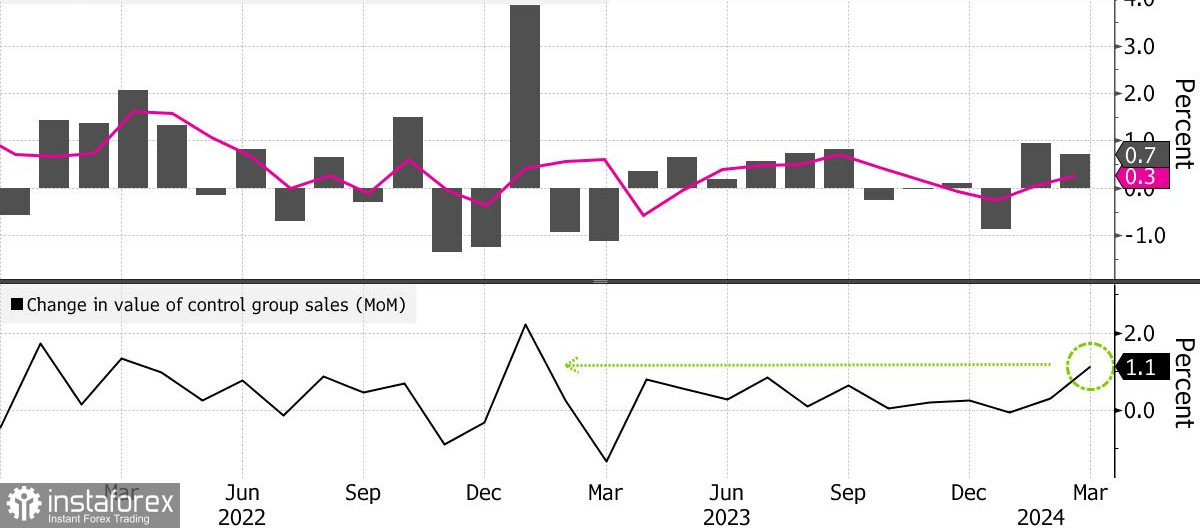

According to the report, US retail sales increased more than expected in March, and figures for the previous month were revised upwards. This confirms steady consumer demand that continues to fuel the surprisingly strong US economy. Retail sales increased by 0.7% month-over-month, matching the highest estimate among economists. Excluding automobiles and gasoline, sales jumped by 1%.

The so-called control-group sales, which are used to calculate gross domestic product, grew by 1.1%, the most since the start of last year.

Therefore, it's not surprising that during yesterday's speech, San Francisco Federal Reserve President Mary Daly pointed out that there is no need to urgently adjust interest rates, citing steady economic growth, a strong labor market, and still relatively high inflation that rebounded in the first quarter of this year.

Daly stated that she needs to be more confident that inflation is heading towards the Fed's 2% target before reacting. The head of the Federal Reserve Bank of San Francisco, who votes on monetary policy this year, reiterated that the current policy is in a "good place." "The worst thing we can do right now is act urgently when urgency isn't necessary," Daly said at an event at the Stanford Institute for Economic Policy Research on Monday.

"We're in the ready position; we can respond as the economy evolves," Daly said. "The labor market's not giving us any indication it's faltering, and inflation is still above our target, and we need to be confident it is on path to come down to our target before we would feel the need — and I would feel the need — to react."

Recall that at the last policy meeting, Fed officials left interest rates unchanged in a range of 5.25% to 5.5% and stated that they would like to see more evidence that inflation is decreasing to the 2% target before lowering borrowing costs.

Last week's report showed that key consumer price indices rose more than expected in March. This marks the third consecutive month of increases, heightening some economists' and policymakers' concerns that progress in combating inflation is slowing. "We have to be thoughtful about not getting too confident that the latest sticky inflation is an indication where we're going forward, and we can't get too confident that our projection — that inflation will gradually continue to come down — is going to materialize," Daly said.

Now let's move on to technical analysis. Speaking of the EUR/USD pair, the euro is clearly under pressure. If buyers regain control of the 1.0630 level, the European currency will have a chance to rise to 1.0665 and then probably to the 1.0700 mark. However, reaching the latter level without support from major players will be quite challenging. The most distant target is the peak of 1.0730. In a bear case scenario, major buyers are expected to take the lead only at around 1.0590. If not, it would be a wise decision to wait for the price to hit a new low at 1.0670 or open long positions from 1.0545.

As for the GBP/USD pair, bulls need to take control of the nearest resistance level of 1.2460. In this case, the Brtiish pound is likely to advance to 1.2500. However, its breakout will be quite problematic. The most distant target is the 1.2540 area. If the price rises above it, sterling will have every chance to climb to the 1.2575 mark. In the event of a decline, bears will likely attempt to take control of the 1.2410 level. If they succeed and the price breaks out of the range, the British pound will suffer heavy losses, diving to the low of 1.2375 and even 1.2340.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română