The new week starts rather quietly; however, the economic calendar builds up expectations of an exciting week ahead. A bit quiet on Monday and Tuesday, but starting from Wednesday, the market will have more events and reports to digest.

On Monday, the market was generally stagnant. However, throughout the day, we received some information that allows us to make new conclusions or support current expectations. JP Morgan Bank economists have revised their forecasts for Federal Reserve rate cuts in 2024. Previously, they expected five rounds of easing by 25 basis points each. JP Morgan now expected the Fed to deliver 75 bps of cuts in 2024.

In my opinion, this is a significant basis for increased demand for the US currency. If previously the market expected more, and now it expects less, it shows that expectations regarding the Fed's monetary policy have tightened. And the tightening of expectations is a growth factor for a currency. The wave pattern also implies growth in the dollar for both instruments.

Goldman Sachs now expects the Fed to deliver 75 bps in 2024. As we can see, the two largest banks are in agreement, and that means a lot. On Wednesday evening, the Fed will officially announce the results of their second meeting in 2024, but the interest rate will remain unchanged. This is already known, following a series of speeches by FOMC members. The market will focus on Fed Chair Jerome Powell's speech. If his remarks confirm my expectations regarding the rate, market expectations, and the forecasts of Goldman Sachs and JP Morgan, then the US currency will have excellent grounds for growth this week.

As for the bearish factors, there aren't many at the moment. There won't be any important reports this week (aside from business activity indices) neither in America nor in the European Union. The European Central Bank has already held its meeting, and the market has only become more convinced that the rate will be lowered in June. It's unlikely that the ECB will change its plans if inflation continues to decline in the European Union. After all, there is only a 0.6% left to reach 2%.

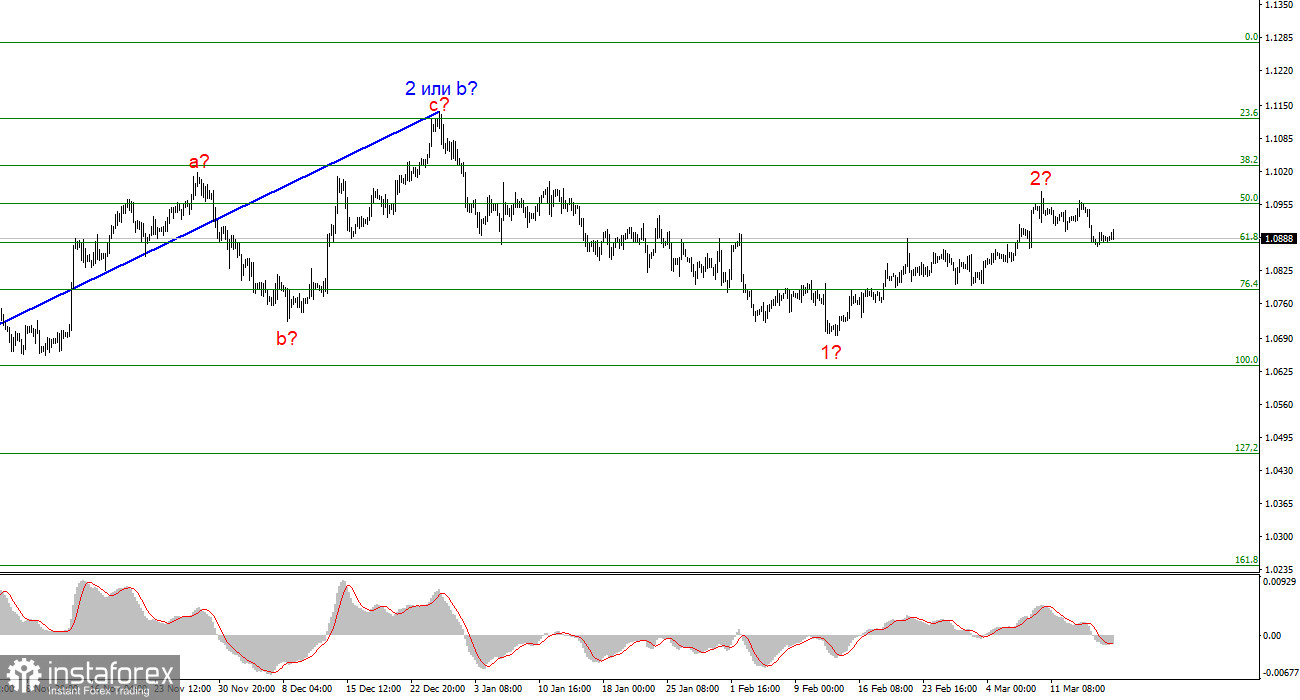

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

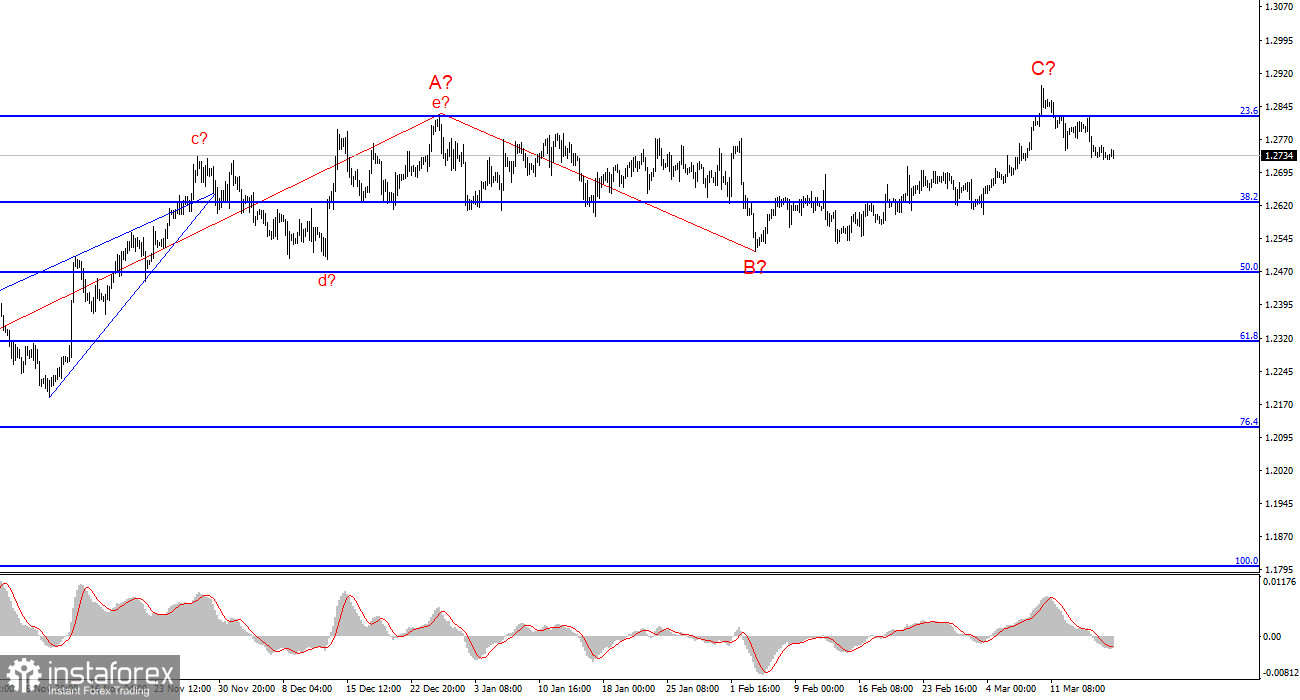

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this. A breakthrough of 1.2715 will encourage those who, like me, are looking only downwards.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română