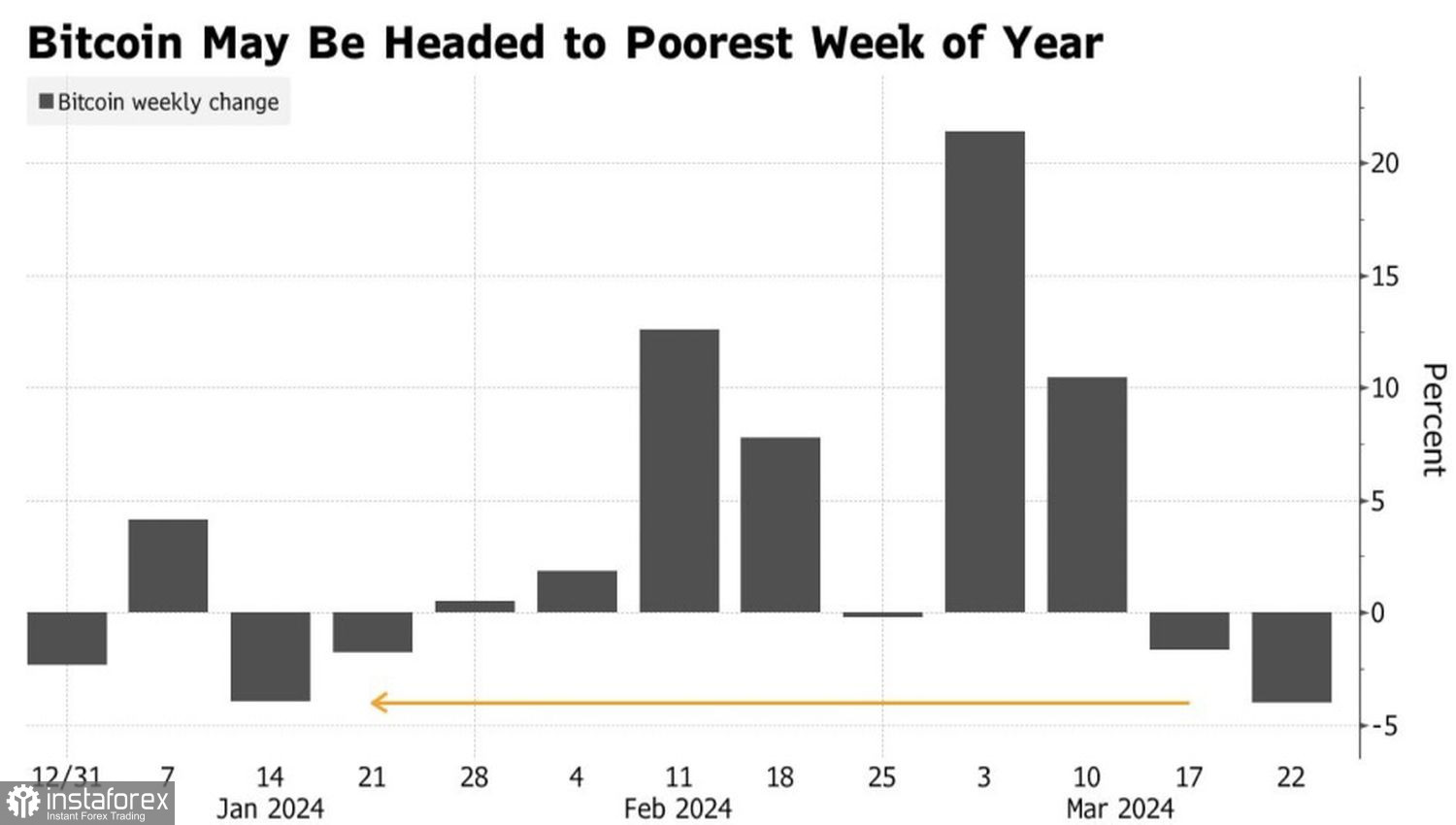

From the great to the ridiculous is just one step. The lower Bitcoin falls, the more stones are thrown at it. According to JP Morgan, BTC/USD quotes will collapse to 42,000, as demand for ETF, as it turns out, is not a one-way street. Following the capital inflows into specialized exchange-traded funds, there was a three-day outflow, which led the cryptocurrency sector leader to one of the worst weeks since the beginning of the year.

Weekly Bitcoin Dynamics

Zaye Capital Markets believes that since there was no continuation of the rally, the risks of correction towards 50,000 are significant. At first glance, this is a controversial assumption; however, considering that Bitcoin lacks fundamental bases that could anchor it, it can be assumed that FOMO or fear of missing out on profit lies at the basis of its upward movement and subsequent retracement. Many bought BTC/USD at 60,000, and if quotes fall below this level, the avalanche of sales will gain momentum.

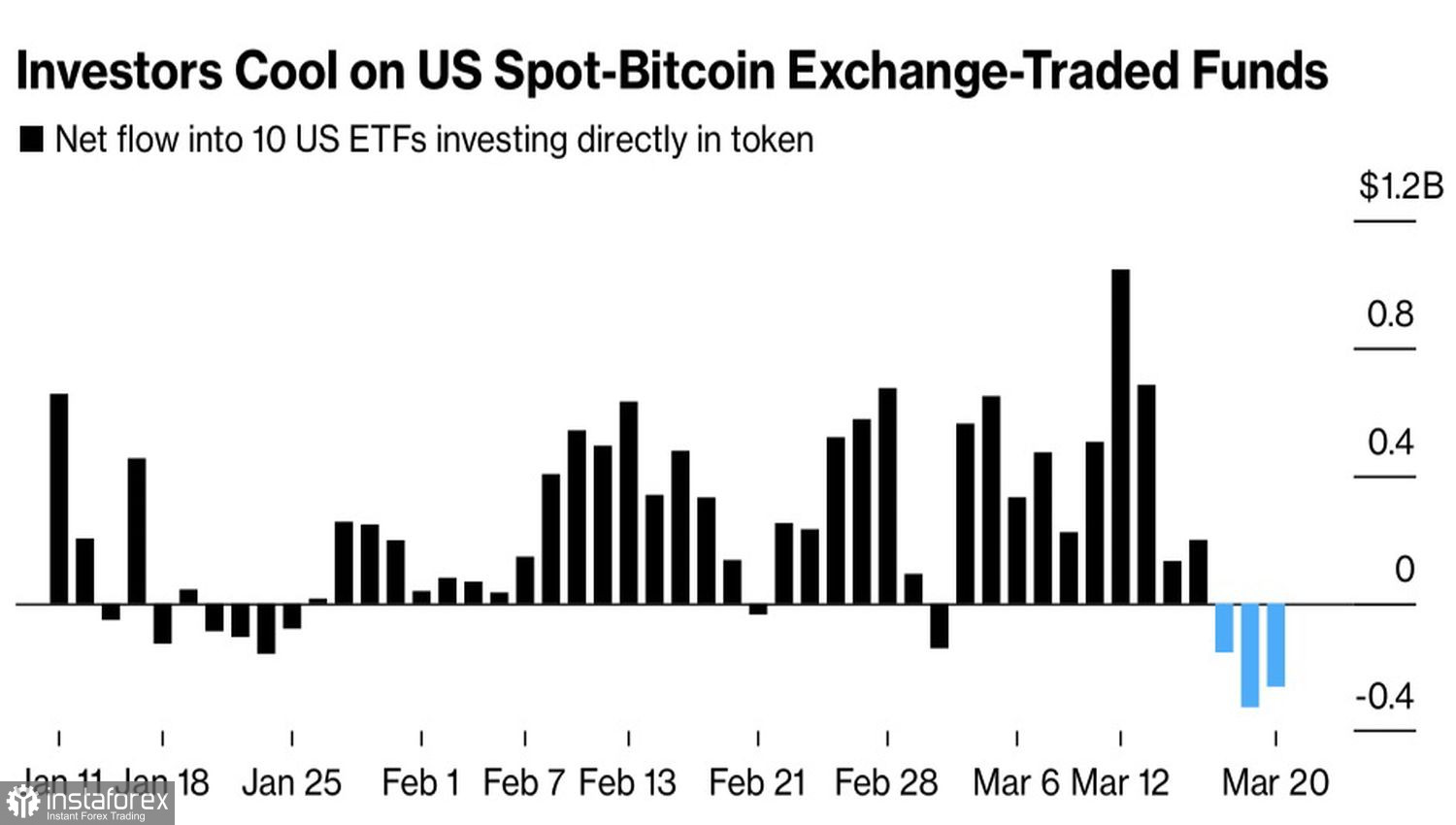

Since the launch of the ETF with Bitcoin as the underlying asset on January 11, capital inflows reached a record peak of $11.2 billion on a net basis, but from March 18 to 20, there was a net outflow of $742 million, driven by concerns that the Fed may keep the federal funds rate at 5.5% plateau longer due to the acceleration of U.S. inflation in January–February. This would be a serious shock to risky assets and would lead to a strengthening of the U.S. dollar. Since the cryptocurrency trades in U.S. dollars, the increase in the USD index is a "bearish" factor for it.

Capital Flow Dynamics in ETFs with Bitcoin as the Underlying Asset

Signals from the FOMC and Jerome Powell that the overall story has not changed and the Fed is not going to deviate from its December forecasts of three rate cuts in 2024 allowed the BTC/USD bulls to go on the counterattack. Bitcoin has found its bottom, especially since U.S. stock indices continue to rewrite record highs, and Treasury bond yields are falling. Such an environment is favorable for risky assets.

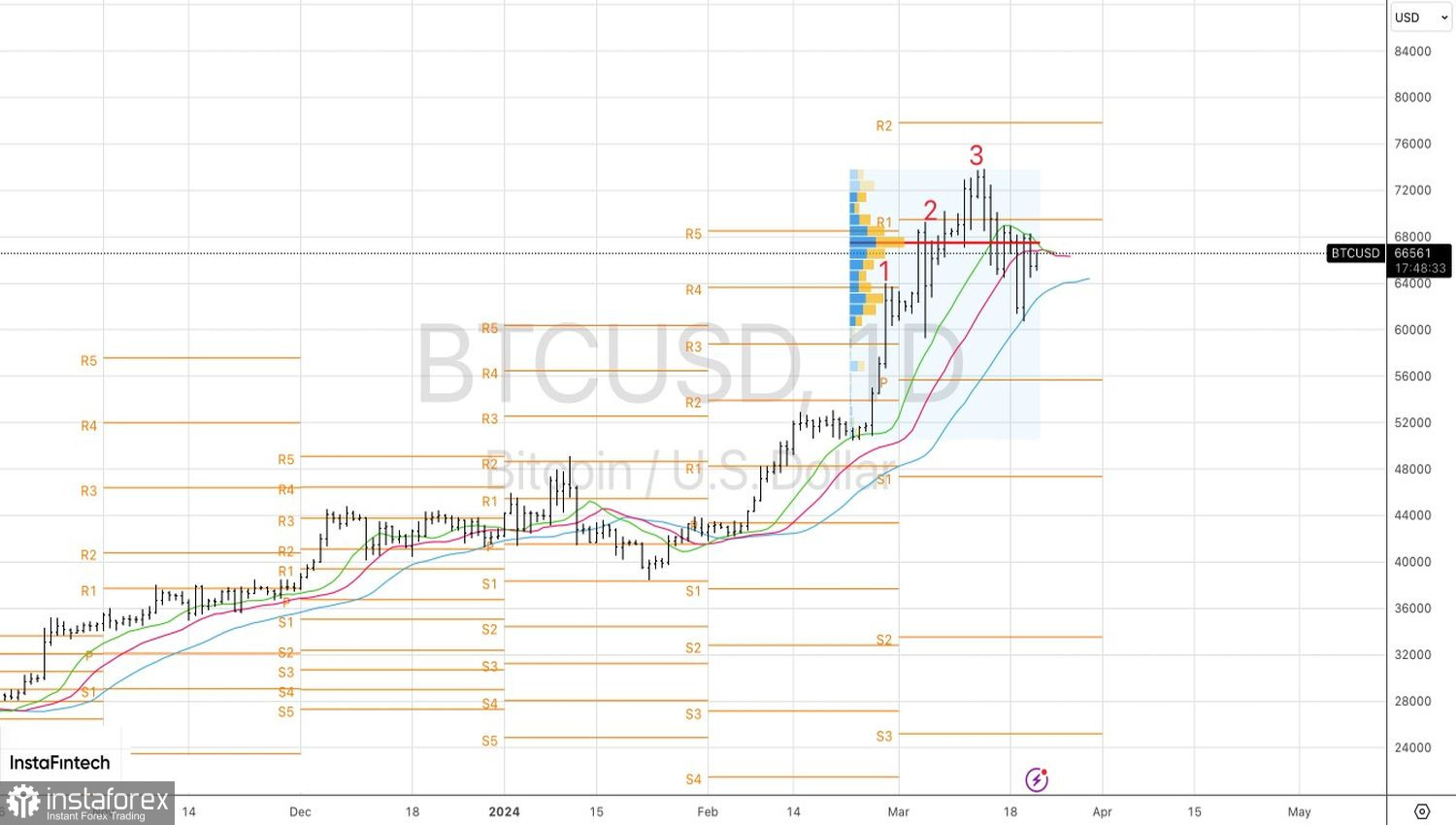

Bitcoin is supported by the intention of leading central banks in the world to ease monetary policy, undermining the positions of fiat currencies and forcing investors to look towards their digital counterparts. On the other hand, the cryptocurrency sector leader has yet to reach a record high before the halving. This factor may be already reflected in its quotes, which increases the risks of playing out the "buy on rumors, sell on news" principle.

Technically, there is consolidation on the BTC/USD daily chart, which can result in either 1-2-3 patterns or a Spike and Ledge and a recovery of the upward trend. It will all depend on the bulls' ability to storm the fair value at 67,500 and the pivot level at 69,500. Their successful breakthroughs will pave the way for Bitcoin towards a record peak. Conversely, a rebound will be the basis for forming short positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română