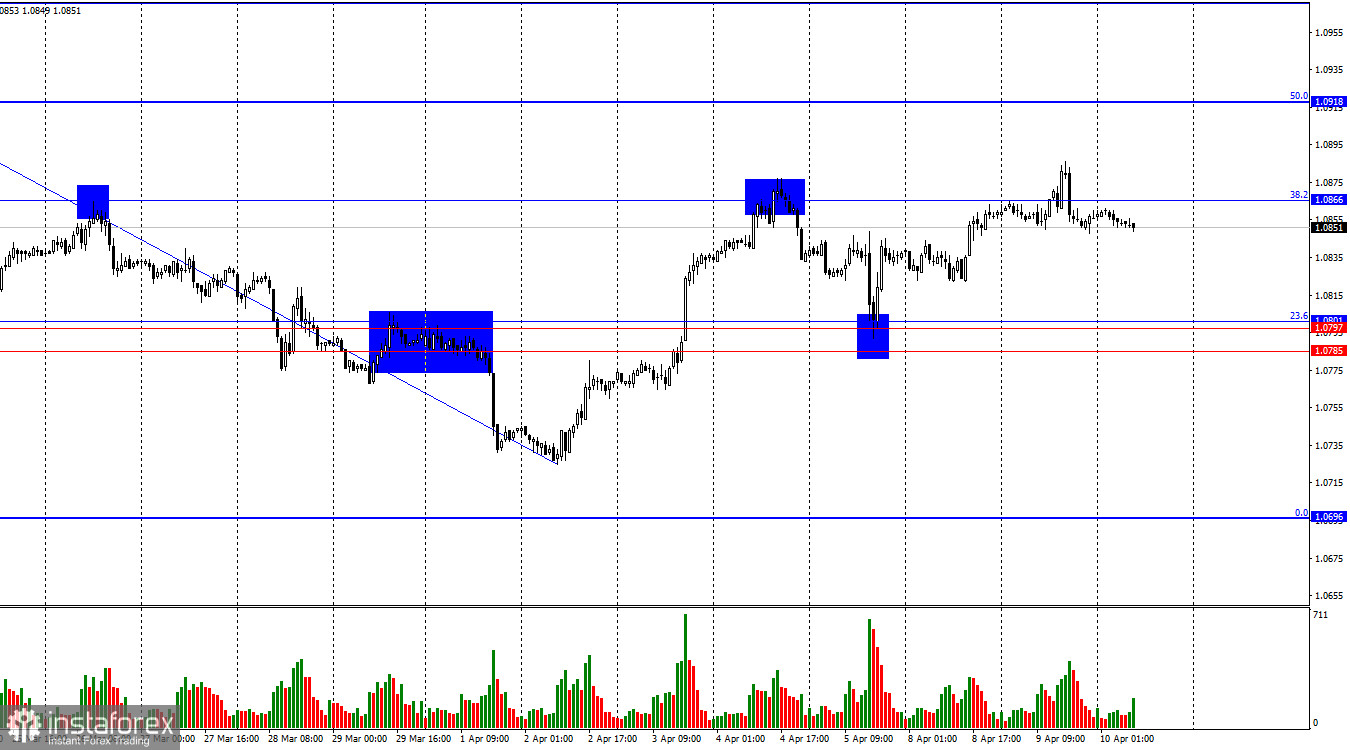

Hi, dear traders! The EUR/USD pair continued its growth on Tuesday above 1.0866, the correction level of 38.2%. However, yesterday the instrument reversed in favor of the American currency and consolidated below this level. Thus, EUR/USD may extend its slide towards the support zone of 1.0785–1.0801. A new consolidation above the level of 1.0866 will allow us to expect further growth in the direction of the next correction level of 50.0% – 1.0918.

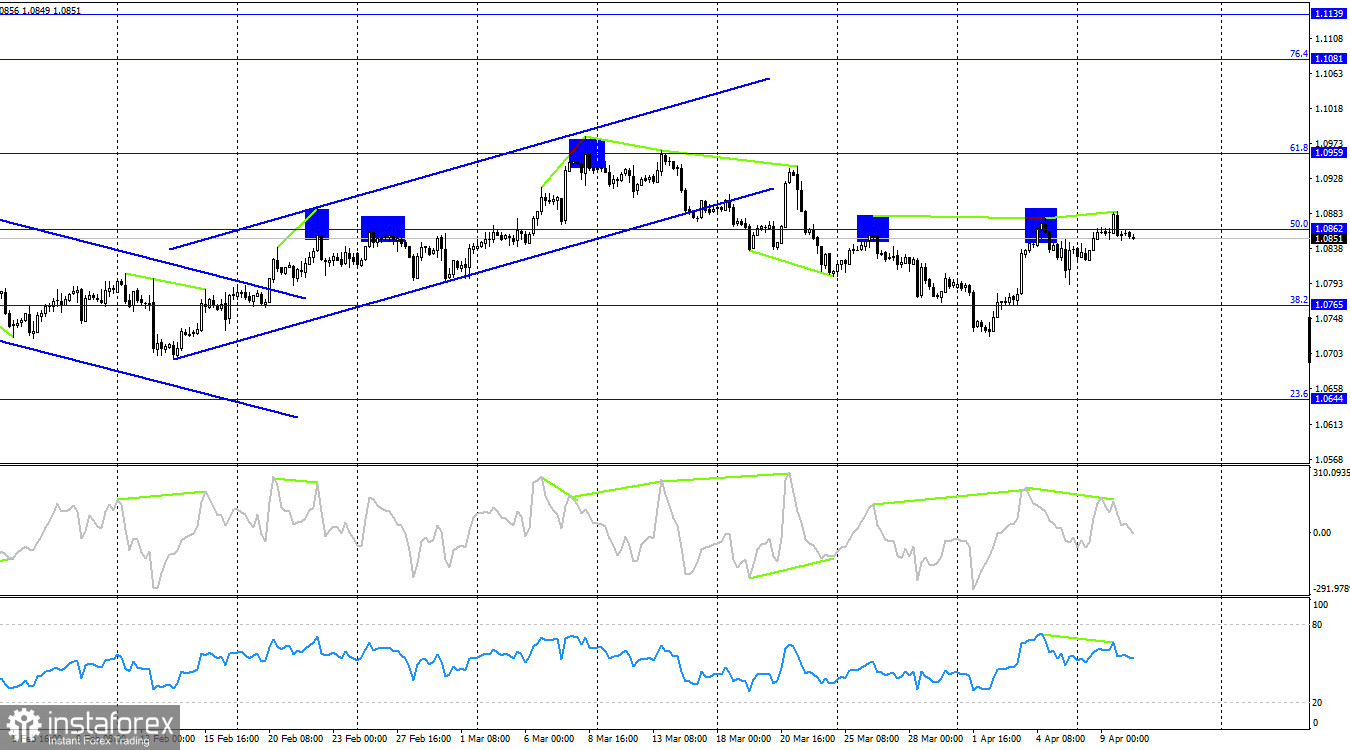

The wave situation remains unchanged. The last completed downward wave broke the low of the previous wave dated March 19. The new bullish wave has not yet come close to the last high dated March 21. Thus, EUR/USD is now following a bearish trend. At the moment, there is no sign of its completion. In order for such a sign to appear, the current upward wave must break through the last high of March 21. If the new downward wave fails to break the low of April 2, this will also be a sign of the end of the bearish trend. I would also like to note that trading activity at this time is subdued and I do not separate each small movement into an individual wave.

The economic calendar was empty on Tuesday, but today the market will be satisfied with the calendar of events. Today, market participants are looking forward to the inflation report for March in the US. Besides, the minutes of the FOMC meeting in March will be published during the New York session. In my opinion, the rhetoric of Jerome Powell and the entire rate-setting committee remained hawkish at the last policy meeting. The FOMC still sees no reason to move to a rate cut in the foreseeable future, even though the market is still expecting monetary easing in June. However, Powell and other policymakers have repeatedly said that at the moment there is not enough evidence of inflation returning to 2% to start cutting interest rates. Thus, the first rate cut may happen later than June. For the US dollar, this is a reason to slightly improve its position.

On the 4-hour chart, EUR/USD returned to 1.0862, the correction level of 50.0%. A new dip from this level will again work in favor of the US currency and trigger some fall in the direction of 1.0765, the correction level of 38.2%. If the price settles above the level of 1.0862, this will allow traders to expect further growth towards 1.0959, the next correction level of 61.8%. Bearish divergence in the CCI and RSI indicators increases the chances of a rebound from 1.0862. The trend on the 4-hour chart is bearish at this time.

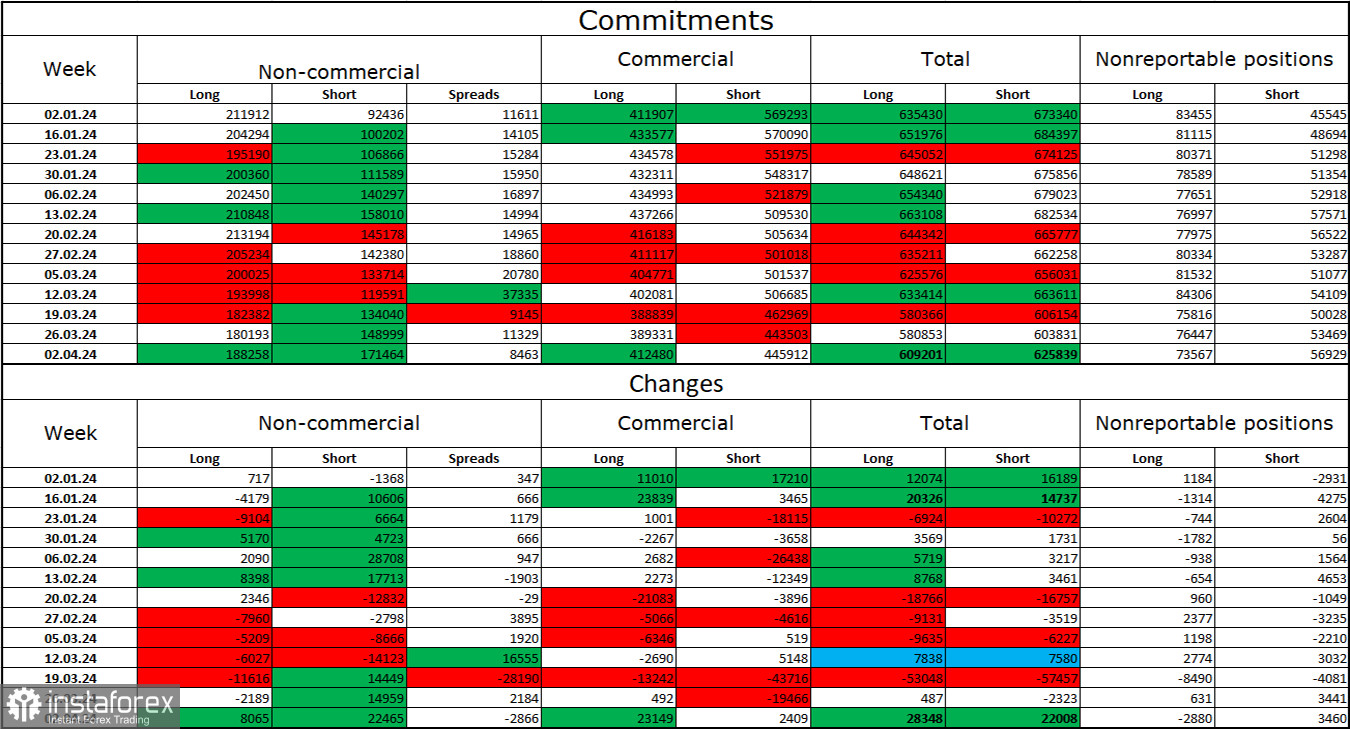

Commitments of Traders Report (COT)

In the last reporting week, speculators opened 8,065 long contracts and 22,465 short contracts. The non-commercial group's sentiment remains bullish, but it is waning rapidly. The total number of long contracts in the hands of speculators is now 188 K and short contracts – 171K. I still believe that the situation will continue to change in favor of the bears. In the second column, we see that the number of short positions has increased from 92K to 171K over the past 3 months. Over the same period, the number of long positions declined from 211K to 188K. The bulls have dominated the market for too long. Now they need a strong information background to resume the bullish trend. I don't see that happening in the near future.

Economic calendar for US and EU

US: consumer price index due at 12-30 UTC

US: FOMC minutes due at 18-00 UTC

The economic calendar on April 10 contains two important reports. The influence of the information background on market sentiment will be serious in the second half of the day.

Outlook for EUR/USD and trading tips

Short positions on EUR/USD were possible upon a rebound from the level of 1.08 62 on the 4-hour chart with a target of 1.0785–1.0801. This target was actually hit. New sell positions will be relevant when the price rebounds from 1.0866 with the same targets. Long positions on EUR/USD were logical during a dip from the zone of 1.0785–1.0801 with a target of 1.0866. The target was also hit. We may plan new long positions when EUR/USD closes above 1.0866 with a target of 1.0918.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română