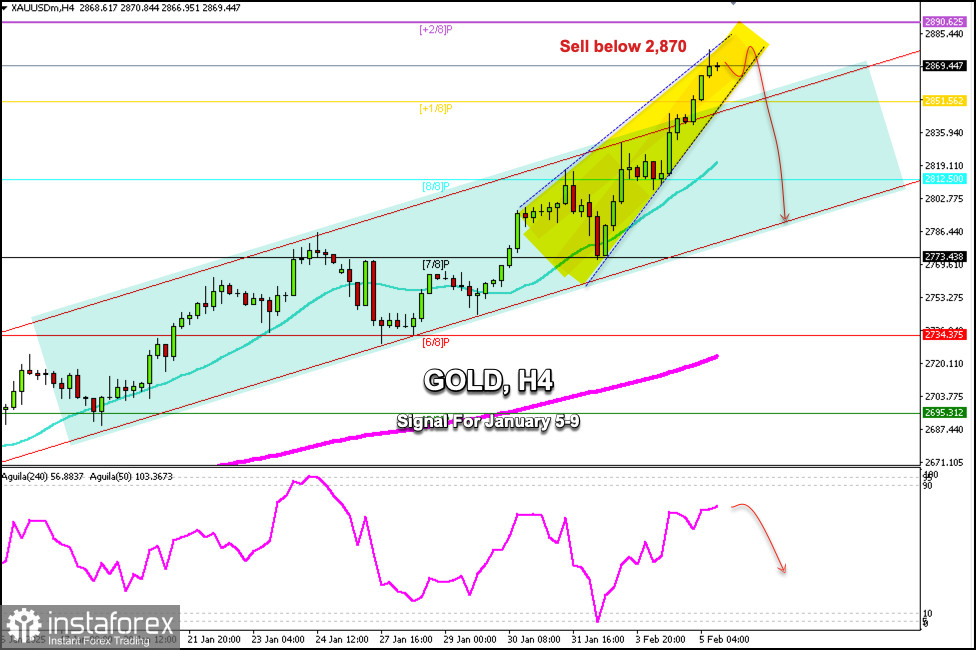

Early in the American session, Gold was trading around 2,869 with a strongly bullish bias after having reached the annual high around 2,877.

Gold is showing signs of exhaustion and the last Japanese candlestick formed shows us a technical reversal pattern.

If gold trades below 2,877 in the next few hours, the outlook allows for a technical correction. We could expect the price to plunge to 2,851 and even 8/8 Murray located at 2,812.

2.129 / 5.000

The next resistance for gold is around +2/8 of Murray at 2,890. This area could be a very strong level for gold and we could expect a technical correction to occur below this area.

If the gold price turns back inside the uptrend channel and consolidates below 2,851, we could expect a technical correction to be confirmed and gold could reach the bottom of the uptrend channel around 2,790.

We are watching the formation of a symmetrical triangle pattern which is likely to confirm a fall in gold if it breaks below 2,760. The metal could first reach 2,851 and eventually, 8/8 Murray at 2,812.

We need to be careful at current price levels if we have long positions as the market could liquidate these positions and we could see an instant drop in the gold price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română