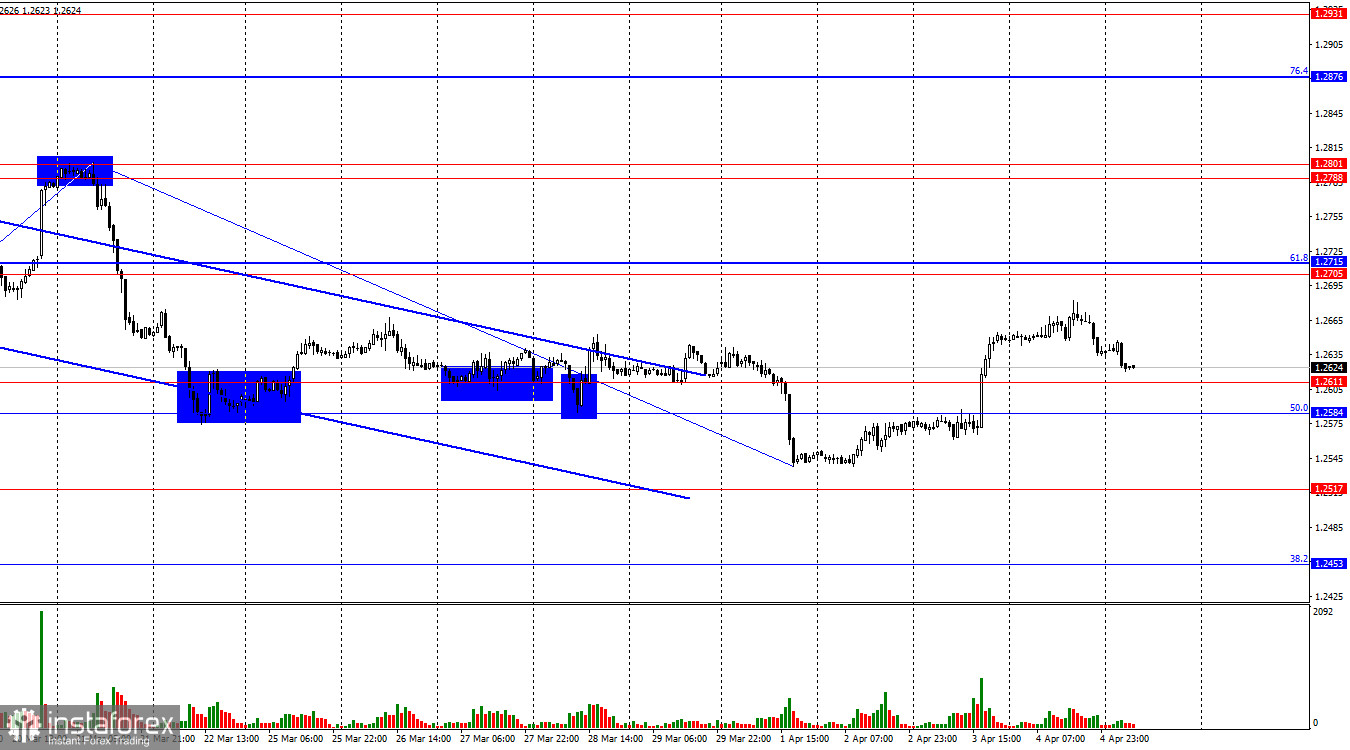

On the hourly chart, the GBP/USD pair continued its upward movement towards the resistance zone of 1.2705–1.2715 on Thursday. However, then there was a reversal in favor of the American currency, and the process of decline toward the support zone of 1.2584–1.2611 began. A bounce from this zone will work in favor of the British and the resumption of growth. Consolidation below it will increase the chances of further decline towards the level of 1.2517.

The wave situation recently raised no questions. The last completed downward wave easily broke the previous low (from March 19), while the new upward wave is still too weak to break the previous peak (from March 21). Thus, the trend for the GBP/USD pair is currently "bearish," and there are no signs of its completion. The first sign of a transition to an uptrend could be a breakout of the peak from March 21. However, bulls need to overcome a distance of about 180 pips to reach the zone of 1.2788–1.2801, which is unlikely to happen today. If the new downward wave does not break the low from April 1, this will also be a sign of a trend change to "bullish," but this wave has not even started yet.

There were no important news releases on Thursday, but earlier this week, Jerome Powell made a speech, once again pleasing us with "hawkish" rhetoric. Several important reports were published in the US, most of which were positive, while there were no significant events in the UK this week. I don't consider business activity indices in my calculations, as they are not the most significant data, and they did not surprise traders. Today, in the US, reports on the labor market, wages, and unemployment will be released. Considering that bulls dominated this week when the information background supported bears, I do not believe in a strong rise of the dollar today, regardless of the values of the American reports. However, higher values of nonfarm payrolls and unemployment may help bearish traders to counterattack.

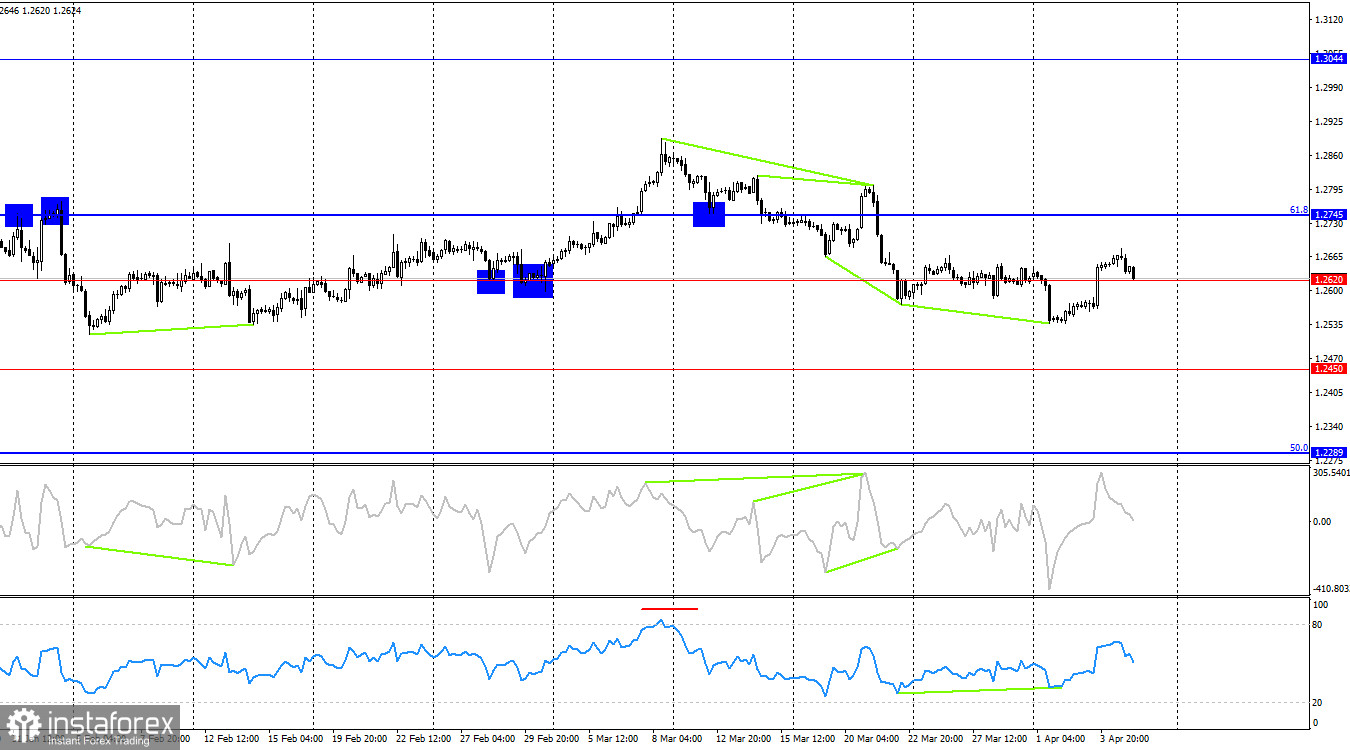

On the 4-hour chart, the pair made a reversal in favor of the British after forming a "bullish" divergence on the RSI indicator and consolidating above the level of 1.2620. Thus, the upward movement may continue towards the next Fibonacci retracement level of 61.8%–1.2745. There are no new emerging divergences observed today with any indicator. The "bearish" trend persists on the hourly chart, but on the 4-hour chart, horizontal movement is maintained.

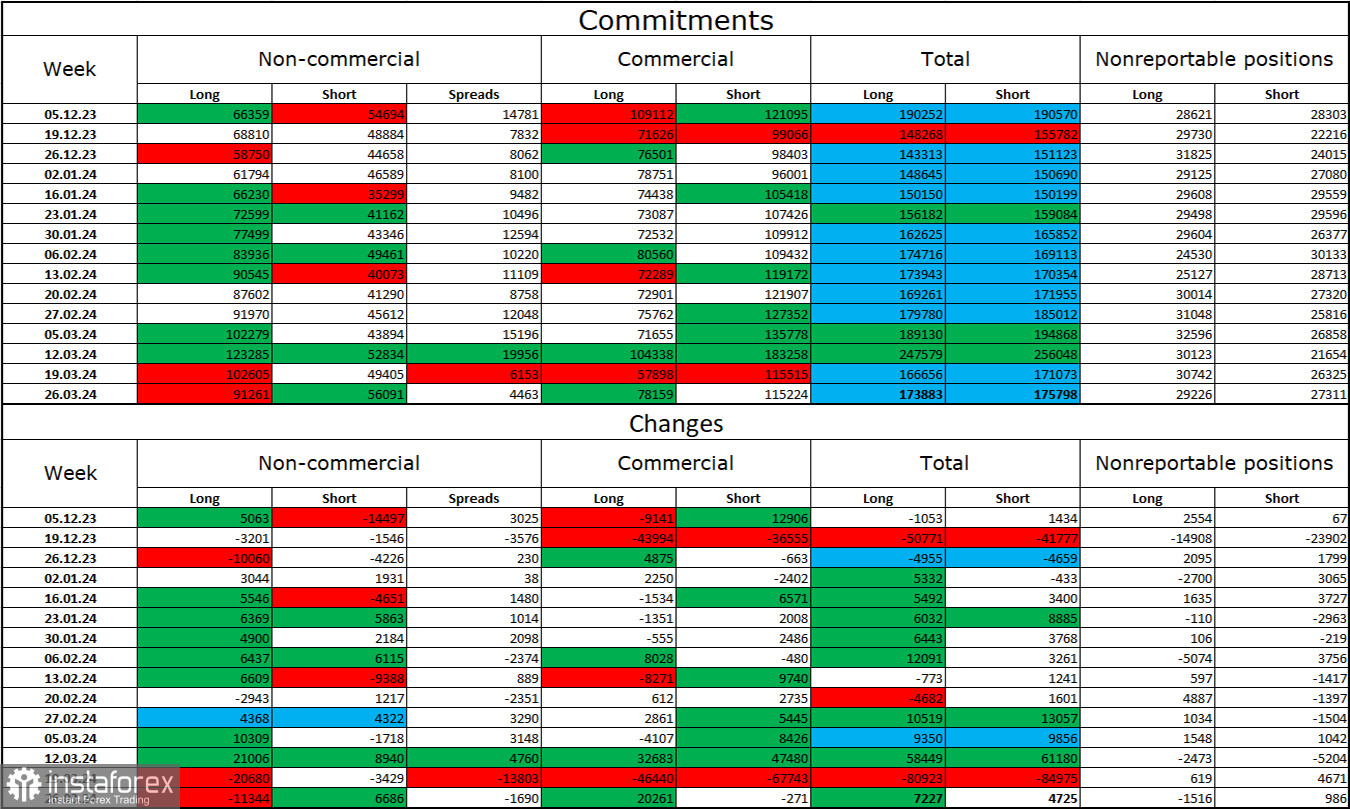

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category for the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 11344 units, while the number of short contracts increased by 6686 units. The overall sentiment of major players remains "bullish," but it has begun to weaken in recent weeks. The gap between the number of long and short contracts is now less than double: 91 thousand versus 56 thousand.

There are still prospects for a decline for the British, but over the past 2.5 months, the number of Long contracts has increased from 66 thousand to 91 thousand, while the number of Short contracts has practically not changed. Over time, bulls will start to get rid of their buy positions, as all possible factors for buying the British pound have already been exhausted. However, bears continue to demonstrate their weakness, which prevents the pound from starting to decline.

News Calendar for the US and the UK:

UK – Construction Purchasing Managers' Index (08:30 UTC).

US – Change in Nonfarm Payrolls (12:30 UTC).

US – Unemployment Rate (12:30 UTC).

US – Change in Average Hourly Earnings (12:30 UTC).

Friday's economic events calendar contains several very important entries. The impact of the information background on market sentiment today can be strong.

Forecast for GBP/USD and Trader Advice:

Selling the British can be opened upon consolidation below the zone of 1.2584–1.2611 with targets at 1.2517 and 1.2453. Buying opportunities were possible upon closing above the zone of 1.2584–1.2611 on the hourly chart with a target of 1.2705. These trades can still be kept open, but it should be remembered that the British pound maintains a horizontal movement vector, and today's information background may support both bulls and bears.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română