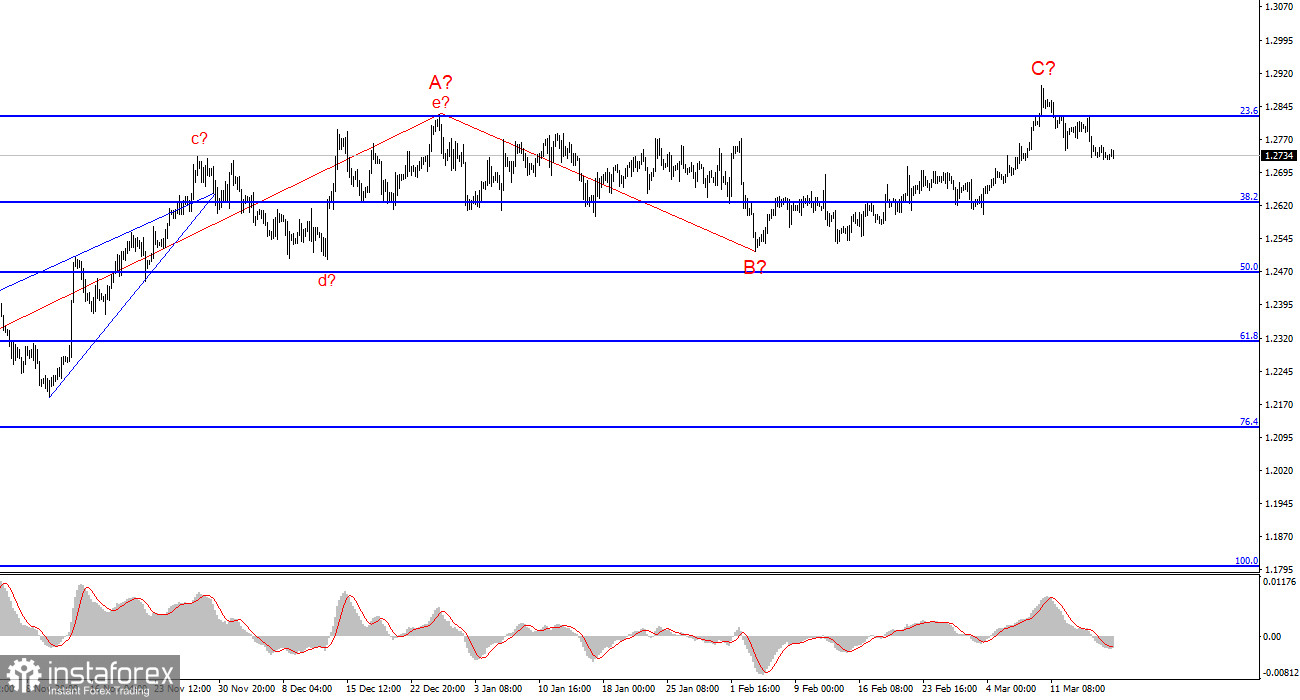

Regarding the GBP/USD pair, the wave analysis remains sufficiently clear and at the same time remains complex. The construction of a new downward trend section continues, the first wave of which took on a quite elongated form. The second wave also turned out to be quite extensive, giving us every reason to expect the prolonged construction of the third wave.

At the moment, I have no confidence that the construction of wave 2 or b is complete. Wave 2 or b has already taken on a three-wave form but has again become more complex. Theoretically, wave 2 or b may extend to 100% of wave 1 or a. An unsuccessful attempt to break the 1.2876 mark, which corresponds to 76.4% according to Fibonacci, may indicate the long-awaited completion of the bullish wave.

The targets for the pair's decline within the assumed wave 3 or c are located below the 1.2039 mark, which corresponds to the low of wave 1 or a. Unfortunately, wave analysis tends to become more complex and may not correspond to the news background. At the moment, I do not reject the working scenario, but the market does not yet see motives for long-term sales of the pair.

Bulls may continue to withdraw from the market in the coming weeks.

The GBP/USD pair's rate did not change on Monday, and the range of movements was 10 points. Certainly, such movements had no opportunity to influence the current wave picture. As of the beginning of the American session, I cannot make any new conclusions. I am currently guided by the unsuccessful attempt to break 1.2876, indicating that the pair corrected by 76.4% from the assumed wave 1 or a. It is important to understand that we are still talking about a corrective movement, not an impulse one. If this assumption is correct, the decline in quotes should not just resume. It should continue until the 1.2032 mark when wave 1 or a completed its construction.

This week's meetings of the Bank of England and the Federal Reserve may cause almost any market reaction. A central bank meeting is always a "pig in a poke." High hopes can be placed on the UK inflation report, which, according to market expectations, should show a noticeable slowdown. However, if the report matches market expectations, we will not see either a rise or a fall in the pound because this value is already factored in. Therefore, the British pound retains the probability of a prolonged decline, but the market still doubts the feasibility of such a trading strategy. Perhaps the Bank of England or the Federal Reserve will push it towards the right decision. In the near future, sellers need to overcome the 1.2715 mark (61.8% according to Fibonacci).

General conclusions

The wave picture of the GBP/USD pair still implies a decline. At the moment, I still consider selling the pair with targets located below the 1.2039 mark, as I believe that wave 3 or c will start sooner or later. However, until wave 2 or b is completed (with a hundred percent probability), we can expect an increase in the pair up to the 1.3140 mark, which corresponds to 100.0% according to Fibonacci. The construction of wave 3 or c may have already begun, but the retreat of quotes from the peaks reached is still too small to be confident in such a conclusion. Breaking the 1.2715 mark will add confidence to anyone, like me, who only looks down.

On a larger wave scale, the picture resembles the EUR/USD pair, but there are still some differences. The downward correctional trend section continues its construction, and its second wave has taken on an elongated form - 61.8% of the first wave. An unsuccessful attempt to break this mark may lead to the beginning of the construction of wave 3 or c.

The main principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play, often bringing changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is no one hundred percent certainty in the direction of movement and there can never be. Do not forget about Stop Loss protective orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română