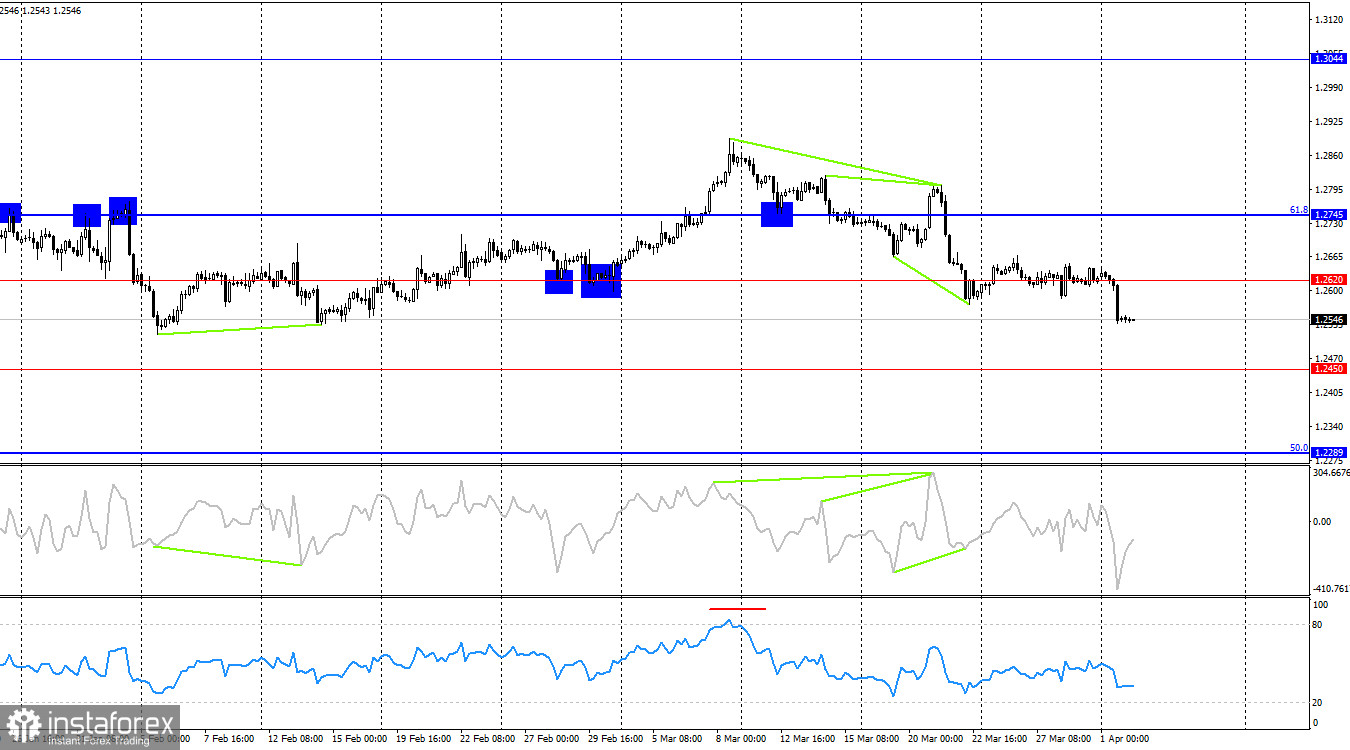

Hi, dear traders! On the 2-hour chart on Monday, the GBP/USD pair performed a new reversal in favor of the American currency and consolidated under the support zone of 1.2584–1.2611, which prevented the British currency from a further fall for a whole week. Now the fall in GBP/USD can continue in the direction of the lower level of 1.2517. Consolidation below 1.2517 will increase the likelihood of a further decline in the direction of the 38.2% correction level of 1.2453. The trend remains bearish.

The situation with waves recently has not raised any questions. The last completed upward wave failed to reach the peak of the previous wave. The new downward wave (which is being formed at this time) easily broke through the last low from March 19. Thus, the trend for the GBP/USD pair is now bearish and there are no signs of completion. It just started recently. The first sign of the bulls going on the offensive could be a breakout of the high of March 21. But to reach the 1.2788-1.2801 zone, the bulls need to cover a distance of about 270 pips, which may take a long time. Thus, a change in trend will hardly happen in the near future.

On Monday, the ISM business activity index in the US benefited the dollar. The PMI reading turned out to be significantly higher than traders' expectations, which supported the bears in their endeavors. I believe that the information background continues to encourage the bears, even without taking into account yesterday's ISM index. However, this week, there will be crucial reports on the US labor market and unemployment, which tend to disappoint the market from time to time. Today, for example, the JOLTS report may stop the victorious growth of the dollar. If it turns out that the number of job openings is less than expected, this could negatively affect the unemployment rate, which has risen in the US from 3.4% to 3.9% over the past year. Therefore, the bulls can become active for a short period.

On the 4-hour chart, GBP/USD made a new reversal in favor of the dollar and consolidated below 1.2620. Thus, the instrument may extend its weakness in the direction of the next level of 1.2450. No new emerging divergences are observed in any indicator. A rebound in the price from 1.2450 will work in favor of the British pound. Also, a rebound can be made from the level of 1.2500, which is the low for the last few months.

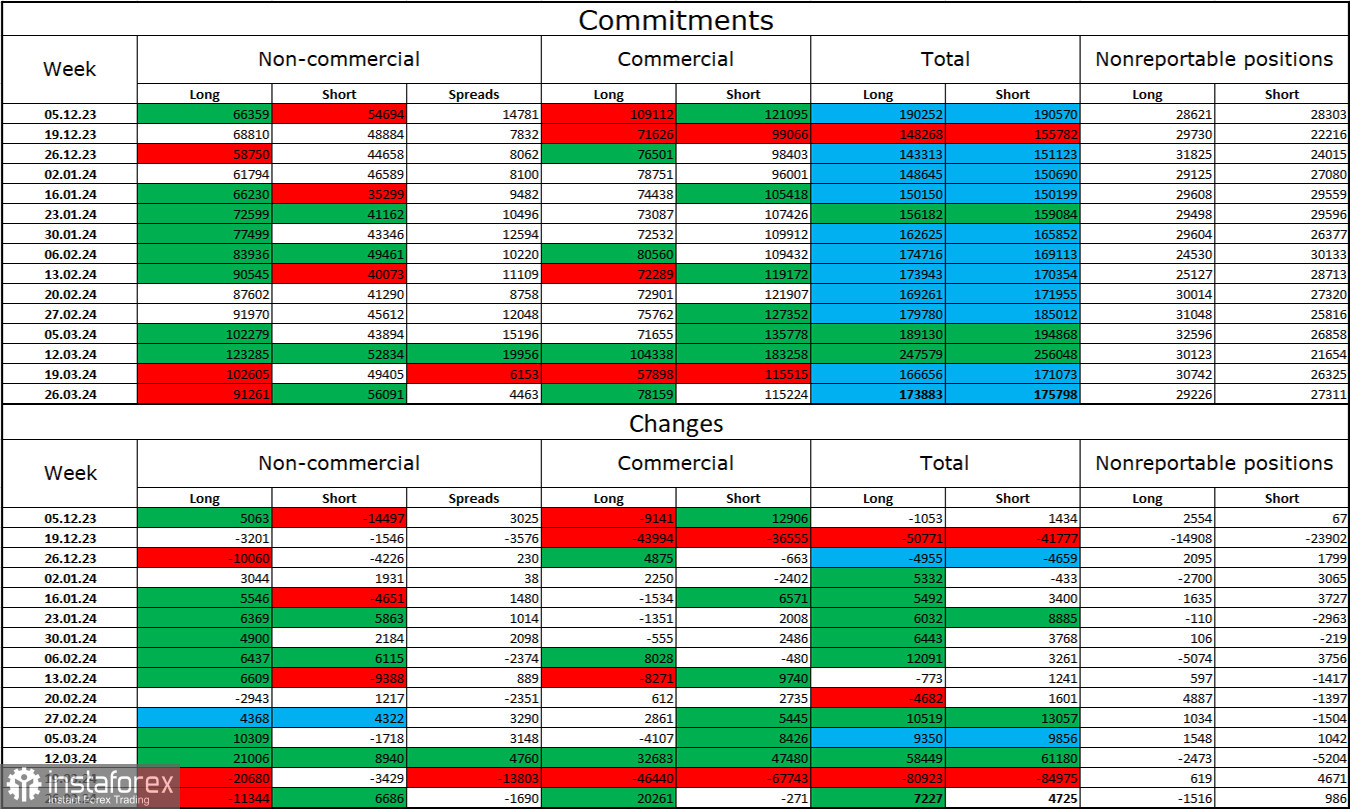

Commitments of Traders (COT)

The sentiment of the Non-commercial category of traders became less bullish over the last reporting week. The number of long contracts in the hands of speculators decreased by 11,344, whereas the number of short contracts increased by 6,686. The overall sentiment among major players remains bullish, but has begun to weaken in recent weeks. The gap between the number of long and short contracts is already less than twofold: 91K versus 56K.

In my opinion, there are still prospects for a fall for the British currency, but over the past 2.5 months the number of longs has increased from 66K to 91K, and the number of shorts has remained virtually unchanged. I believe that over time, the bulls will begin to get rid of buy positions since all possible factors for buying the British pound have already been worked out. However, the bears continue to demonstrate their weakness, which prevents the pound from a fall.

Economic calendar for US and UK

UK: manufacturing PMI due at 08:30 UTC

US: JOLTs job openings due at 14:00 UTC

The economic calendar contains just two significant reports. The JOLTs job openings is the priority for traders. The information background could make a modest impact on market sentiment.

Outlook and trading tips on GBP/USD

Short positions on GBP/USD could be opened if the instrument consolidates under the zone of 1.2584–1.2611 with targets of 1.2517 and 1.2453. Now these transactions can be kept open with designated targets. I will not consider buying today since several dips from the zone of 1.2584–1.2611 proved passive buyers. Today there will be no such important reports that could put strong pressure on the US dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română