The currency market is quiet, with major pairs demonstrating low volatility and subdued reaction even to significant macroeconomic reports. The GBP/USD pair is not an exception.

This week, the UK reported key data on labor market growth and the overall economy. The first release triggered a fairly strong reaction from the pair, while the second report was essentially ignored by the market. However, despite increased volatility at the beginning of the week, the pound/dollar pair eventually returned to its previous area of 1.2800. Last week, sterling buyers tried to push the price up to 1.2900 but failed. The day before yesterday, sellers attempted to drag the price below the 1.2800 mark. However, the pair failed to overcome the support level of 1.2745 (Tenkan-sen line on the daily chart) and bounced off it. A sharp drop was used by traders as a reason to open long positions. The British pound made a round and returned to the 1.2800 level. It seems that in the near future, the pair will not leave this range, against a backdrop of a contradictory fundamental picture.

Exactly a week from now - on March 21st - the Bank of England will hold its next meeting. The formal outcome of this meeting is predetermined: with a high degree of probability, the regulator will leave its monetary policy parameters unchanged. This decision has been already priced in by the market and will hardly provoke volatility. However, the future prospects are vague. Most analysts are confident that the central bank will start lowering interest rates in the second half of the year - in August or at one of the autumn meetings. However, there is another point of view. For example, currency strategists at Morgan Stanley stated the day before yesterday that their baseline scenario suggests the first rate cut at the May meeting. According to them, markets greatly underestimate the chances of easing policy in the spring.

Unfortunately, the latest macroeconomic reports failed to shed some light on this issue.

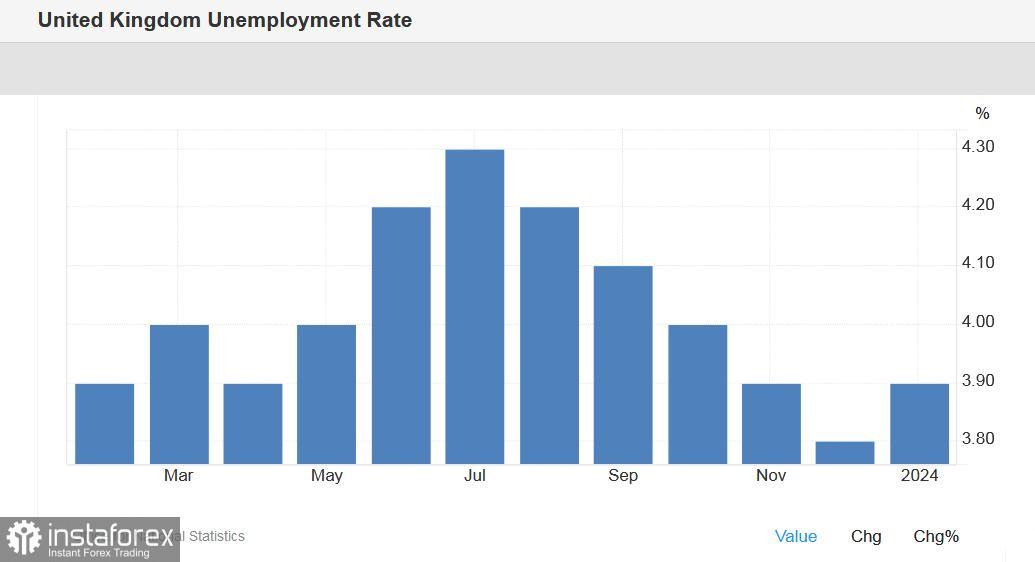

Thus, the unemployment rate in the UK unexpectedly rose to 3.9% in January. The indicator had decreased consistently for 5 preceding months, reaching 3.8% in December. According to forecasts, January was supposed to be the sixth month in this series. However, unemployment rose for the first time since July last year.

The number of claims for state unemployment benefits rose by 16,000. On one hand, the indicator was in the green zone (since the forecast was at 20,000). On the other hand, the indicator still demonstrates negative dynamics. Growth has been observed for the second month in a row, and February's result is almost a one-year high (the highest level since April last year).

Data on wages also failed to support the British currency. Average wage growth including bonuses came in at 5.6% compared to the expected 5.7%. The indicator has been decreasing for six months in a row. The January rate was the weakest pace of growth since September 2022. Excluding bonuses, the indicator also came out in the red zone (6.1% instead of 6.2%). Here, a downward trend has been observed for 5 months in a row. January's rate was the lowest since December 2022.

Reacting to this report, the GBP/USD pair dropped sharply, but as already mentioned above, it failed to overcome the support level of 1.2745.

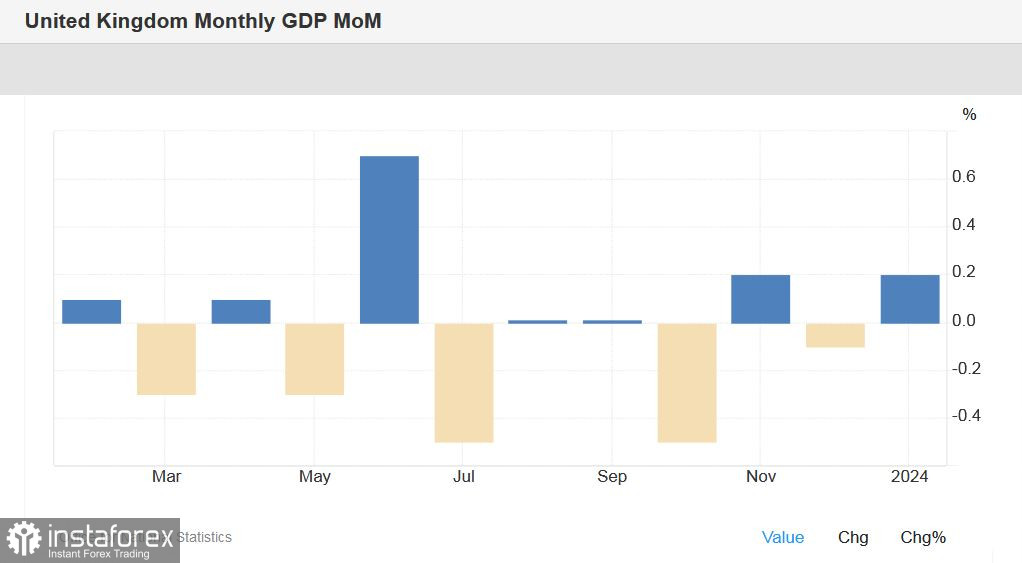

Data on the UK economic growth released the following day leveled the situation, allowing buyers to bring the price back to the 1.2800 level, even though almost all GDP figures were in line with analyst estimates.

Monthly gross domestic product rose by 0.2% in January after a 0.1% decline in the previous month. In the three months to January, the indicator fell by 0.1%. Nevertheless, its dynamics are positive: the indicator dropped by 0.4% in November and 0.3% in December. The report indicates that the construction sector's performance improved by 1.1% (whereas this sector was experiencing stagnation throughout 2023). Besides, the report noted high retail sales figures at the beginning of this year.

Notably, at the end of February, Bank of England Governor Andrew Bailey stated that the regulator does not need to wait until inflation reaches the target level before lowering rates. According to him, the central bank will evaluate the incoming data as a whole before making the corresponding decision. However, he refused to talk about any timelines. Thus, the aforementioned reports only added to uncertainty regarding this issue.

Given contradictory fundamental factors as well as the upcoming meeting of the Bank of England, it can be assumed that neither buyers nor sellers will open large positions. The situation remains uncertain. Therefore, excluding the scenario of a sharp decline/surge in the dollar, the pound/dollar pair is likely to trade within a 100-pip range bounded by the levels of 1.2750 and 1.2850, that is, between the Tenkan-sen line and the upper Bollinger Bands line on the daily chart (until March 21).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română