The upcoming week will be very important for the British pound. While there won't be too many significant events in the European Union, we can look forward to the Bank of England meeting and the inflation report for February. Let's start with the inflation report since this will be the basis for the BoE's decisions. By the end of the second month of 2024, the Consumer Price Index may slow down to 3.6% (the current value is 4.0%). In my opinion, these are good rates, so the BoE is unlikely to change its stance the next day. However, inflation may show a different value.

I believe that stronger inflation for February will put an end to sellers' attempts to pull down the instrument. The market will understand that the BoE may also start to ease monetary policy much later than the expected dates. In other words, like the Federal Reserve, it will maintain a hawkish policy for longer. This will support the British currency, which has already been in demand for the past six months. If both central banks hold rates at their peak for longer, neither the dollar nor the pound will have new reasons to appreciate.

If, however, inflation decreases sharply in February, this could trigger the British pound's decline. The fact that it has not fallen for six months regardless of any news background indicates the market's confidence in the BoE. If this confidence begins to erode, the British pound could take a hit along with it.

Just before the BoE meeting, business activity indices for March will also be released, but the market will surely focus on the central bank meeting on Thursday. I would advise paying attention to the results of the Monetary Policy Committee's vote. At the last meeting, one of the nine committee members voted for a rate cut. If there are two members this time, it could exert pressure on the pound. The softer the stance of the BoE and its policymakers led by Andrew Bailey, the higher the chances of the pound falling in the upcoming week.

The week will close with the retail sales report, but I want to remind you that the Fed meeting will also be held in the same week. This event will also affect the fate of the British pound.

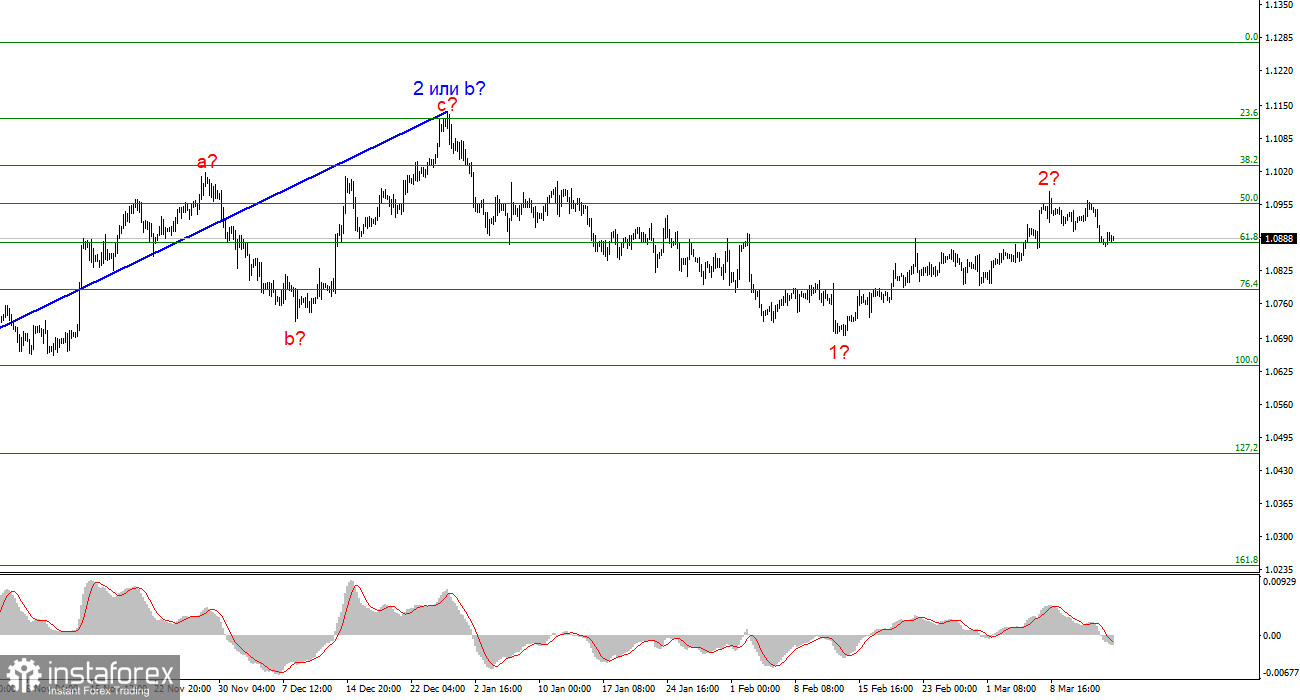

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

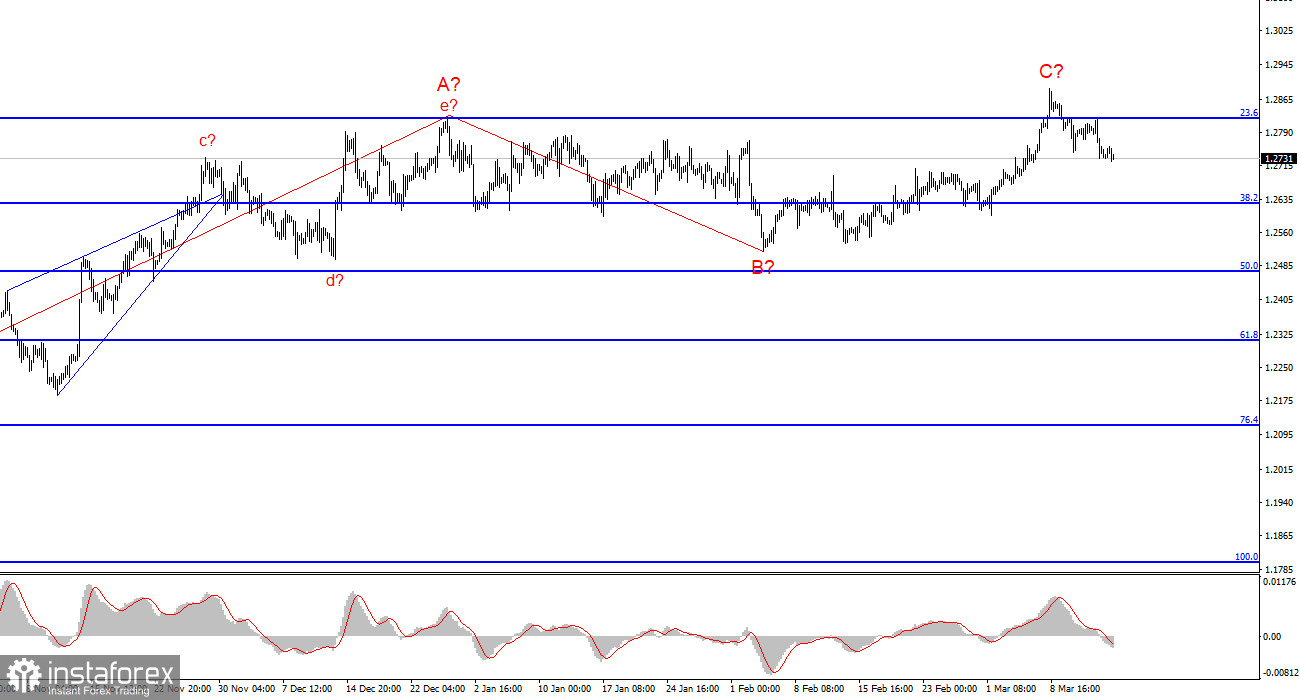

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% Fibonacci retracement, will indicate that the market is ready to increase the demand for the instrument. However, at this time it is futile, so the construction of wave 3 or c may have already started.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română