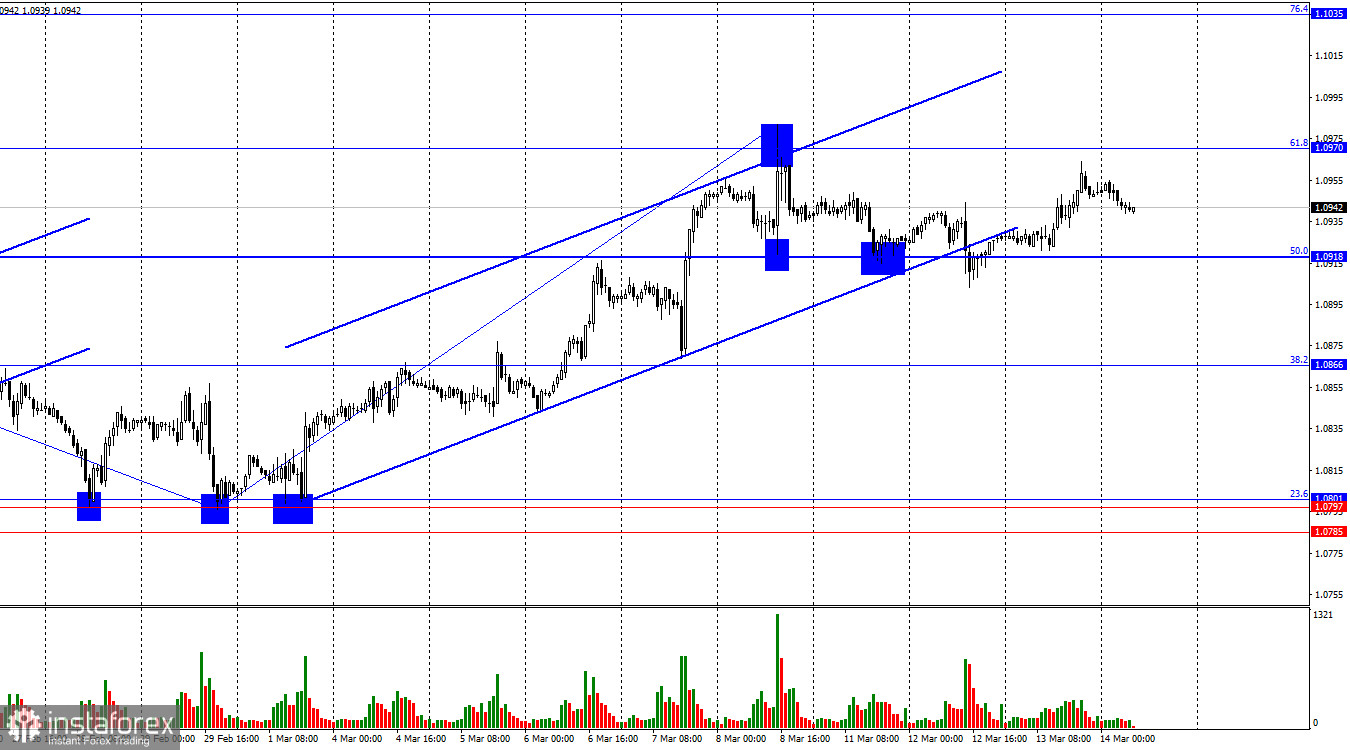

The EUR/USD pair continued its growth process on Wednesday after the third rebound from the corrective level of 50.0%–1.0918. The growth process continued almost to the Fibo level of 61.8%–1.0970. For the last four days, traders have not been able to get out of the 1.0918–1.0970 zone, we have a new sidewall. The information background is quite weak this week, so traders took a break. Bulls – temporary, bears – long-term. The consolidation of quotes under the upward trend corridor did not lead to an increase in the dollar. Fixing the pair's exchange rate below the level of 1.0918 will allow us to count on a slight drop in the direction of the corrective level of 38.2%–1.0866.

The situation with the waves remains quite clear. The last completed wave up confidently broke through the peak of the previous wave (from February 12), and the last wave down did not even come close to the previous low. Thus, at the moment we have a bullish trend and there is not a single wave sign of its completion. A new upward wave has managed to break through the peak of February 22 and continues to form. This allows me to expect a stronger onslaught of bulls in the near future, which is exactly what we are seeing. Despite the weak support of the information background, the bulls continue to attack.

The news background on Wednesday was weak. In the European Union, the report on changes in industrial production volumes for January was released. It was reported that volumes decreased by 3.2% month-on-month and by 6.7% year-on-year, exceeding even the weakest forecasts for this indicator. However, bearish traders did not become more active after this report, considering it unnecessary and unimportant. The euro showed restrained growth for most of the day. I continue to think that traders frequently disregard the current news background. The American currency is too weak, but bears continue to rest.

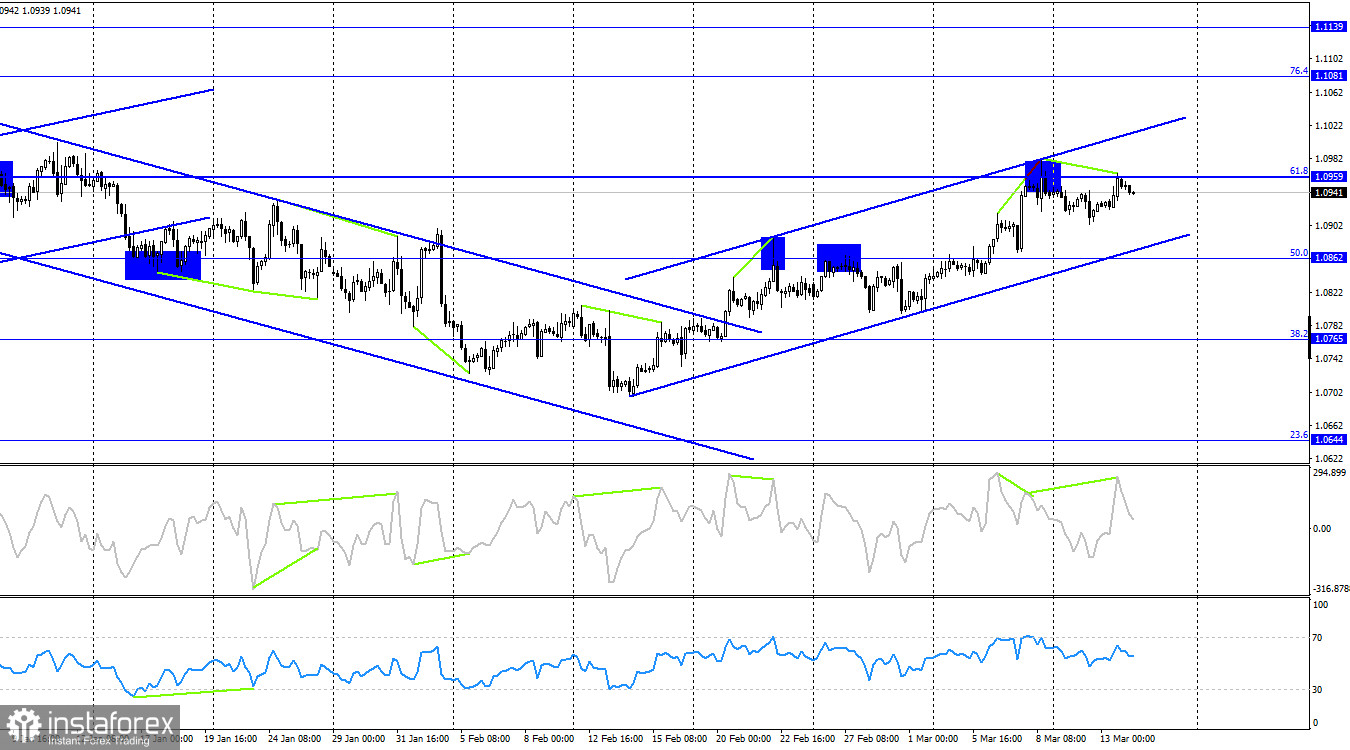

On the 4-hour chart, the pair retraced to the 61.8% Fibonacci level at 1.0959. A new rebound from this level would favor the US dollar again, potentially leading to a drop towards the 50.0% Fibonacci level at 1.0862. The current mood of traders is characterized as bullish due to the ascending trend corridor. Only a close below it would indicate that bears may initiate a significant counterattack. A bearish divergence on the CCI indicator increases the likelihood of a pair's decline.

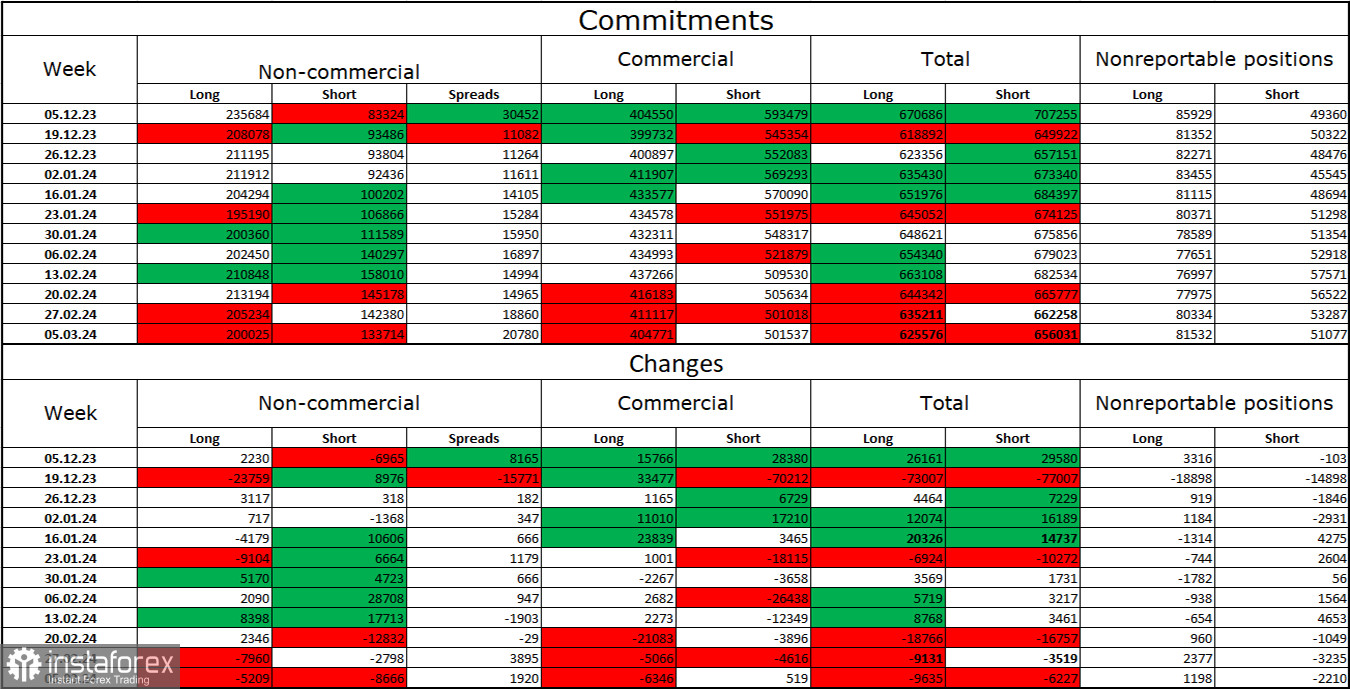

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 5209 long contracts and 8666 short contracts. The sentiment of the "non-commercial" group remains bullish but continues to weaken. The total number of long contracts held by speculators now stands at 200,000, while short contracts amount to 133,000. I still believe that the situation will continue to change in favor of bears. Bulls have dominated the market for too long, and now they need strong informational support to maintain their bullish trend. I don't see such support at the moment. At the same time, the total number of open long positions is lower than the number of short positions (625K versus 656K). However, this distribution of forces has been observed for quite some time.

News calendar for the USA and the European Union:

USA - Producer Price Index (12:30 UTC).

USA - Retail Sales (12:30 UTC).

USA - Initial Jobless Claims (12:30 UTC).

On March 14th, the economic calendar includes only three entries, with retail sales being the most significant. The impact of the news background on traders' sentiment today may be weak. Trader activity has remained low for quite some time.

Forecast for EUR/USD and trader recommendations:

Sales of the pair were possible on a rebound from the 1.0959 level on the 4-hour chart, with targets at 1.0918 and 1.0866. The first target has been achieved, and the second one could be reached upon confirmation below 1.0918. A new rebound from the 1.0959 level would open up new selling opportunities. Buying the pair is possible on a close above the 1.0959 level on the 4-hour chart, with a target at 1.1081. Alternatively, a rebound from the lower boundary of the corridor on the 4-hour chart with a target at 1.0959.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română