The updated UK GDP data for quarter 4 2023 turned out to be worse than the preliminary figures, as the economy fell by 0.3%. This marks the second consecutive decline, indicating a technical recession. In output terms in Q4 2023, there were falls in all three main sectors with declines of 0.2% in services, 1.0% in production, and 1.3% in construction. There were also falls in net trade, household consumption, and gross capital formation, partially offset by an increase in government consumption.

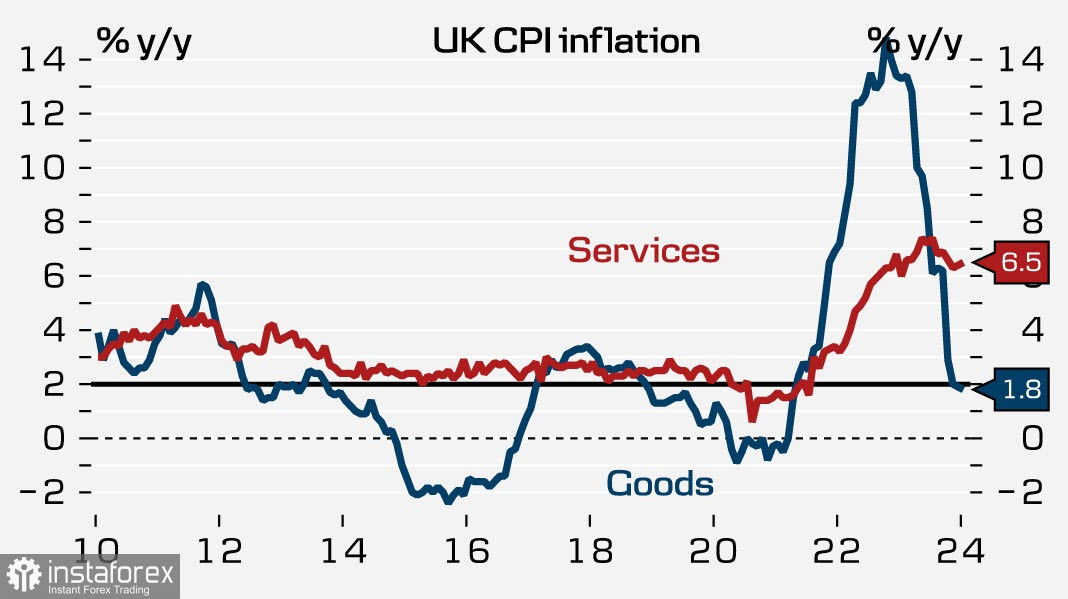

If viewed from a financial perspective, the technical recession indicates that the economic slowdown, as one of the main factors driving inflation down, has taken place. And if inflation shows a steady downtrend, the likelihood of a Bank of England rate cut at the next meeting increases. The UK's rate of inflation has fallen to 3.4% for the year to February, down from 4.0% in January. March data is set to be published on April 17, so it would be premature to expect changes in rate forecasts in the next two weeks.

All the BoE needs to see so it can begin to lower rates is a slowdown in inflation in the services sector. Once this happens, the last hurdle preventing a rate cut will disappear.

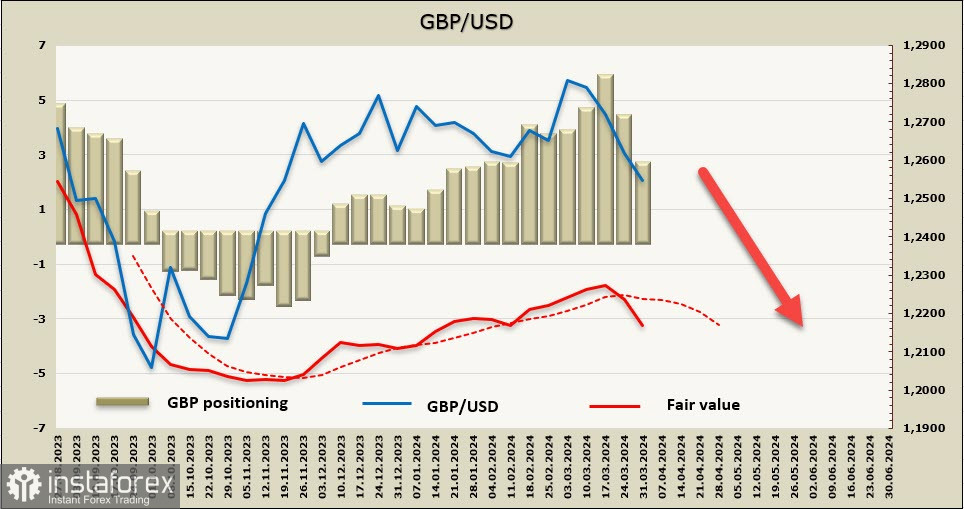

The BoE historically follows the Federal Reserve's policy with a delay of 2-3 months, but the current situation does not allow this. If the US economy is on the rise, which may require maintaining a restrictive policy for a longer period of time, then on the contrary, the UK economy is on the decline, which indicates the need to start the easing cycle. There is a higher chance that the BoE will start cutting rates sooner than the Fed, and this seems to be the main pressure on the pound in the coming weeks.

The net long GBP position decreased by 1.454 billion to 2.776 billion, the bullish bias remains intact, but halving the long position in just a couple of weeks clearly indicates a trend reversal. The price firmly falls below the long-term average.

GBP/USD is one step away from the support level of 1.2500/20, and there's a high probability of an attempt to break through this mark. In order for the pair to fall further, it needs a new impetus, and if the US employment report does not provide such grounds, GBP/USD may trade in a sideways range. The pound doesn't have much reason to rise; a possible pullback will find resistance in the 1.2610/30 zone, after which attempts to decline will resume. In case the price breaks the support, the next target is the technical level of 1.2464 (50% retracement from the October-March rise).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română