The EUR/USD currency pair corrected lower on Thursday, but overall, the market calmed down very quickly after the FOMC meeting and its results. In the previous article, we mentioned that analyzing the outcomes of the second FOMC meeting in 2024 should be completed on time. It is necessary to wait until the market "digests" all the information. Today, we are ready to draw certain conclusions and outline an updated forecast. Meanwhile, the pair easily and quickly returned to their initial positions, as we predicted.

Let's start with what we have been talking about for the past six months. The market still eagerly buys the euro and the pound much more than the dollar. The American currency has been out of favor with market participants for a long time now, and we have repeatedly encountered situations where there is no reason for the euro to appreciate, yet it continues to rise. So, what happened on Wednesday evening that caused the American currency to plummet?

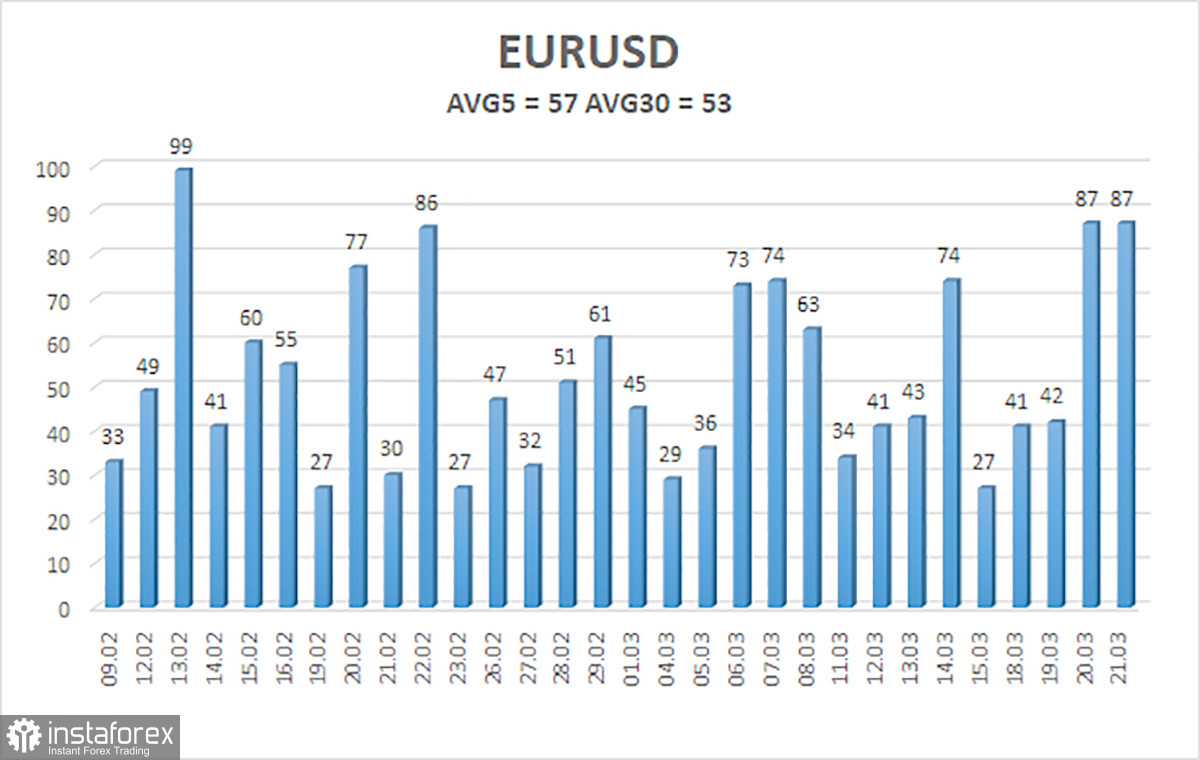

First of all, it should be noted that there was no collapse of the dollar. The American currency lost only 90 points. Yes, compared to the average volatility of the pair over the last month and a half (50 points), this is a lot. But overall, it is a low value. Furthermore, the dollar fell again, almost out of nowhere. The Fed's key rate remained unchanged, and the key parameters of monetary policy also did not change. Essentially, the market was only waiting for the Fed's updated forecasts for interest rates and inflation.

Recall that in recent weeks, the market has been anticipating three policy easing steps in 2024 and four in 2025. After news of another acceleration in inflation became known, some experts (including us) expected the Fed to tighten its stance and reduce the number of expected rate cuts for the current year to two. However, this did not happen, and Jerome Powell stated at the press conference that inflation continues to slow down and conclusions should not be drawn based on just one or two months. And now, in 2025, only three rate cuts are planned, not four as before. So, the Fed's stance did tighten after all. Then why did the dollar fall?

The dollar fell, as usual, due to purely formal factors. The market expected the Fed to significantly tighten its monetary approach, but the Fed tightened it only minimally. And who is to blame for this? The dollar? No, the market once again mistook wishful thinking for reality, interpreting the significant event as it pleased. Some analysts wrote today that the "dollar fell on rumors," but we would like to note that this version could be true if the American currency had been actively rising before the meeting. Then, it could be said that the market believed in the Fed, believed in the dollar, and the regulator disappointed them with not too strong "hawkish" decisions. But the dollar has been falling for the past few weeks. How could the market then expect "hawkish" decisions?

So the picture is as follows: the market expects "dovish" decisions, and the dollar falls; the market expects "hawkish" decisions, and the dollar still falls. The American currency should regain growth against the euro, but now the pair needs to confidently consolidate back below the moving average line.

The average volatility of the EUR/USD currency pair over the last 5 trading days as of March 22 is 57 points and is characterized as "low." Thus, we expect movement of the pair between the levels of 1.0805 and 1.0919 on Friday. The senior linear regression channel still points downward, indicating that the global downward trend is still in place. The oversold condition of the CCI indicator suggests the need for an upward correction, but the pair has already corrected sufficiently on the downtrend.

The nearest support levels:

S1 – 1.0864

S2 – 1.0834

S3 – 1.0803

The nearest resistance levels:

R1 – 1.0895

R2 – 1.0925

R3 – 1.0956

Trading recommendations:

The EUR/USD pair has securely settled back below the moving average line. Therefore, short positions can be maintained, with targets at 1.0814 and 1.0803. If the market finally abandons similar dollar sales, then the American currency may rise only in the near future to the seventh level. And in the long term, to the level of 1.0200. After a fairly long rise in the pair (which we consider a correction), we see no reason to consider long positions. Even if the price consolidates above the moving average.

Explanations for illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, it means the trend is strong right now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română