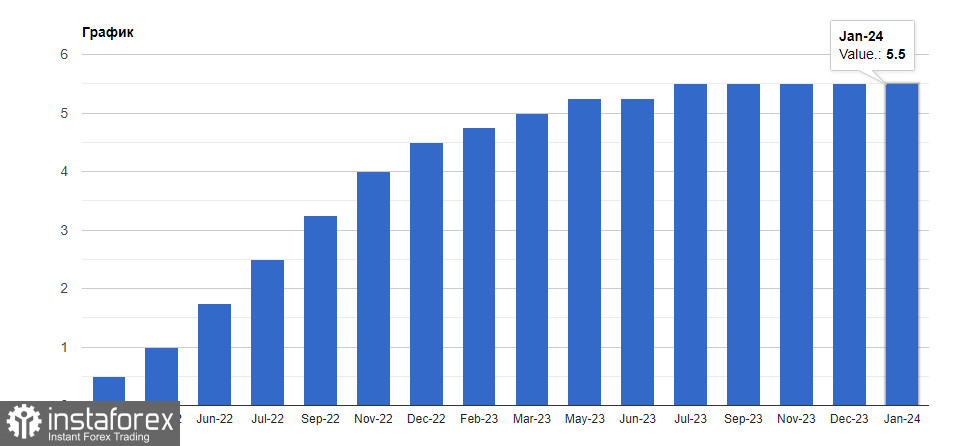

The Federal Open Market Committee is expected to maintain rates in the range of 5.25% to 5.5% at its two-day meeting, a two-decade high reached last July. The rate decision and economic forecasts will be published today, closer to the middle of the American session, followed by a press conference by Chairman Jerome Powell.

Notably, almost all Fed officials advocate for a cautious reduction in borrowing costs until they are confident that inflation is approaching the 2% level, which they consider suitable for a healthy economy. However, the recent rise in unemployment to a two-year high means they will have to balance between the labor market and the price growth observed in recent months.

Investors and traders will also focus on the Federal Reserve officials' interest rate forecasts – the so-called dot plot – which will show how many rate cuts the committee expects in 2024 and 2025.

Many economists expect that policymakers will announce three cuts in 2024, with the first one to be made in June this year, according to current market prices. However, there are more conservative policymakers: Minneapolis Fed President Neel Kashkari recently stated he considers the possibility of just one rate cut in 2024.

Given Powell's reaction to signs of economic slowdown, which continues to be present, and high inflation rates, the Fed chief is likely to face tough questions at the press conference. If his stance is more dovish than before, it could lead to a sharp sell-off of the US dollar. Otherwise, pressure on risk assets will return.

Some economists, including those from JPMorgan Chase & Co., predict that the FOMC may also revise its forecast for the long-term federal funds rate, reflecting persistent price pressure. According to the committee's estimate, this rate is 2.5%, and any increase would mean that rates will remain higher for a longer period in the future.

Regarding the euro/dollar pair, although demand for the euro has returned, everything will depend on today's Fed meeting. Buyers now need to consider breaking above the 1.0875 level. Only this will allow them to aim for a test of 1.0910. From there, reaching 1.0945 is possible, but doing so without support from major players will be quite problematic. The farthest target is the 1.0990 high. In case of a trading instrument's decline, only around 1.0850 do I expect any significant actions from major buyers. If no one is there, it would be wise to wait for a new low of 1.0820 or to open long positions from 1.0800.

As for the pound/dollar pair, for the development of an upward trend, bulls need to take the nearest resistance at 1.2745. This will allow them to reach 1.2775, above which breaking through will be quite problematic. The next target is the 1.2820 area, after which we can talk about a more significant surge of the pound upwards to 1.2855. In case of a pair's decline, bears will try to take control over 1.2700. If they manage to do so, breaking through the range will deliver a serious blow to the bulls' positions and push the pair down to the low of 1.2660 with a perspective of reaching 1.2625.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română