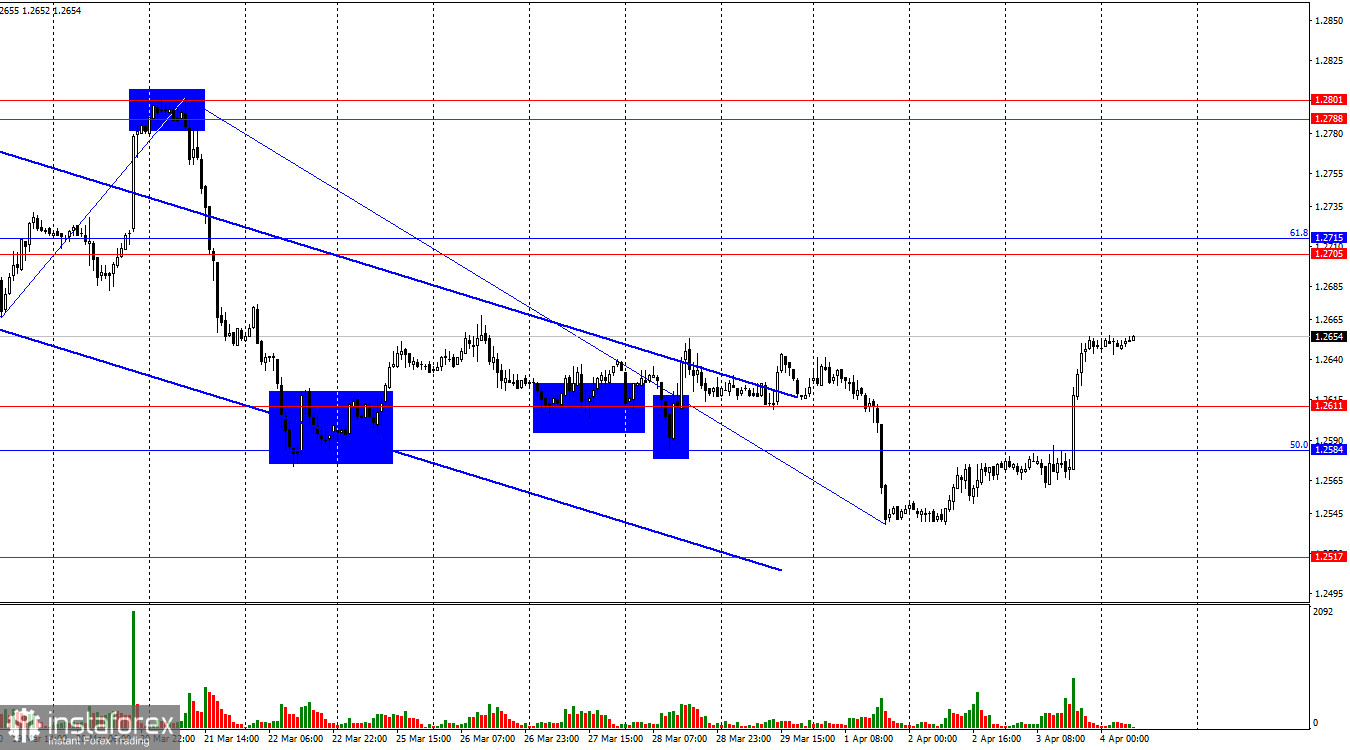

On the hourly chart, the GBP/USD pair on Wednesday consolidated above the zone of 1.2584–1.2611, which allows us to count on the continuation of the British pound's rise towards the next resistance zone of 1.2705–1.2715. The "bearish" trend may be coming to an end as quotes consolidated above the descending trend corridor.

The wave situation recently does not raise any questions. The last completed downward wave easily broke through the last low (from March 19th), while the new upward wave is still too weak to break the last peak (from March 21st). Thus, the trend for the GBP/USD pair is currently "bearish," and there are no signs of its completion. The first sign of bulls transitioning to an offensive could be breakng the peak from March 21st. However, bulls need to overcome a distance of about 150 points to the zone of 1.2788–1.2801, which is unlikely to happen today. If the new downward wave does not break the low from April 1st, this will also be a sign of a trend change to "bullish," but this wave has not even started yet.

On Wednesday evening, Federal Reserve Chairman Jerome Powell spoke, which could have supported bearish traders. Despite not making any new statements at the Stanford Graduate School of Business, Powell's rhetoric did not soften compared to his previous speeches. He reiterated that the current level of inflation needs to be increased for the Fed to start discussing rate cuts. According to him, there is progress in reducing consumer prices, but it still needs to allow for a shift to a softer monetary policy stance. He also noted a 3% GDP growth and the creation of 3 million jobs in 2023. However, the interest rate will only begin to decrease when the regulator is confident in achieving the target inflation level. Thus, the first easing is unlikely to occur in the near future, and the US dollar could have shown growth yesterday.

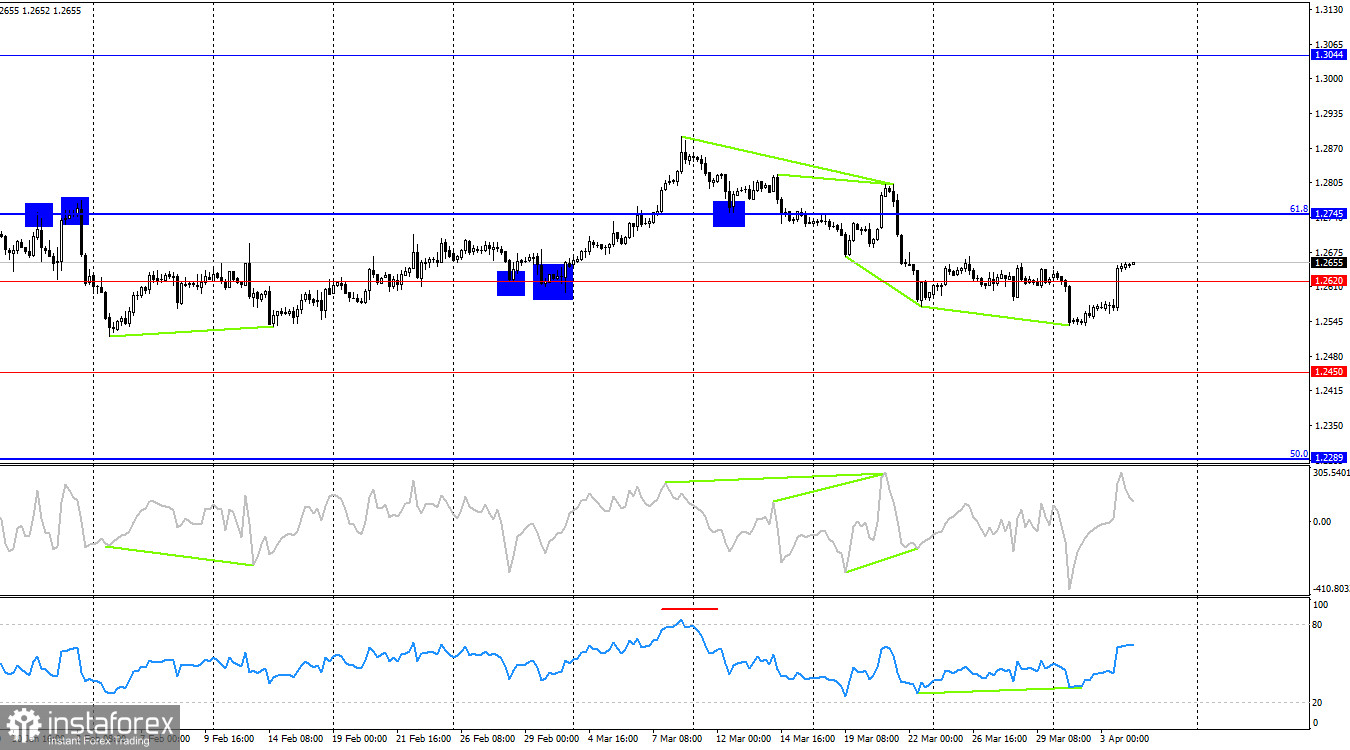

On the 4-hour chart, the pair made a reversal in favor of the British pound after forming a "bullish" divergence at the RSI indicator and consolidating above the level of 1.2620. Thus, the growth process can be continued towards the next corrective level of 61.8%–1.2745. There are no new emerging divergences observed today in any of the indicators. The "bearish" trend remains on the hourly chart, but on the 4-hour chart, horizontal movement persists.

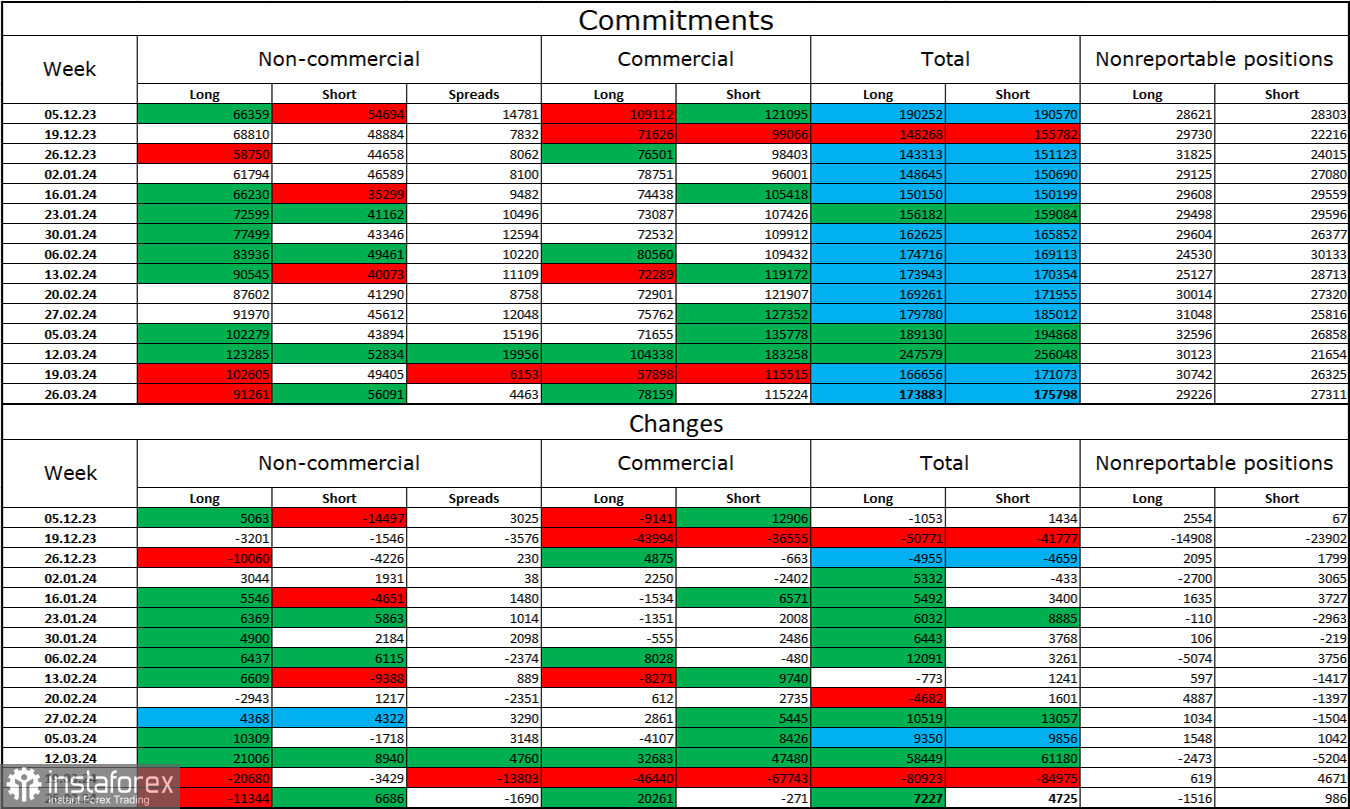

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category for the last reporting week has become less "bullish." The number of long contracts held by speculators decreased by 11,344 units, while the number of short contracts increased by 6,686 units. The overall sentiment of major players remains "bullish," but it has begun to weaken in recent weeks. The gap between the number of long and short contracts is now less than double: 91 thousand versus 56 thousand.

Prospects for a decline remain for the British pound, but over the past 2.5 months, the number of long positions has increased from 66 thousand to 91 thousand, while the number of short positions has remained practically unchanged. Over time, bulls will start to get rid of their buy positions, as all possible factors for buying the British pound have already been exhausted. However, bears continue to demonstrate their weakness, which prevents the pound from starting to decline.

News Calendar for the US and UK:

UK – Services Purchasing Managers' Index (08:30 UTC).

US – Initial Jobless Claims (12:30 UTC).

On Thursday, the economic events calendar contains only reports of low significance. The impact of the news background on the market sentiment today may be very weak.

Forecast for GBP/USD and trader recommendations:

Sales of the British pound can be opened on a rebound from the zone of 1.2705–1.2715 with a target of 1.2611. Purchases were possible when closing above the zone of 1.2584–1.2611 on the hourly chart with a target of 1.2705. These trades can be kept open for now, but it should be remembered that the British pound maintains a horizontal trajectory.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română