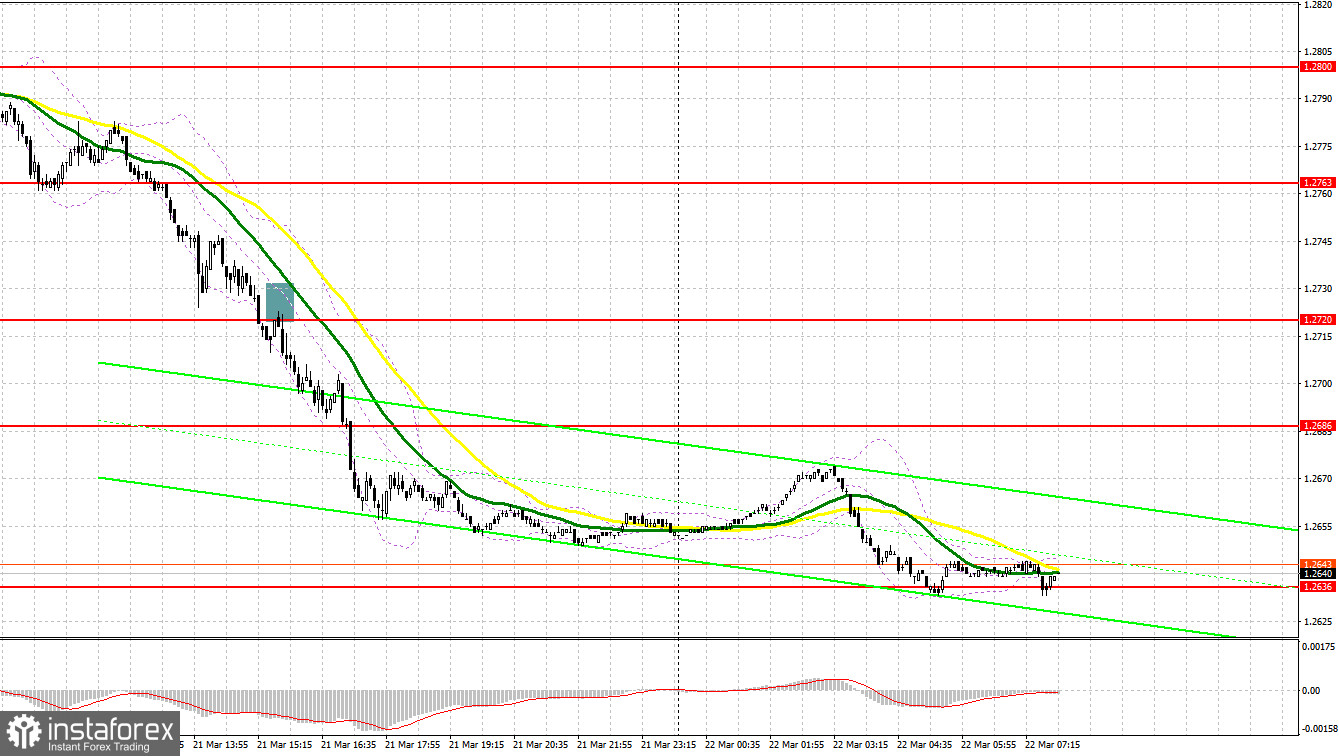

Yesterday, traders received several signals to enter the market. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2766 as a possible entry point. A decline and false breakout there produced a buy signal, which sent the pair up by 20 pips, and after that the pair came under renewed pressure. In the afternoon, the Bank of England's decision led to a breakout and retest of 1.2720, which generated a sell signal. As a result, the pair fell by 80 pips.

What is needed to open long positions on GBP/USD

Yesterday, the BoE abruptly changed its stance to a softer one, saying that the restrictive stance of monetary policy is weighing on activity in the real economy. This led to a revision of the timing of rate cuts - specifically to June, which caused a GBP/USD sell-off. The UK retail sales and the Confederation of British Industries industrial trend orders are due today. If the figures point to a decline, the pair may extend losses, which I plan to take advantage of. A false breakout near the new support at 1.2636, which, as far as I am concerned, has very little hope, will give a good entry point for long positions in hopes that demand will return with the prospect of testing 1.2673. A breakout and consolidation above this range will strengthen the bulls' positions and open the way to 1.2708, which is in line with the bearish moving averages. The farthest target is seen at the high of 1.2756, where I am going to take profit. In case of a decline and a lack of bullish activity at 1.2636, the pound will continue to fall, which will lead to building a new downtrend. In this case, only a false breakdown near the next support at 1.2600 will confirm the correct entry point. I plan to buy GBP/USD just after a rebound from the low of 1.2559, aiming for a correction of 30-35 pips within the day.

What is needed to open short positions on GBP/USD

The bears have regained control over the market and are unlikely to face problems today. In case the pair grows, the sellers' goal is to protect the resistance at 1.2673, a breakout of which could take place in the near future. A false breakout there will confirm the sell signal, which will give the bears a chance to move the price down to the 1.2636 area. A breakout and an upward test of this range will deal a blow to the bulls' positions, leading to the removal of stop orders and open the way to 1.2600. This is where I expect big buyers to show up. The farthest target will be the area of 1.2559, where I will take profits. If GBP/USD grows and there is no activity at 1.2673, buyers will become active. In this case, I will postpone selling until there is a false breakdown at 1.2708. If there is no downward movement there, I will sell GBP/USD just after a bounce from 1.2756, in anticipation of the pair declining by 30-35 pips intraday.

COT report:

According to the COT report (Commitment of Traders) for March 12, the number of both short and long positions increased. Despite expectations that rates in the UK may be lowered even if inflation does not reach the 2% target, the British pound continues to be in demand. The current corrective phase is entirely due to sharp demand for the US dollar across the market, which is associated with the release of the US inflation data last week. The third consecutive month of price increases will surely compel the Federal Reserve to adhere to a tight policy for as long as possible, which is currently reflected in the market. The latest COT report unveiled that long non-commercial positions rose by 21,006 to 123,285, while short non-commercial positions jumped by 8,940 to 52,834. As a result, the spread between long and short positions increased by 4,760.

Indicators' signals

Moving averages

The instrument is trading below the 30 and 50-day moving averages. It indicates that GBP/USD is likely to decline lower.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border near 1.2600 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română