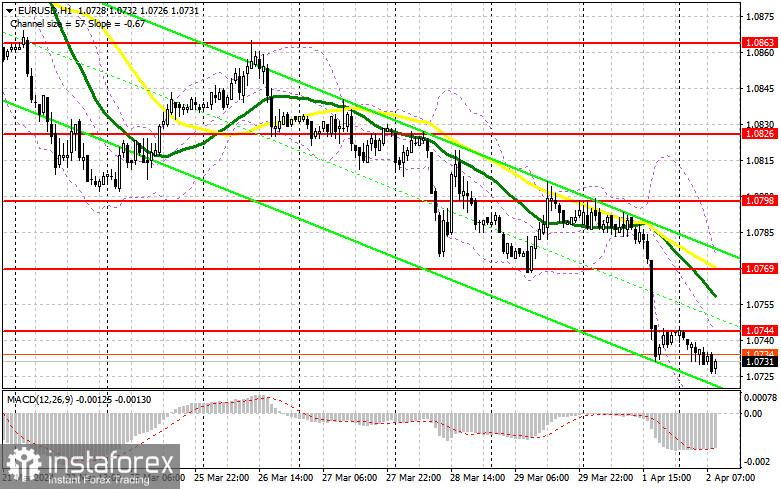

Yesterday there were no signals to enter the market. I suggest we look at the 5-minute chart and figure out what happened. In my precious forecast, I paid attention to the level of 1.0769 and planned to make decisions on entering the market from there. A decline actually occurred, but EUR/USD did not test that level and there was no false breakout there. This did not allow us to receive a normal signal to enter the market. In the afternoon, the sharp collapse of the euro did not allow me to find suitable entry points for buying. I did not open long positions at 1.0735 after a false breakout at the end of the day.

What is needed to open long positions on EUR/USD

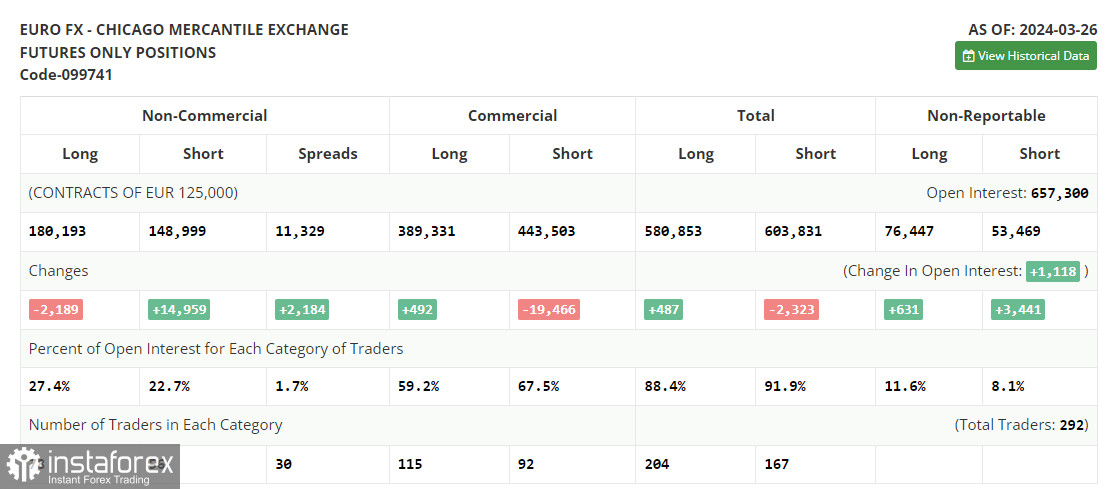

Before talking about the outlook for the EUR/USD pair, let's look at what happened on the futures market and how the positions of the Commitment of Traders report changed. The COT (Commitment of Traders) report for March 26 showed a decline in long positions and an increase in short positions. Despite the past meeting of the Federal Reserve and the dovish tone of the FOMC policymakers, no one is yet going to give up selling risky assets until inflation in the US steadily ebbs away, as is clearly evident from the report. Given the recent statements by ECB policymakers who hinted at an active decline in inflation in the eurozone and a possible quick reversal to monetary easing and rate cuts, the European currency has no chance. For this reason, I bet on further development of the bullish trend in the US dollar and weakness in the euro. The COT report showed that long non-commercial positions fell by 2,189 to 180,193, while short non-commercial positions jumped by 14,959 to 148,999. As a result, the spread between long and short positions increased by 2,184.

Today the economic calendar contains the eurozone manufacturing PMI as well as the manufacturing PMI and the consumer price index for Germany. Strong statistics for Germany will allow the euro to maintain its chances of recovery after yesterday's sell-off, while weak reports along with easing inflation in Germany are all reasons to continue selling the euro following the trend. For this reason, I am not going to rush into long positions, even despite the good drop in the price. It is best to wait for a decline and a false breakout in the area of new support 1.0698. This will provide an entry point into the market with the aim of recovering to 1.0744. A breakout and update from top to bottom of this range on the back of very good statistics is a chance to buy with, bearing in mind an update of the high in the area of 1.0769 where the moving averages are located, playing on the side of sellers. The highest target will be 1.0798, where I will take profits. In case of a further decline in EUR/USD and lack of activity at 1.0698, the chances of a further downtrend will increase. In this case, I will try to enter after the formation of a false breakout in the area of the next support 1.0667. I will open long positions immediately on a dip from 1.0642, beating in mind an upward correction of 30-35 pips within the day.

What is needed to open short positions on EUR/USD

In the first half of the day, it is very important for sellers to prevent the price from leaving the resistance level of 1.0744, which may be tested in the near future. Protection and the formation of a false breakout there will be a suitable scenario for opening short positions in the course of a downtrend with the aim of a decline to the area of 1.0698. This level is very important for the buyers. So, only after a breakout and consolidation below this area, as well as after a reverse test from bottom to top, I expect to get another entry point for selling with a fall to 1.0667. The lowest target will be at least 1.0642 where I will take profits. A test of this level will only reinforce the downtrend. If EUR/USD moves upward during the European session, and there are no bears at 1.0744, the buyers will try to build an upward correction, aiming to update 1.0769. I will act there only on a false breakout. I plan to open short positions immediately on a rebound from 1.0798, bearing in mind a downward correction of 30-35 pips.

Indicators' signals

Moving averages

The instrument is trading below the 30 and 50-day moving averages. It indicates a further decline in EUR/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD goes down, the indicator's lower border at about 1.0700 will act as support. Alternatively, if the instrument rises, the indicator's upper border at about 1.0770 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română