The US dollar is in an unattractive state. Although the downward trends persist in both instruments that I regularly review, the dollar has only shown broad weakness in recent weeks. During this period, we have received news from the US that was supposed to support the greenback; and yet, the dollar has not strengthened at all. A clear example is this week's US inflation report, which unexpectedly accelerated in January. In my opinion, this suggests that the Federal Reserve may delay the monetary easing process.

On Thursday, US Treasury Secretary Janet Yellen indirectly touched on the topic of monetary policy. She said it's "unlikely" that market interest rates will return to levels that prevailed before the Covid-19 pandemic. Back then, the rate was 2.5%. Hence, we are talking about an overall Fed rate cut to 3-3.5% at most. In my opinion, the market was counting on a steeper rate cut, but now it will have to abandon that thought.

In addition, Yellen said that Biden's administration is taking steps to ensure success of the domestic electric vehicle industry in the face of China's growing exports in the sector. However, we are undoubtedly more interested in information regarding monetary policy rather than import restrictions and tariffs on Chinese cars. I believe that the market just received another hawkish signal, this time from the Treasury Secretary. Recall that earlier Federal Reserve Chair Jerome Powell and many of his colleagues mentioned that there is no need to rush with interest rate cuts. In other words, policy easing will begin when the central bank is confident in achieving the long-term 2% target and maintaining inflation at that level. Currently, there is no such confidence, as Powell himself stated last week.

This means that the rate will remain at its peak level for as long as necessary, and all forecasts for rate cuts in March, June, or September are just expectations of analysts, economists, or market participants. The Fed is not obliged to act as expected. Price stability, which is a significant concern for American consumers, is the main priority for the central bank. The majority of the US population are not experts or economists in the currency market; they are ordinary citizens who are very concerned about the constant increase in prices.

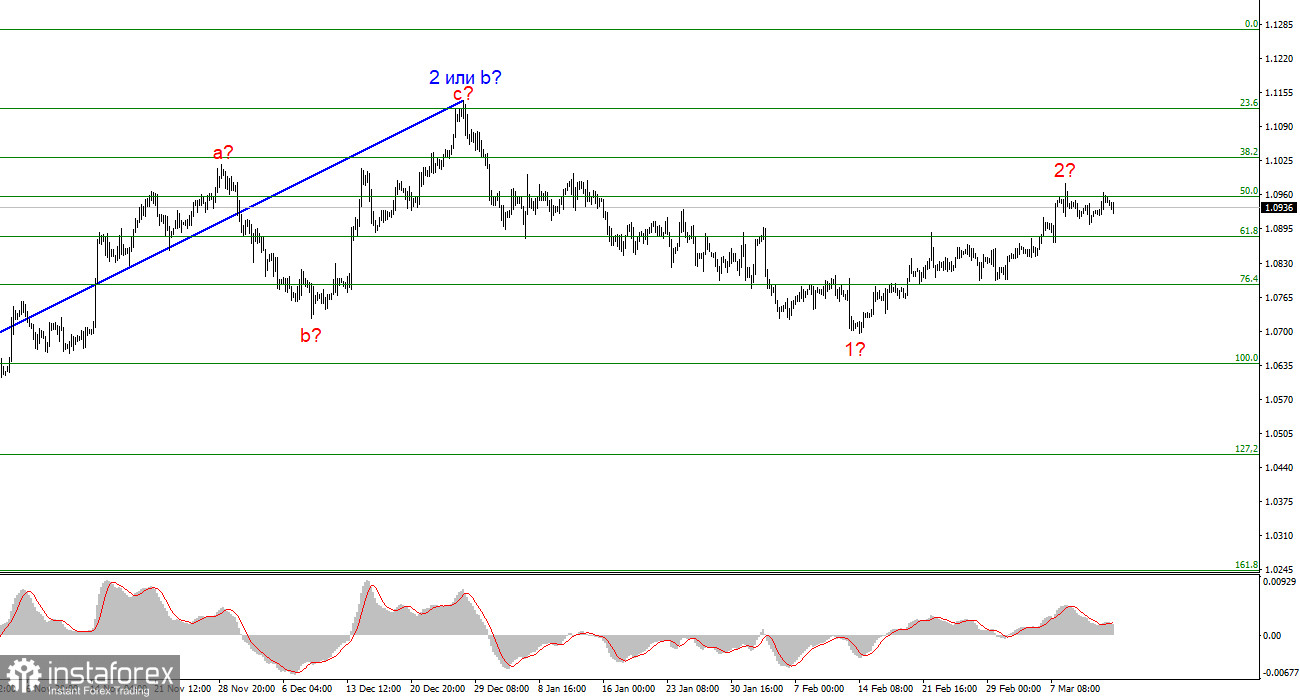

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

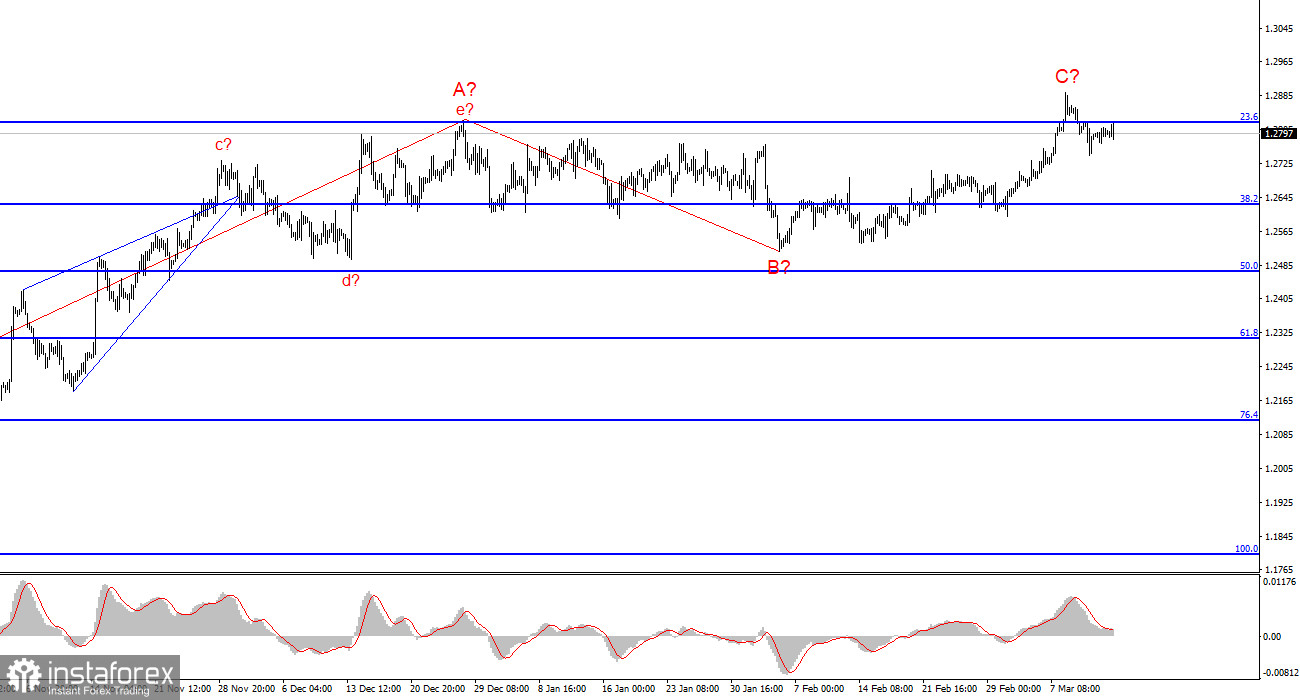

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% according to Fibonacci. A successful attempt to break through the level of 1.2877, which is equivalent to 76.4% Fibonacci retracement, will indicate that the market is ready to increase the demand for the instrument. However, at this time, it is futile, so the construction of wave 3 or c may have already started.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română