Throughout Wednesday, the EUR/USD currency pair continued an upward correction. Volatility remained low once again. While we used to experience occasional periods of high volatility, now the market's volatility consistently fluctuates between "low" and "medium" almost every day. In any case, current movements can't be termed strong. In the 4-hour timeframe, the pair may settle above the moving average line, but everything could change multiple times by the week's end. There are numerous important reports, and market reactions may vary for each. Predicting where the pair will be tonight or tomorrow is practically impossible.

On Wednesday, we noted the report on European inflation. Previously, German inflation was published, showing a slowdown to 2.2% y/y. We speculated then that overall European inflation would continue to decelerate, as Germany is the locomotive of the European economy. Yesterday, it became known that our assumption was correct. Experts predicted a slowdown in the EU Consumer Price Index to 2.6%, but in reality, inflation had already decreased to 2.4%. Consequently, the ECB might cut rates for the first time even in April. We doubt that the European regulator will take such a step, but the likelihood significantly increased on Wednesday.

However, the market's reaction to the inflation report was illogical. In the first half of the day, the euro rose despite the decrease in inflation, which implies an increased probability of the ECB's dovish rhetoric and stance. In other words, the ECB may now consider easing its monetary policy earlier than June. Core inflation also decreased more than forecasted, reaching 2.9% in March. Based on such data, the European currency should have continued to decline in the first half of the day.

The same applies to the US ADP report, which showed a higher value than expected by the market – 184 thousand versus 148 thousand. However, this report was disregarded. Instead, the ISM index, slightly below expectations, was worked on with triple strength. Thus, a situation arises again, which we have observed several times in the past six months. The euro may show growth only because the market buys it, ignoring fundamental and macroeconomic backgrounds.

Of course, one would hope to avoid such a situation, but we, understandably, cannot influence the market or market makers. Let's consider that over the past two days, we witnessed a straightforward technical correction, which will not last long. However, now, if the US labor market statistics turn out to be weaker than expected, the dollar may plummet much deeper. If the market sells it even when there are no reasons to do so, what will it do when the reasons actually emerge?

In the medium term, we still expect the EUR/USD pair to decline. In the 24-hour timeframe, there is no sign of a new upward movement.

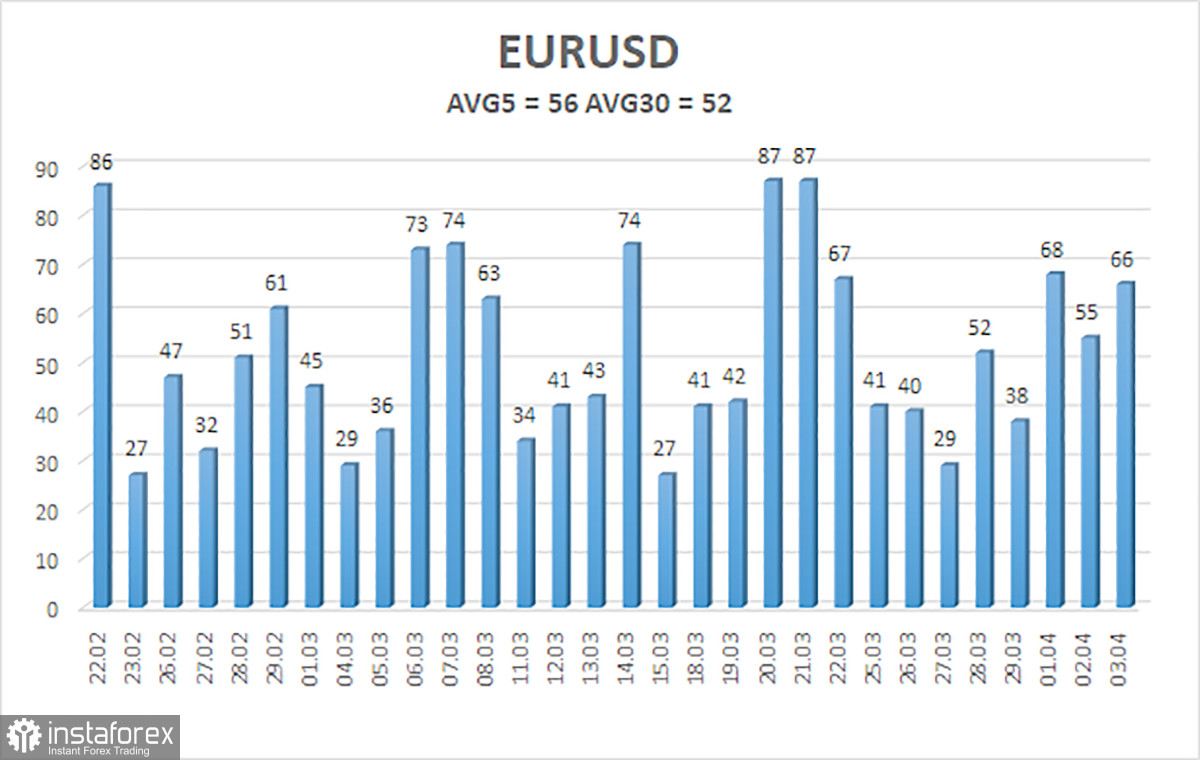

The average volatility of the EUR/USD currency pair over the last five trading days as of April 4th is 56 pips and is characterized as "average." This week, volatility is higher than the previous week due to a large number of important publications in the US and the EU. We expect the pair to move between the levels of 1.0772 and 1.0884 on Thursday. The senior linear regression channel still points downward, indicating a continued overall downward trend. The CCI indicator has left the oversold territory without firmly settling in it, so we do not expect prolonged euro growth.

Nearest support levels:

S1 – 1.0803

S2 – 1.0773

S3 – 1.0742

Nearest resistance levels:

R1 – 1.0834

R2 – 1.0864

R3 – 1.0895

Trading Recommendations:

The EUR/USD pair has settled above the moving average line. However, the movement is clearly corrective, so we believe it's necessary to wait for new sell signals with targets at 1.0742 and 1.0712. We expect a decline towards the 7th level, and in the perspective of several months, towards the level of 1.0200. After a sufficiently long rise of the pair (which we consider a correction), we see no grounds for considering long positions. Even with the price settling above the moving average. Volatility in the first half of the week was quite good; it will likely remain not lower in the remaining days.

Explanations for Illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is strong right now.

Moving average line (settings 20.0, smoothed) - determines short-term trend and direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel where the pair will trade in the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold territory (below -250) or overbought territory (above +250) indicates a trend reversal approaching in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română