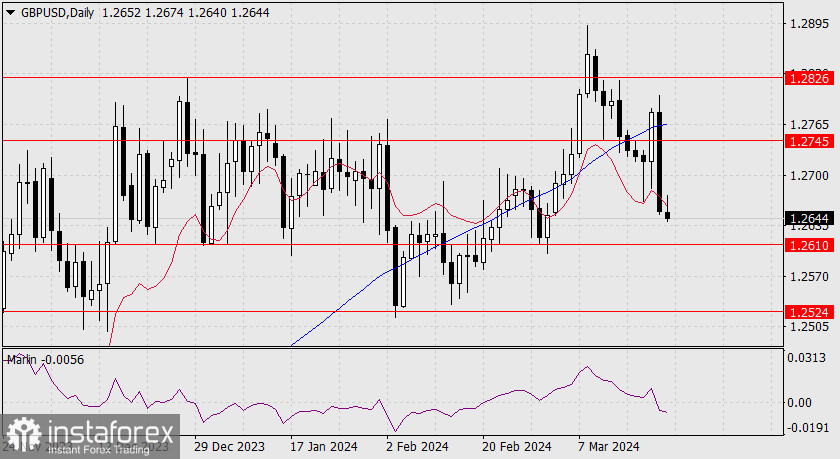

GBP/USD

The British pound plummeted 128 pips at the end of Thursday's session. The Bank of England's meeting played a secondary role here, as the pound covered a small part of the way during the meeting. The UK PMI composite output index edged down marginally to 52.9 points in March from 53.0 in February, while the PMI for the services sector fell to 53.4 from 53.8. The pound pulled down other currencies that had risen the day before during the Federal Reserve meeting. The number of votes in favor of maintaining the rate at 5.25% increased by 2 - from 6 to 8, with one dissent by Swati Dhingra advocating for a 0.25% cut, but these changes were already expected, meaning the market reaction was exaggerated. A truly soft signal was the BoE seeing inflation below the 2% target in 2024 Q2. Markets anticipate the first rate cut in June.

As a result, the price fell below the indicator line, and Marlin entered the downtrend territory. Today, UK retail sales data for February will be released, with a forecast of -0.4% (-0.7% y/y compared to 0.7% y/y in January). We believe that this report will not help the pound recover. But then again maybe an increase in retail sales (take note that sales volumes experienced a rebound of 3.4% in January, and now there may be a natural correction) could support the pound on Friday.

On the 4-hour chart, the price formed a convergence with the Marlin oscillator. This also gives us hope that the pound may recover to the resistance level of 1.2745. To implement such an optimistic plan, the price must consolidate above Wednesday's low of 1.2683. We are waiting for today's news.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română