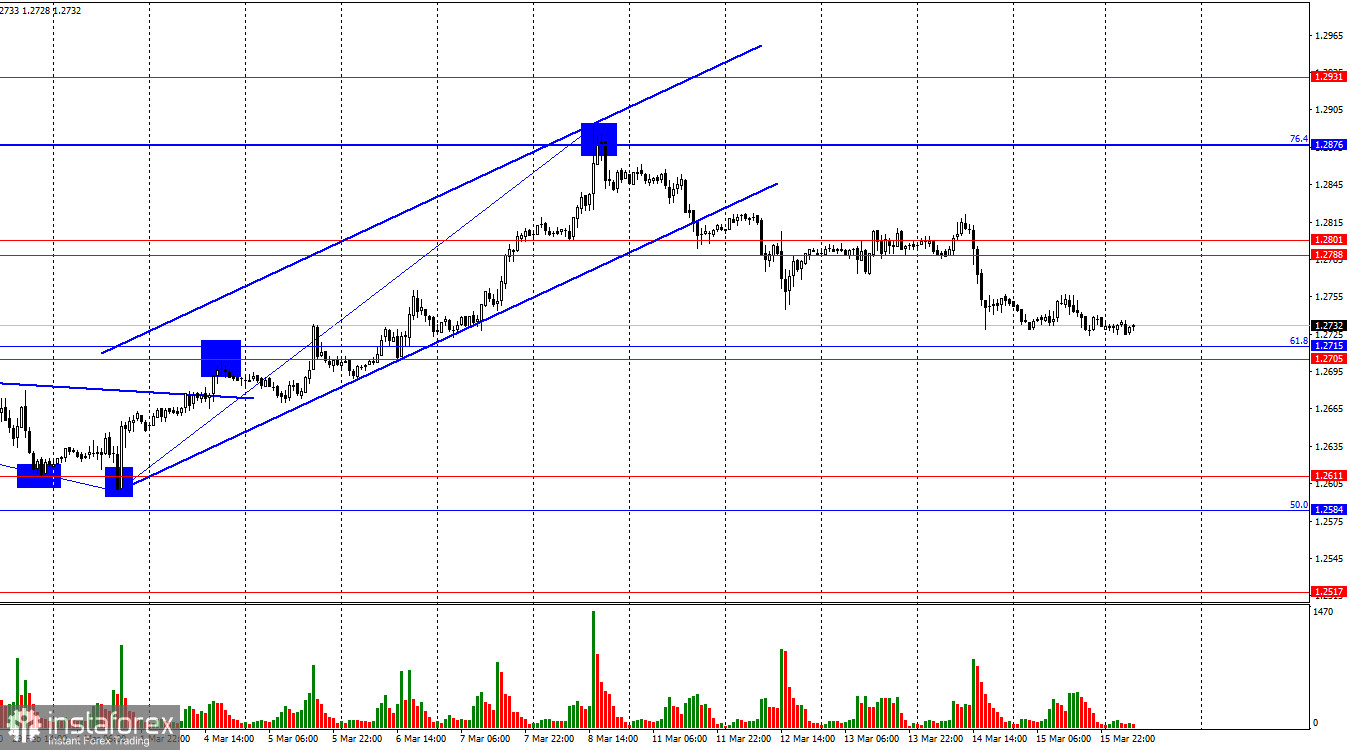

On the hourly chart, the GBP/USD pair on Friday continued a very weak downward movement towards the support zone of 1.2705–1.2715. A rebound of quotes from this zone will work in favor of the British pound and lead to a resumption of growth towards the resistance zone of 1.2788–1.2801. Consolidation of quotes below the zone of 1.2705–1.2715 will increase the chances of further decline of the British pound towards the next support zone of 1.2584–1.2611. Trader sentiment is currently characterized as "bearish."

The wave situation has been clear lately. Bulls remain on the offensive, and we have already seen three consecutive upward waves. The last upward wave managed to surpass the previous peak from February 22nd, so there are currently no signs of a trend change to "bearish." The sideways movement seems to be over, as the British pound has risen above all peaks of the past few months. The last downward wave at the moment is too weak compared to the previous upward wave. The pair needs to decline at least to the level of 1.2584 to show the first sign of a trend change to "bearish." Or the new upward wave should not surpass the peak from March 8th.

On Friday, there was no news background in the UK, and the market was forced to focus on US statistics. However, it became clear in the morning and afternoon that American reports on production and consumer sentiment did not interest traders. Mentally, they were already focused on this week when the Bank of England and the Fed will announce their decisions during the second meetings of the year, and in the UK, the inflation report for February will be released, which could greatly influence the mood of the Bank of England's board of directors. Traders are not ready to make decisions before these important events, so their activity today may also remain quite weak.

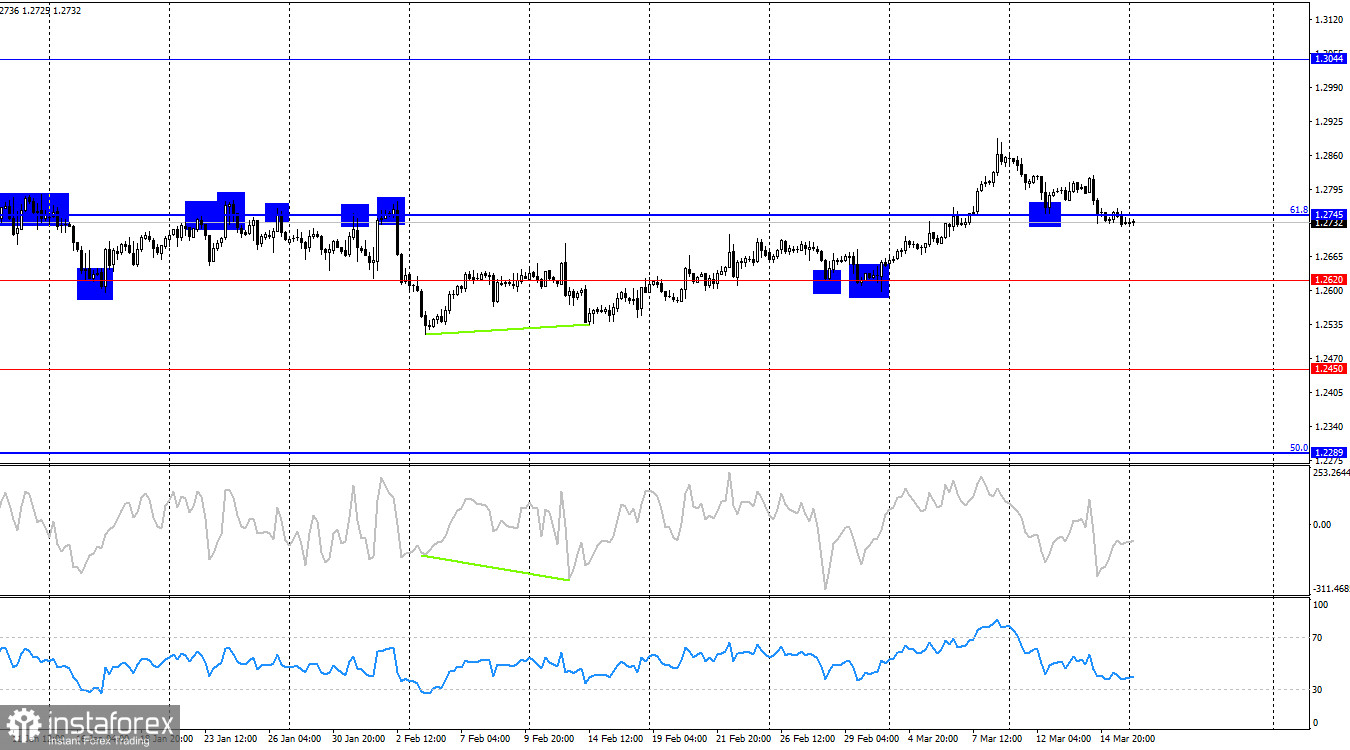

On the 4-hour chart, the pair has made a new reversal in favor of the US currency and declined to the corrective level of 61.8% (1.2745). Consolidation of the pair below this level will allow traders to expect a further decline of the British pound towards the level of 1.2620. A rebound of quotes from the level of 1.2745 will keep bullish traders in the game and allow them to count on growth up to the level of 1.3044. There are no impending divergences observed with any indicator today.

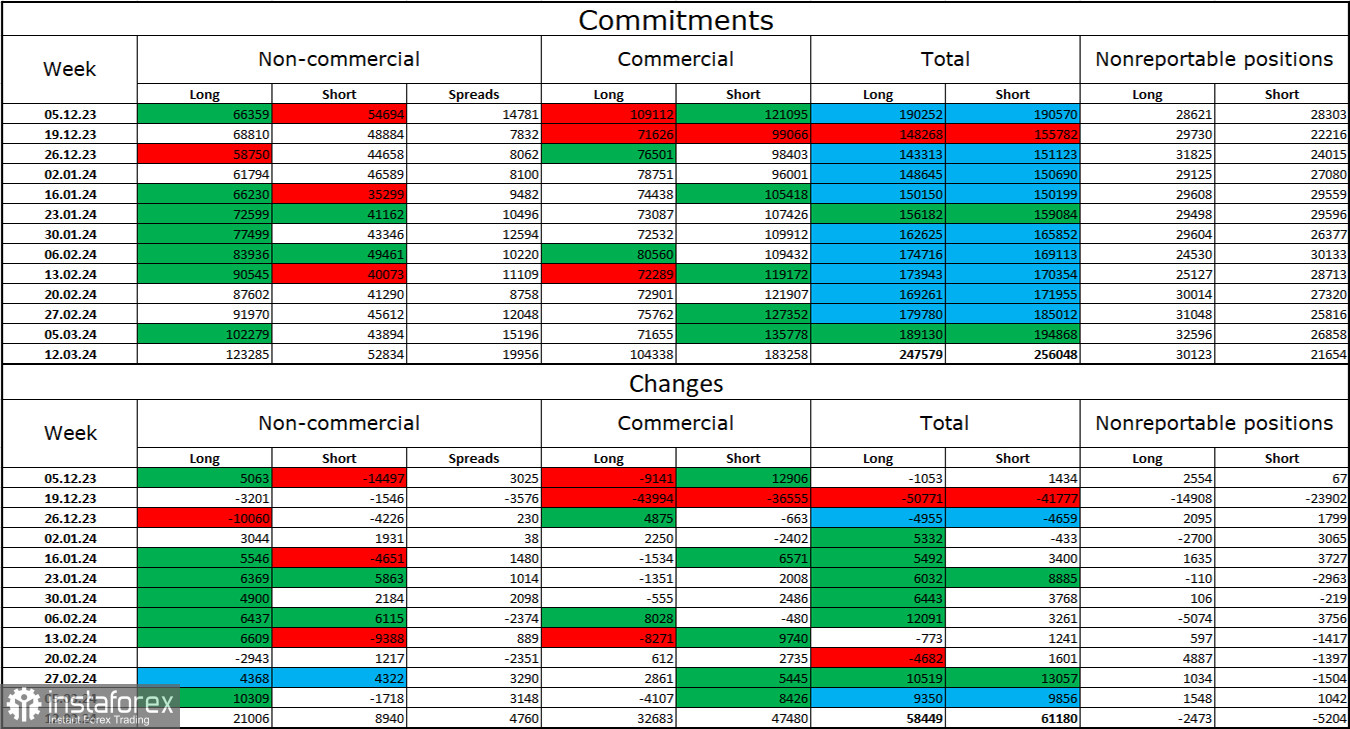

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category for the last reporting week has become even more "bullish." The number of long contracts held by speculators increased by 21,006 units, while the number of short contracts increased by only 8,940 units. The overall sentiment of major players remains "bullish" and continues to strengthen, although I don't see any specific reasons for this. There is more than a two-fold gap between the number of long and short contracts: 123,000 versus 53,000.

In my opinion, there are prospects for a decline in the British pound, but over the last 2.5 months, the number of long contracts has increased from 66,000 to 123,000, while the number of short contracts has remained almost unchanged. I believe that over time, bulls will start to unwind their buy positions, as all possible factors for buying the British pound have already been worked out. However, bears continue to demonstrate their weakness, which prevents the pound from starting to decline. I also want to note that the total number of long and short contracts has practically coincided for several months, indicating overall market equilibrium.

News calendar for the US and the UK:

On Monday, the economic events calendar does not contain any interesting entries. The influence of the news background on market sentiment today will be absent.

Forecast for GBP/USD and trader advice:

Sales of the British pound today can be considered upon closing below the level of 1.2745 on the 4-hour chart with targets at the zone of 1.2705–1.2715 and the level of 1.2620. Or below the zone of 1.2705–1.2715 on the hourly chart with a target of 1.2584–1.2611. Purchases are possible upon rebound on the hourly chart from the zone of 1.2705–1.2715 with a target of 1.2888.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română